Illustration: Chen Xia/Global Times

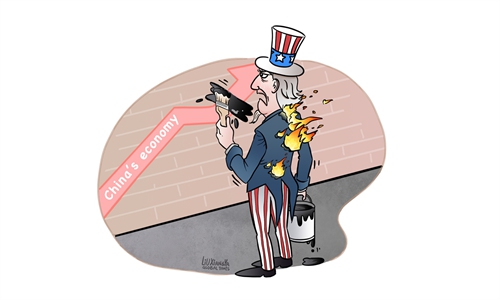

Recently, some Western politicians and media outlets have intentionally described China as a "risk factor" for the global economy. Such false accusations may incite division and hatred in the global supply chain, bringing storms to the world's already fragile economy.The latest example is an article from CNBC with the headline "China's deflation could spill over into a global concern, economists say." Sensational rhetoric, though attention-grabbing, cannot give the world a true picture of the Chinese economy and its interactions with trade partners.

With a gloomy outlook in the global economy, almost all countries, regions and industries are facing challenges, and China is no exception. Amplifying problems in the Chinese economy won't help support the global economy, but will create new setbacks. Crucially, it needs to be clarified that there is no deflation in China.

Due to a high base of comparison, the consumer price index (CPI) declined 0.3 percent year-on-year in July, but it was up by 0.2 percent from June. Fu Linghui, a spokesperson of the National Bureau of Statistics (NBS), said on August 15 that the fall of consumer prices in July was "within normal monthly fluctuations," and the CPI's growth rate would gradually revert to normal.

Will China's CPI fluctuations have a spillover effect on the global economy? Some Western economists believe the answer is yes, as they said prices of goods imported from China are down 3 percent on average versus last year, while producer prices of consumer goods in China are down 5 percent in dollar terms.

If these numbers are accurate, then it will be good news for the Western economy. What the Chinese economy exports is not a "risk factor" or "deflation," but economic dividends to curb inflation.

Since last year, inflation has gripped many economies around the world. Rising costs of living have been affecting several countries, which means ordinary people are feeling the pinch - as prices rise, incomes aren't going as far as they once did. Although the US and some other Western economies hope to revitalize local manufacturing, in the context of curbing inflation, countries should encourage free trade and allow more high-quality, affordable products to be imported. Economists need not worry too much about imagined deflation risks.

China's labor costs have been rising in recent decades, but people who believe China is no longer a low-cost country ignore two facts.

First, China has the most complete industrial chain in the world. This means it's easier to find reliable and cost-efficient suppliers in China than in any other part of the world.

Second, China has experienced rapid technological progress. We can see manufacturing enterprises improving their productivity, driven by innovation. These enterprises are also increasing their contribution to foreign trade in terms of technology.

It is not much of a surprise when people say that prices of goods imported from China are down. We hope that the US-led West can restrain its tendency toward trade protectionism. Increased trade with China will help curb inflation. That's because China's large labor force, efficient supply chains and rapid technological progress contribute to lower production costs than can be found in many other countries.

Both China and the US-led West have many economic challenges, and they should strengthen cooperation, especially in trade and investment, instead of decoupling their economies. Global policymakers have in the past made hard-won achievements in promoting free trade, and what should be done now is to keep those efforts from being ruined by an economic decoupling.

We hope that the rhetoric of "China's deflation could spill over into a global concern" will not become a new argument for de-globalization and trade protectionism aiming to exclude China from the global industrial chain.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn