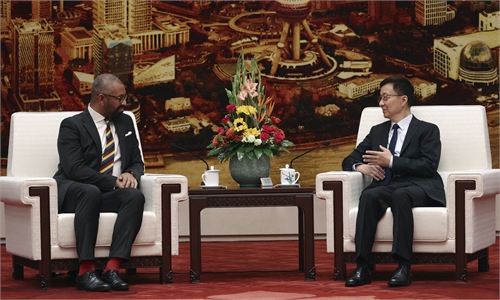

China UK Photo: VCG

Chinese investors are welcome to invest in the UK and Chinese financial firms are important to London's financial ecosystem, a UK official said on Sunday at a forum of the 2023 China International Fair for Trade in Services (CIFTIS).

"Britain's financial industry has a leading position in the world. In particular, it can provide a lot of services and financing channels to China. We welcome China to invest in Britain," Lord Dominic Johnson, UK Minister of State in the Department for Business and Trade, said on Sunday at the China International Finance Annual Forum, a sideline event of the CIFTIS.

"London is a global financial center, and Chinese financial companies are very important in the London ecosystem. There are more than 40 Chinese financial institutions operating in London, and the British government welcomes the enormous contribution these financial institutions have made to the economies of both countries and the world economy," said Johnson.

He explained that Chinese companies are investing across the UK, which is testament to the strength of the relationship between the two nations. Also, Chinese enterprises have issued a large sum of green bonds, which have put the UK on a path to carbon neutrality, shoring up its position as a global capital center.

The UK's capital markets are favorable for Chinese corporate financing, with the Shanghai-London Stock Connect - which enables Chinese firms to list in the UK and vice versa - giving companies direct access to global markets, according to Johnson.

"The launch of the Shanghai-London Stock Connect and the recent Shenzhen-London Connect has provided us with more opportunities for cross-border investment and brought the capital markets of two major financial centers together," Lord James Sassoon, Chairman of the China-Britain Business Council (CBBC), said on Sunday at the China International Finance Annual Forum.

Financial services are a major part of the UK's exports of services to China. In the 12 months to March this year, 1.1 billion pounds ($1.38 billion) of financial services were exported to China, according to statistics from the UK Department for Business and Trade.

"We can see that while geopolitics are complex, the China-UK relationship is stable and expanding, and at the core of this relationship is financial and professional services, including education and research and development," said Sassoon.

Growing trade in goods and services between China and the UK will definitely boost bilateral financial cooperation and bring more Chinese investors to the UK, a manager at a major Chinese commercial bank told the Global Times on Sunday at the bank's booth at CIFTIS.

The manager declined to be identified as she is not authorized to represent the bank.

According to the manager, the bank's yuan clearing bank in London has remained its largest offshore yuan clearing bank outside Asia.

"London is a major financial hub in the world. At a time when the US is continuously losing its credit in the financial sector, the importance of London in the field will increase," said the manager.

Financial cooperation with the UK will be conducive for the internationalization of Chinese enterprises and financial institutions, the manager said.

"CBBC will continue to support collaboration and innovation between our two countries, not just in financial services, but in other areas as well," said Sassoon.

Despite the twists and turns in China-UK relations in recent years, economic and trade cooperation are still on an upward trend. Bilateral trade amounted to $103.4 billion in 2022, with the stock of two-way investment standing at $51.02 billion at the end of 2022, official data showed.