China's second-largest chip foundry Hua Hong Semiconductor to raise $3 billion in planned Shanghai IPO

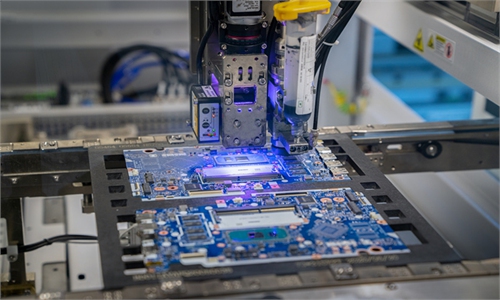

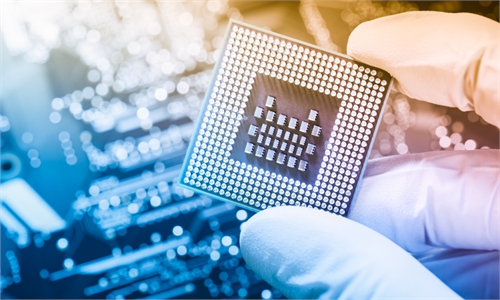

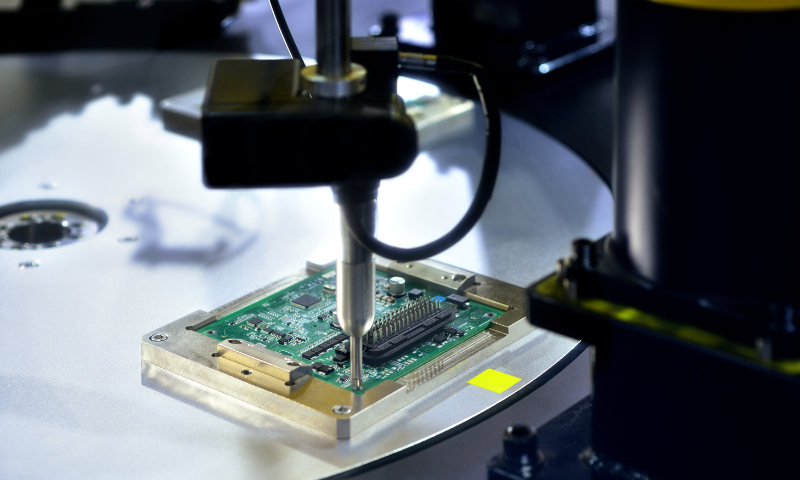

Production of semiconductor chip File photo: VCG

Hua Hong Semiconductor, China's second-largest chip foundry, announced on Monday that it aims to raise up to 21.2 billion yuan ($2.95 billion) in a listing on the Shanghai Stock Exchange, which is expected to be this year's biggest A-share IPO.

The move is part of China's intensified efforts to achieve self-reliance in semiconductor supply to break the technology blockade by the US.

Analysts said that the listing will boost the country's semiconductor sector, as larger capital inflows are expected to support breakthroughs in tech innovation.

The company will sell 407.75 million shares at 52 yuan each, which will be about 23.76 percent of the enlarged share capital, the company said in a filing to the Hong Kong Stock Exchange, where it's already listed.

The expansion of fund-raising channels in the Chinese mainland will contribute to Hua Hong's future growth and presence in more key links of the industrial chain to increase its market share and profits and shore up sustained development, Han Xiaomin, general manager of Jiwei Insights in Beijing, told the Global Times on Monday.

According to Hua Hong, the China IC Fund II (the second phase of the National Integrated Circuit Industry Investment Fund Co), is a strategic investor, accounting for 48.33 million shares with an aggregate allotted amount of 2.5 billion yuan.

"China's chip industry faces a complex external competitive situation, and the fund's investment in mature processes will yield long-term returns for the sector to progress in advanced processes," Han said.

Compared with the first phase, which focused on chip manufacturing, the China IC Fund II has invested heavily in domestic semiconductor manufacturing, equipment and related materials so as to break the current bottleneck, Liang Zhenpeng, an independent tech sector analyst, told the Global Times on Monday.

China's semiconductor industry has vast potential, but the country remains weak in advanced chips manufacturing, so it's crucial to seek core technology breakthroughs, Liang said.

"As the US rolled out the CHIPS and Science Act and sought to form a Chip-4 alliance to contain China's tech rise, the Chinese government could move to set up a semiconductor industry alliance at home to boost breakthroughs and compete with the US," Ma Jihua, a veteran telecom industry observer, told the Global Times.

China is striving to achieve greater self-sufficiency in key advanced technologies, as the US and its allies have intensified their containment and encirclement of China.

Under pressure from the US, the Netherlands imposed new controls on exports of advanced semiconductor manufacturing tools on June 30. And, Japanese export control measures on 23 crucial chip-manufacturing items took effect on Sunday.

The Chinese Foreign Ministry blasted Japan's unreasonable move on Monday, and vowed to firmly safeguard China's own interests.

"The Chinese side deeply regrets and is unsatisfied with Japan's export curbs that obviously target at China," Mao Ning, a spokesperson of the ministry, said on Monday.

For some time, certain countries have politicalized trade and economic issues, and recklessly pushed for high-tech "decoupling" from China with measures including the abuse of export controls.

These wrongdoings violate market rules, free trade principles and international trade rules, cause losses to relevant enterprises and affect the security and stability of regional and global semiconductor industrial and supply chains, Mao said.

"We hope Japan can honor its commitment to international trade rules, as part of an effort to safeguard its own interests and bilateral trade and economic cooperation more broadly. It's important to refrain from disrupting normal semiconductor cooperation between the two countries," Mao said.