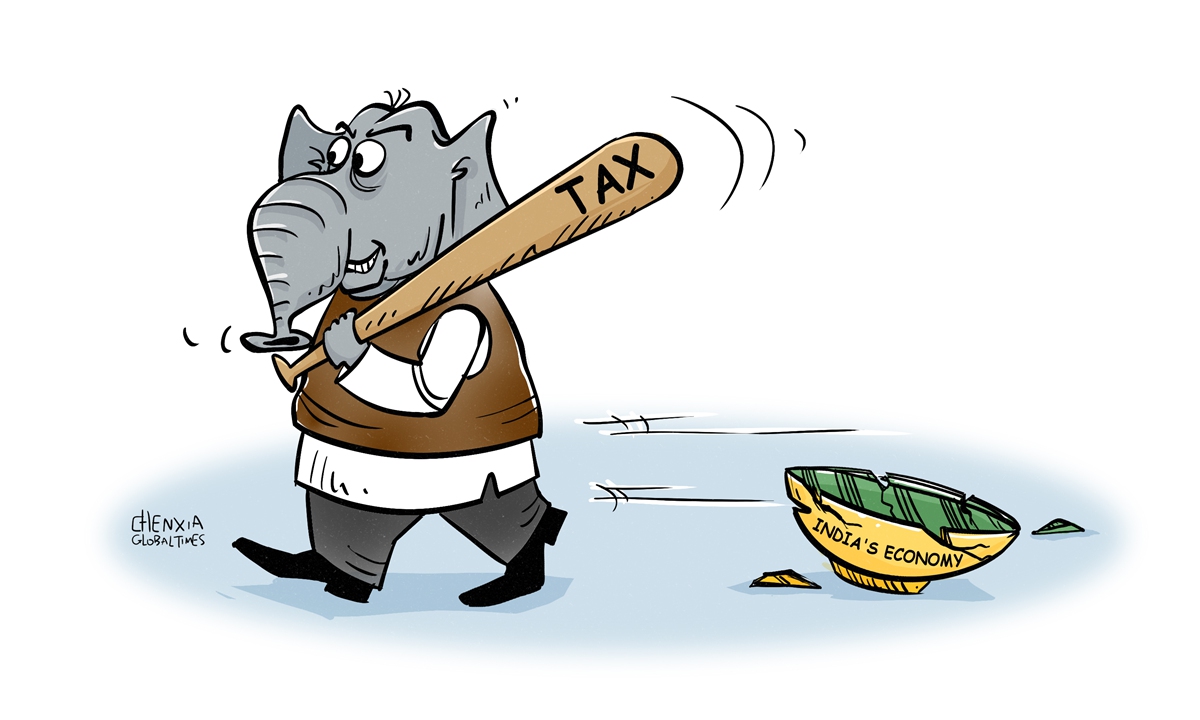

Illustration: Chen Xia/Global Times

No matter whether media reports saying Chinese automaker BYD faces an ongoing Indian tax investigation are true, in view of a series of crackdowns India has imposed on Chinese companies in recent years, it's necessary to remind Indian policymakers that waving a big tax stick is not the right way to seek fairness, and the ultimate victim will be the Indian economy itself.

Chinese automaker BYD faces an ongoing Indian investigation over allegations that it paid too little tax on imported parts for cars it assembles and sells in the country, Reuters reported on Wednesday, citing two sources with direct knowledge of the matter. The news came after an Economic Times report saying that two weeks ago, India asked top Chinese smartphone brands such as Xiaomi, Oppo, Vivo and PC maker Lenovo to pay "unpaid tax dues" and "is pursuing recoveries" with owners of the brands concerned.

It is a company's obligation to pay taxes. The Chinese government has always asked Chinese enterprises to strictly abide by local laws and regulations when operating overseas, but why have so many Chinese companies in India been investigated for so-called tax evasion in recent years?

The situation draws attention to India's complex tax system - more importantly, it reflects how India abuses its taxation power to suppress Chinese enterprises and embrace trade protectionism.

The Indian taxation system is a complicated mix of laws, rules and regulations that requires a thorough understanding of tax-related issues at the district, state and central levels. The complex unfriendly tax system and ambiguous regulations give Indian officials room for arbitrary interpretation of these rules, and they can use taxation issues as a tool to reward or suppress multinational corporations.

It is not uncommon for India to see tax disputes with multinational corporations. In 2013, the tax authorities reportedly froze Nokia's assets in a dispute over tax payments. In the following years, tax disputes became a frequent occurrence in India.

From 2014 to November 2021, 2,783 foreign companies registered in India closed their operations in India, accounting for approximately one-sixth of the multinational corporations in the country, media reports said. This outcome was the result of multiple factors, among them a complex unfriendly tax system.

Following the China-India border clash in 2020, anti-China sentiment soared in India. Against this backdrop, it is not much of a surprise when Chinese companies become a big target for India's tax stick. Taking advantage of fuzzy rules to suppress Chinese companies is an easy way to pursue trade protectionism, while embracing nationalist sentiment against China. Recent years have seen India frequently wield the big stick of tax sanctions against Chinese companies. However, the tax stick will undermine Chinese companies' investment confidence in India, even causing some Chinese firms to withdraw from the country.

India's tax problems don't just plague Chinese companies, but also enterprises from other countries. The tax stick that strikes Chinese companies today is very likely to batter companies from other countries tomorrow.

Currently, India is enthusiastically attracting US enterprises, including Apple and Tesla, to invest in the country. However, if one day there is a conflict of interest between India and these companies, will these firms become victims of India's tax stick?

A fair business environment and friendly tax system are preconditions that ensure India can make itself a preferred destination for foreign investment. However, now things are going in the opposite direction of what people expected. If the Reuters report saying that BYD faces an ongoing tax investigation is true, complaints and anger against India's business environment will continue to accumulate.

If 2,783 foreign companies having ceased to operate in India is not enough to sober up the country and prompt it to improve its investment environment, then more companies will leave. Losing international investment will ultimately hurt the Indian economy, its employment and taxation. Hopefully India can improve its business environment and stop wielding the tax stick.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn