Chinese regulators reveal plans to boost financial sector after top meeting sets clear direction

Development with Chinese characteristics focuses on security, efficiency: analysts

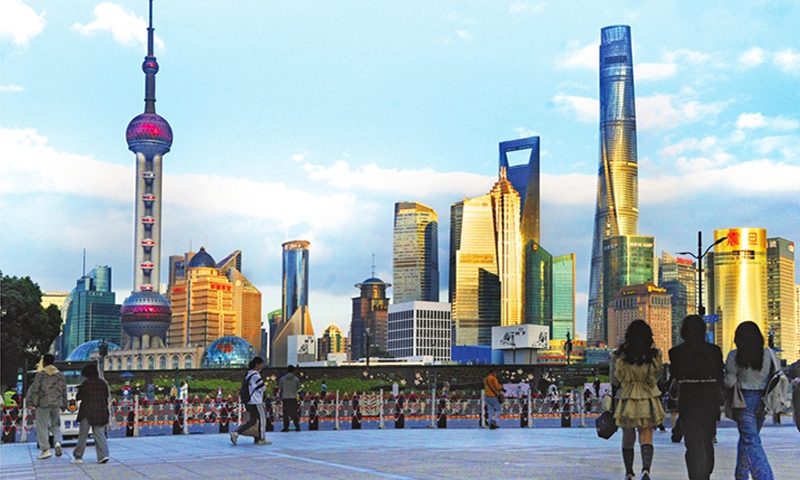

Lujiazui Photo:VCG

Chinese financial regulators on Friday provided more signals on how they plan to tackle risks and ensure long-term high-quality development in the country's financial sector, after a top meeting set clear directions for what top policymakers call "financial development with Chinese characteristics" that will turn China into a global financial power.

China's vision for its financial industry focuses on security, efficiency in serving the real economy and inclusiveness that benefit all, unlike financial markets in Western countries that have not only failed to boost the real economy but also caused tremendous risks for the world, Chinese analysts said, noting that Chinese regulators' swift responses after the meeting again underscored the effectiveness of China's policy execution.

Following the central financial work conference that concluded on Tuesday, various Chinese ministries and the ministerial level institutions, including the People's Bank of China (PBC), the central bank, the China Securities Regulatory Commission (CSRC) and the Ministry of State Security (MSS) have all vowed to swiftly and accurately carry out tasks set by the top meeting.

In an article on Friday, the monetary policy department of the PBC said that it will enrich the monetary policy toolbox, optimize the capital supply structure, unblock the channels for funds to enter the real economy, and strive to create a good monetary and financial environment. It will guide more financial resources to crucial areas such as technological innovation, advanced manufacturing, green development and micro, small and medium firms.

Growing signals of increasing support for the financial industry have also helped lift market sentiment. On Friday, Chinese stocks rallied, with the benchmark Shanghai Composite Index gaining 0.71 percent, the Shenzhen Component Index surging 1.22 percent, while the tech-heavy ChiNext index went up 1.47 percent.

The CSRC is also preparing a number of reform measures to improve market expectations, including studying and releasing a number of new important measures, in cooperation with relevant parties, to guide medium and long-term funds into the market and encourage long-term value investment, the Securities Times reported on Friday, citing sources from the regulator. It will also take more measures to invigorate the capital market.

Meanwhile, the MSS also said in an article on its WeChat account that it would step up efforts to prevent and defuse financial risks and crack down on illegal activities that endanger national security in the financial field, noting that certain countries are using the financial sector as a geopolitical tool and some speculators are trying to stir up financial turmoil in China.

The ministry also vowed to intensify monitoring and effectively prevent risks, and crack down on and punish illegal and criminal activities in the financial sector that endanger national security.

The plans from the ministries all covered top priorities set at the central financial work conference, and highlighted China's institutional advantage in swiftly and effectively turning top policy blueprints into real actions, in stark contrast to the chaotic governance seen in some Western economies, Chinese analysts said.

The conference stressed that China will remain committed to the path of financial development with Chinese characteristics and boost the high-quality development of the financial sector to provide strong support for fully building China into a strong country and achieving national rejuvenation through Chinese modernization.

Such a grand vision not only takes into account China's overall development at the current stage but also its massive potential in the long-term, and also draws a contrast between China's path for financial development and that in the developed economies, analysts noted.

Hu Qimu, a deputy secretary-general of the digital-real economies integration Forum 50, said that the financial industries in some developed economies have shown a trend of abandoning their job of serving the real economy.

"Although their capital markets look very prosperous, all they create are capital bubbles. Without the support of a large enough real economy, the eventual contradiction between supply and demand or structural contradictions will lead to an economic crisis," Hu told the Global Times on Friday, adding that China's path for financial development is about serving the real economy and improving people's livelihoods.

The central financial work conference stressed that in exploring the path of financial development with Chinese characteristics, China should uphold a people-centered approach, and adhere to the ultimate mission of serving the real economy.

"A series of financial risks in some advanced economies persistently remind us that we cannot follow the 'old path' of financial development in those countries. We should focus on the real economy," Cong Yi, a professor from the Tianjin School of Administration, told the Global Times on Friday, noting that China's path for financial development is perfectly in line with its national conditions.

Another difference between China's financial development and that of some Western economies is that China's approach will benefit its partners through various efforts such as continued opening-up and the Belt and Road Initiative, as opposed to the profound risks created and exported by financial markets in the West, analysts said.

"From an international perspective, the financial industries of developed economies often grab fortunes from other countries through capital investments, while China's financial industry will focus on the real economy and real projects that benefit people," Hu said.