US chipmakers defy Washington’s restrictions to tap into promising Chinese market at CIIE

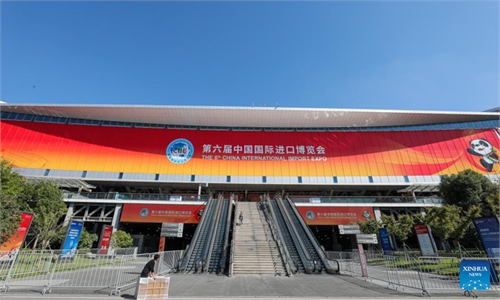

Global semiconductor companies arrive in the sixth CIIE in full force on November 6, 2023. Photo: Li Hao/GT

The 6th China International Import Expo (CIIE) is currently in full swing in Shanghai, with almost all of the world's top chip manufacturers showcasing their cutting-edge products at the fair, including those from the US. Despite Washington's restrictions on China's chip industry, these companies are determined to use this exceptional opportunity to expand their presence in the colossal market.

The semiconductor companies at the event are more eye-catching than one another, with large exhibition areas and products brimming with technological sophistication, Global Times reporters observed in Shanghai on Monday.

For instance, at the US tech giant Intel's booth, a simulation car exhibited their intelligent cabin system. Qualcomm's booth allowed visitors to experience the immersive possibilities of "5G+XR."

Among American chip companies, Intel and Qualcomm have been the "exhibitors with perfect attendance", showcasing products at the CIIE for six consecutive years.

Strong commitment

Intel has established a comprehensive presence in China, second only to its operations in the US, which includes significant manufacturing facilities in Chengdu, Southwest China's Sichuan Province, and a research and development center in Shanghai, Zhou Bing, general manager of Intel China corporate affairs, told the Global Times on Monday.

"The Chinese market holds significant importance for Intel's global growth," Zhou said, noting that China's digital economy has a huge scale and is growing rapidly; while Intel, as a semiconductor manufacturer, hopes to facilitate the development of China's digital economy.

Qualcomm has also brought multiple new technologies and products, making their debut in China for the first time. Among these is their flagship Snapdragon 8 Gen 3 platform, specially designed for generative AI.

At the CIIE, Qualcomm also showcased comprehensive "cross-industry collaborations" with Chinese manufacturers, spanning various terminals like smartphones, automobiles, computers, extended reality (XR), wireless headphones, and wearables, all delivering "new experiences" enabled by 5G and AI.

Analog Devices, another US semiconductor manufacturer at the CIIE, unveiled the industry's first wireless battery management system designed for mass-produced automobiles. This system enhances battery pack flexibility, reduces potential failure points, and promotes the incremental use and recycling of batteries. It's worth noting that the crucial chips for this system are developed and manufactured in China, the Global Times learned.

"Our chip products are intricately linked to batteries," an engineer at the Analog booth told the Global Times, adding that China has some of the world's leading suppliers in the new-energy battery sector, and it is also one of the most crucial battery supply nations globally.

"It's essential to be aligned with such an industry chain for the company to have the need and drive for innovation," the engineer said.

Fiercer competition

China has become the world's largest semiconductor market, with imports worth $415.6 billion in 2022. Due to a relatively low rate of self-sufficiency, China's chip import value once exceeded that of crude oil and iron ore imports combined, according to media reports.

However, as Chinese domestic chip companies continue to grow, this landscape is changing. China's self-sufficiency in chip production has been on the rise in recent years, and the unwarranted crackdown from the US government is only expediting this progress, experts said on Tuesday.

"The Chinese market is vast, with significant growth potential in the future. International semiconductor giants, including American companies, clearly know that they cannot afford to exit the market," Ma Jihua, a Beijing-based industry analyst, told the Global Times on Tuesday.

However, the US government has continuously imposed restrictive measures on the Chinese chip industry in recent years, which, in fact, have caused greater harm to American companies as the measures have not only resulted in financial losses of the firms but have also eroded their global competitiveness, Ma said.

"The market demand is there and Washington's restrictions effectively amount to letting American firms hand over their market shares voluntarily," Ma said, adding that, as a result, American companies are bound to face fiercer competition from Chinese domestic firms and other international enterprises in the future.

In 2022, Intel's revenue in the Chinese market reached approximately $17.125 billion, accounting for around 27 percent of its total revenue, making it the second-largest revenue contributor after the US market, according to media reports.

The Chinese market has consistently been Qualcomm's most significant source of revenue, with China's share of the firm's revenue climbing from 49.4 percent in the 2013 fiscal year to 63.5 percent in the 2022 fiscal year, media reports said.

At the end of the day, businesses are ultimately interest-oriented and their active presence at CIIE is the case in point that they cannot afford to ditch the market and certain US politicians "decoupling" push is doomed to fail, experts said.