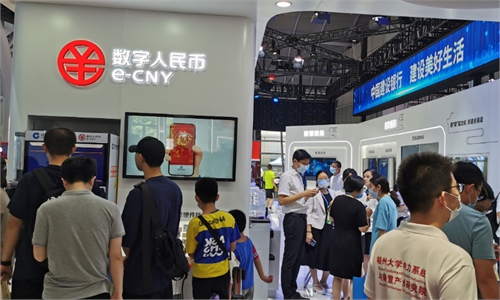

The mascot of digital yuan Photo: VCG

Chinese banks and mobile carriers are teaming up to roll out a SIM card purse product embedded in the payment platform of digital yuan, or e-CNY, further expanding the application scenarios of the digital currency.

Jointly developed by the Bank of China (BOC), China Telecom and China Unicom, the SIM card purse will provide a more convenient payment method for users as they only need to bring their cellphones closer to the point of sale machine to complete the payment process, the BOC said on its official WeChat account on Monday.

The payment can be made even if the user's cellphone is powered off or disconnected with the internet.

Yet users need to first change their current SIM cards with new super ones if they want to experience the new purse, and currently only invited users can have access to the function. It will later be promoted to other trial regions, the BOC said.

The launch of the SIM card purse for digital yuan reflected the organic integration between the financial infrastructure and IT infrastructure, it added.

China has entered the "super SIM era" since 2016. Compared with ordinary SIM cards, the super ones have larger capacity for data, and more complex encryption algorithm to better protect user's privacy. Meanwhile, they can perform more functions, telecom industry analysts said.

"SIM cards are a widely used hardware medium featured with high penetration ratio and acceptance among users. Its introduction could bring down costs and enhance the popularity of digital yuan," Xiang Ligang, a veteran telecoms expert, told the Global Times on Tuesday.

"The SIM card purse has higher safety guarantee compared with an individual app thanks to its advanced encryption algorithm," Xiang added.

For digital currencies and payment tools, the variety of functions often affects user selection and experience, Chen Bo, director of the Digital Finance Research Center at the Central University of Finance and Economics, told the Global Times on Tuesday.

"The launch of the SIM card purse is expected to promote further usage of the e-CNY as it provides new experience different from the QR code scanning model, which is widely used by third-party payment tools such as Alipay and WeChat Pay," Chen noted.

In March, the payment platform of the digital yuan app started to support both Alipay and WeChat Pay. Users can make payments with their digital yuan wallets in WeChat's mini-programs.

Since the start of the year, the digital yuan continues to explore new application scenarios in pilot areas, ranging from the issuance of digital yuan red envelopes and salary distribution to the purchase of funds.

Moreover, regional governments are seen accelerating the use of the digital yuan in public services payment, financial lending, cross-border payment, medical care services and insurance claims.

The city of Suzhou in East China's Jiangsu Province launched the country's first digital yuan scenario to pay housing provident fund for designated employees in April. In May, Changshu, also in Jiangsu, started to pay public sector workers in digital yuan.

The People's Bank of China (PBC), the country's central bank, launched e-CNY pilots in four places - Shenzhen, South China's Guangdong Province, Xiong'an New Area in North China's Hebei Province, Chengdu, capital of Southwest China's Sichuan Province, and Suzhou in East China's Jiangsu Province - at the end of 2019. Later, more domestic cities joined the pilot program following the digital yuan's successful operation.

By the end of 2022, the total sum of digital yuan in circulation stood at 13.61 billion yuan ($1.96 billion), according to the PBC.

With application scenarios, transaction value and amount of digital yuan in use increasing steadily in the recent years, the related management and calculation systems have been improved accordingly, a PBC official said.

Global Times