Anti-subsidy probes into Chinese steel dangerous zero-sum game for EU's own industry

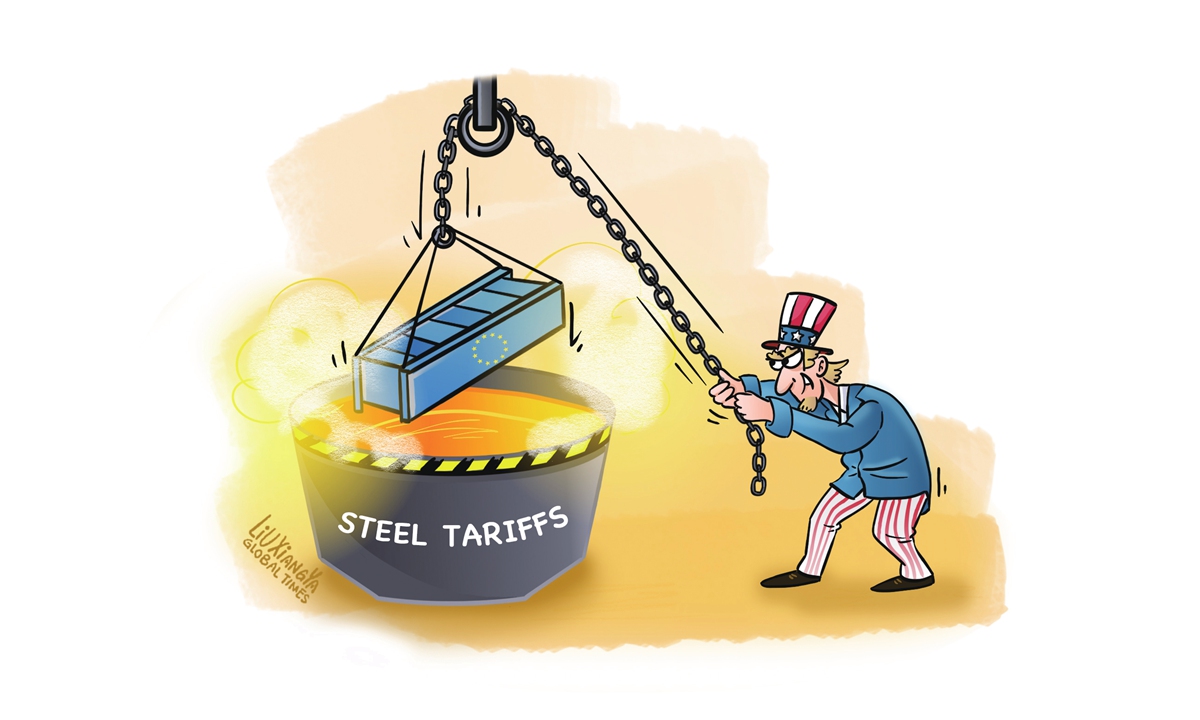

Illustration: Liu Xiangya/Global Times

Ahead of EU foreign policy chief Josep Borrell's scheduled visit to China, the Financial Times and some Western media outlets reported on Tuesday that the EU is planning to announce anti-subsidy investigations against "steelmakers producing to excess" in countries such as China as part of an agreement with the US to end Trump-era tariffs. The report, although it is yet to be confirmed by the EU, has drawn market attention, partly given its sensitive timing coinciding with Borrell's visit.As China-US relations become increasing complex, in which Washington labels China as a strategic competitor, the EU will inevitably face pressure from the US. However, European policymakers should maintain sobriety and pursue an independent diplomatic strategy.

China and Europe are important trade partners for each other. If politicians in Brussels use Europe's China strategy as a bargaining chip to exchange benefits with Washington, it will have catastrophic consequences for Europe's economy, companies and ordinary people.

As for the steel industry, it is hoped that European policymakers can realize that China's steel industry is a fully competitive market, and in such a highly competitive fray, the government does not, and has no reason to subsidize the intensely competitive industry. The government, in contrast, has always encouraged steelmakers to cut obsolete production capacity and continuously upgrade environment standards.

If the EU launches an anti-subsidy investigation against Chinese steelmakers, the decision may be based on two considerations. First, it seems that Brussels wants to alleviate some of the competitive pressure faced by European steelmakers. As reported by Reuters, the share of steel imports compared with consumption in the EU was 22 percent in the first quarter, which is high in historical terms. It means that European steel's competitiveness is declining.

Steel demand in the EU is expected to slide 3 percent this year amid persistently high energy prices and sluggish demand, which may put greater pressure on politicians to protect steelmakers' low-competitive production capacity. Trade protectionism may allow some breathing space, but low competition levels will hinder Europe from eliminating obsolete production capacity and making sound progress.

Second, observers are concerned about whether the EU's anti-subsidy probes will be used as a bargaining chip to reach a steel deal with the US. Reuters reported on Wednesday that a joint statement is expected to say the EU will use its trade defense instruments to assess the market situation for steel, without mentioning China, but this would lead to investigations by the European Commission.

"Washington has asked Brussels to move against Chinese steel producers in particular in return for avoiding the re-imposition of Trump-era tariffs on EU steel and aluminum, with an end-October deadline to reach an agreement," the report said.

The US steel industry is feeling the sting of the United Auto Workers strike. As reported, United States Steel Corp said it was temporarily idling one of its blast furnaces in Granite City, Illinois, an indication that the company expects the strike to reduce demand for steel. Washington is easily influenced by steelmakers' lobbying and pressure. As a result, it may be not easy to resolve the dispute over steel tariffs between the US and EU.

However, if the EU is too weak and even uses its China strategy as a tool to fawn on Washington, Europe won't gain Washington's respect. On the contrary, this will allow Washington to bully the bloc, and lead to economic problems for itself.

In September, annual inflation in the eurozone cooled to its lowest level since October 2021, falling to 4.3 percent. However, an inflation rate exceeding 4 percent means inflation remains a serious issue facing the eurozone economy.

Some analysts have said that if the EU launches anti-subsidy investigations against Chinese steel, it will exacerbate inflation pressure in Europe, especially against the backdrop of the escalation of the Palestinian-Israeli conflict, which may lead to an increase in global energy prices.

The economic complementarity of China and the EU creates potential for cooperation in the field of steel and broader industrial chains, which shouldn't be sabotaged by Washington's geopolitical pressure. It is sincerely hoped that Borrell's visit will inject positive momentum into bilateral relations.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn