Production of semiconductor chip File photo: VCG

The US is set to ban exports of more advanced artificial intelligence (AI) chips to China in the coming weeks. Chinese observers said that the Biden administration's long-planned move, which aims to contain China's tech rise and distract US voters from domestic woes, will backfire on American firms. They said that the ill-intentioned move will have a limited impact on China's AI industry and only accelerate the push for domestic replacements.

The Ministry of Commerce on Wednesday blasted the tightened US chip export restrictions on China, vowing to take necessary measures to maintain China's legitimate rights and interests.

"The US is urged to remove its chip export restrictions on China and build a fair and predictable business environment for companies from other countries, including China. The US should join hands with all parties to build a safe, stable, highly efficient, open and inclusive and win-win global industrial chain," the ministry said in a statement on its website.

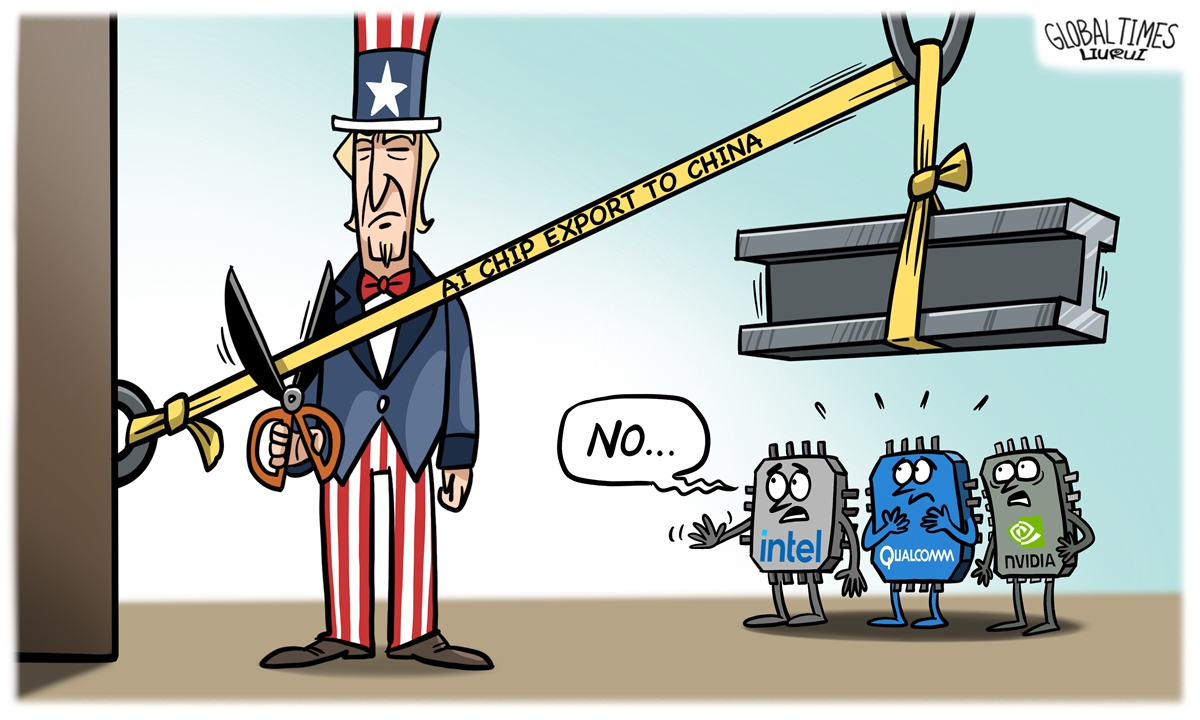

The US Commerce Department said on Tuesday that it would halt exports of AI chips, making it tougher for US firms including Nvidia and Intel to sell existing products in China or to introduce new chips to circumvent the rules, the Wall Street Journal reported.

The goal, according to US Commerce Secretary Gina Raimondo, is to limit China's "access to advanced semiconductors that could fuel breakthroughs in AI and sophisticated computers," the report said.

The US rules, which will take effect in 30 days, restrict sales of a broader swathe of advanced chips and chipmaking tools to more countries including Iran and Russia, and it added Chinese chip designers Moore Threads and Biren to a US blacklist, Reuters reported.

"The stepped-up US export controls will backfire and strike another blow at US chipmakers, which is already being reflected in these companies' share prices," Xiang Ligang, the director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Wednesday.

Following the news, US chip stocks closed lower on Tuesday. Nvidia fell about 5 percent, while Broadcom edged down about 2 percent and Intel down 1.4 percent.

Shares of AMD fell more than 1 percent.

China is a significant market for Nvidia. In the fiscal year ended in January 2023, markets in the Chinese mainland, Hong Kong and Taiwan accounted for a whopping 47 percent of Nvidia's global revenues, according to media reports.

Xiang said the move by the US will have a limited negative impact on China's AI sector, and instead would boost domestic research and development of AI chips and the development of the domestic semiconductor ecosystem.

"Chinese chipmakers supplied only about 5 percent of the country's total semiconductors by volume in 2018, but the share grew to 17 percent in 2022 as the country started to boost domestic replacements," Xiang said, and the proportion may rise to 25 percent by the end of this year.

"The move by the US may push China to achieve self-reliance in AI chips sooner than expected," Ma Jihua, a Beijing-based industry analyst, told the Global Times on Wednesday.

Washington's move will increase insecurity for Chinese AI firms and may prompt them to rush for AI chips in the short term, but they would avoid US chips in the future to reduce uncertainty, he said.

Whatever measures the US takes, they will not affect China's resolve to strive for technological breakthroughs, which has become a consensus in the country, Ma said.

ASML said on Wednesday that the new regulations will be applicable to a limited number of the company's fabs in China related to advanced semiconductor manufacturing.

"We do not expect these measures to have a material impact on our financial outlook for 2023 and for our longer-term scenarios for 2025 and 2030," it said in a statement sent to the Global Times on Wednesday.

Moore Threads and Biren expressed strong opposition to the US move, saying that they strictly comply with the laws and regulations in related countries. Biren said it would appeal the US decision and hopes the US government would review the announcement.

In response to the US' planned move, Chinese Foreign Ministry spokesperson Wang Wenbin said at a press briefing on Friday that China opposes US politicizing, instrumentalizing and weaponizing trade and technology.

"Arbitrarily placing curbs or forcibly seeking decoupling to serve political agenda violates the principles of market economy and fair competition, undermines international economic and trading order, disrupts and destabilizes global industrial and supply chains and will eventually hurt the interests of the whole world," Wang said.