EU’s FDI review mechanism poses increasing challenges and uncertainty for Chinese firms, investments: commerce chamber

China-EU Photo: VCG

The EU's foreign direct investment (FDI) review mechanism is posing increasing challenges and uncertainty for Chinese companies' future expansion and investment in Europe, the head of the China Chamber of Commerce to the EU (CCCEU) noted in an exclusive written interview with the Global Times on Friday.

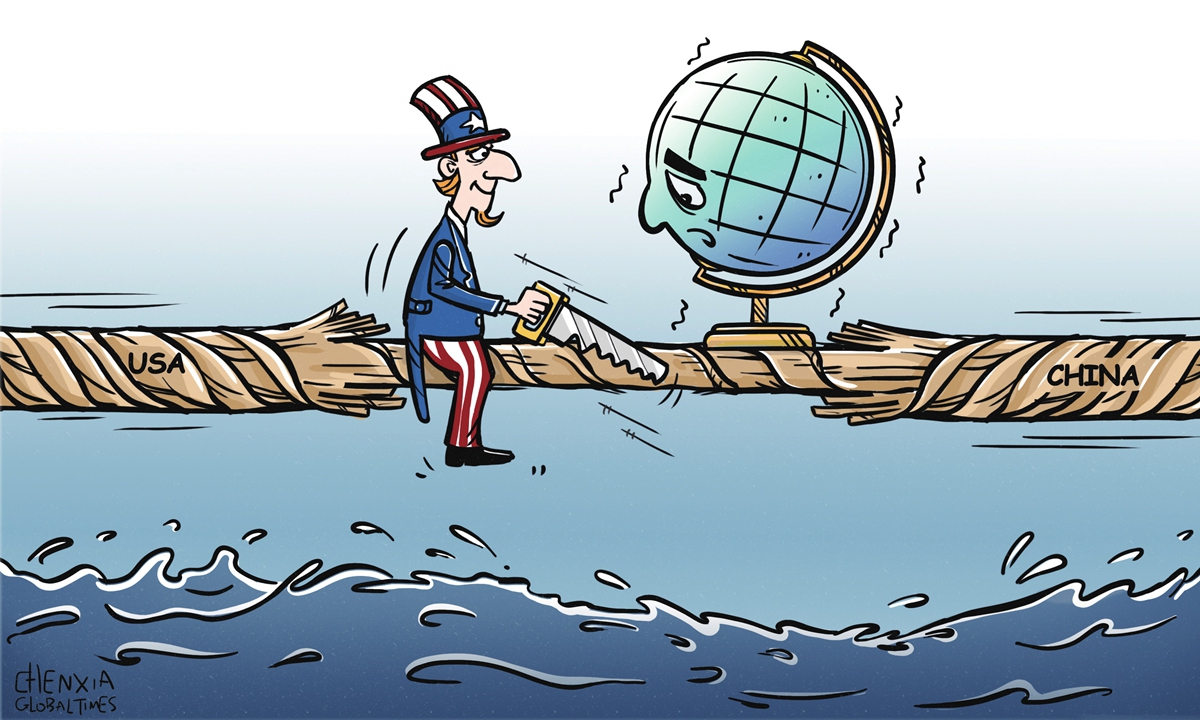

The EU, as a region full of opportunities and high-complementarity with China in economic and trade affairs, is gradually becoming a significant destination for Chinese companies' overseas investment. However, such positives have now been shadowed with more uncertainty as some politicians and media outlets are seeking "decoupling" or "de-risking" from China, and the EU's FDI has becoming a frontline of the experimental ground for this policy agenda.

The EU established its framework for coordinating FDI screening through Regulation 2019/452, adopted in March 2019, a policy which has been enforced since October 2020. This regulation grants the European Commission powers to review private transactions related to FDI.

The FDI regulation also requires the commission to consider changes to the regime by October 2023, and conduct reviews every five years thereafter.

Fang Dongkui, Secretary-General of the CCCEU, told the Global Times on Friday that the EU's FDI review mechanism has garnered significant attention as a crucial element of the European economy, since it has important implications for foreign enterprises operating in various sectors, especially Chinese companies.

"This has led EU member states to reassess their regulatory pathways for foreign investments, posing challenges and uncertainty for Chinese companies' expansion in Europe," Fang noted.

Chinese companies have committed to extensive investment in Europe across various sectors, including manufacturing, technology, and energy. However, due to the implementation of this review mechanism, Chinese investments in strategic sectors may face stricter review processes and limitations, the secretary-general said.

Recently, there have been new developments in the foreign investment review regulations of some EU member states such as Spain and Belgium, Fang observed, noting that the EU's "risk mitigation" strategy may lead to tighter investment reviews in European countries including Germany and France in the future.

Overall, Chinese mergers and acquisitions in Europe account for a relatively small proportion of foreign investment in the EU, and the absolute number of transactions subject to review is lower than mergers and acquisitions by companies from North America, but the level of attention is higher, including from foreign media, Fang said.

The EU has intensified its measures targeting Chinese investors. Recently, German Economic Minister Robert Habeck has advocated tougher measures governing foreign direct investment from China, the region's largest trading partner, in critical sectors such as semiconductors and artificial intelligence, according to foreign media reports.

The effort comes as Berlin urges companies to reduce their reliance on China and as the government examines whether its current set of regulations is sufficient to encourage this, Reuters reported on August 20.

Europe has become a prominent destination for Chinese business expansion and investment.

As a crucial component of the global economy, Europe possesses developed economies and markets. For Chinese companies seeking internationalization and diversification, it offers significant business opportunities and potential partners. The diversity of the European market also allows Chinese companies to explore various types of investment opportunities across sectors such as technology, manufacturing, finance and energy.

While the EU boasts significant advantages in areas like technological innovation and talent development, Chinese companies can establish research and development centers or collaborate on joint labs in Europe to engage with high-level research institutions and universities. This fosters technological exchange and innovation, enhancing the competitiveness of both parties.

"We appeal to the European side to adopt a more open attitude toward foreign investment, improve the business environment, and entry conditions," Fang said.

"Moreover, security factors in FDI reviews should not be politicized, and normal business mergers and acquisitions should not be hindered by political barriers," he said.

In addition, the European side should also provide due convenience covering the implementation of the China-EU investment agreement, remove political obstacles, and provide practical assistance for the implementation of the agreement, said Fang.

Currently, there is significant potential for China's investment in Europe, Fang stated, noting that "the EU should make greater efforts to promote Chinese investment in Europe and create a more favorable business environment for Chinese companies investing in the region."