Chinese mainland, HK, Macao link each other’s fintech supervision tools, to deepen GBA’s fintech innovation cooperation

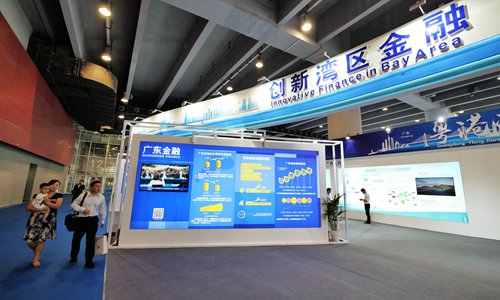

A view of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) special section at the China International Financial Expo in Guangzhou, South China's Guangdong Province on Sunday. This is the first time for the financial event to set aside a special section for the GBA since the Expo started in 2012. A total of 48 financial projects worth 350 billion yuan ($ 51 billion) are expected to be signed during the Expo this year. Photo: IC

The Chinese mainland, Hong Kong and Macao have signed a tripartite memorandum of understanding (MOU) to link each other's fintech supervision tools, in a bid to deepen exchanges and cooperation in financial technology innovation, and promote the development of digital finance in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

The connected supervision network will accelerate the improvement of the quality and effectiveness of financial services in the GBA, and increase financial support for the development of the GBA, the People's Bank of China (PBC), China's central bank, said in a statement on Thursday.

The PBC, the Hong Kong Monetary Authority (HKMA) and the Monetary Authority of Macao (AMCM) held the signing ceremony on Wednesday, at the opening ceremony of the 5th Chengfang Fintech Forum & the 3rd Global Fintech Conference, sideline events of the ongoing 2023 Annual Conference of Financial Street Forum.

The three parties will deepen their coordination in the regulation of fintech innovation and facilitate high-quality financial development in the GBA, the PBC said on Thursday.

Under the MOU, the PBC's Fintech Innovation Regulatory Facility, the HKMA's Fintech Supervisory Sandbox and the AMCM's supervisory requirements on innovative fintech pilot projects will realize a network connection.

As an important engine of national economic development, the GBA promotes innovation in the financial sector and more importantly, the synergies of the three parties' joint cooperation, HKMA Chief Executive Eddie Yue said on Wednesday when addressing the opening ceremony.

"This year, we actively promoted cross-border cooperation with the mainland and Macao in aspects of finance, infrastructure, technology and data integration," said Yue.

Yue noted that fintech will further help financial institutions to develop cross-border business.

"It is hoped that by achieving fintech docking with Guangdong and Hong Kong through the MOU, the GBA will jointly promote fintech connectivity, so as to accelerate the establishment of an international financial arena in the GBA with financial innovation and technology," Chan Sau San, chairman of the board of directors of the AMCM, said on Wednesday at the opening ceremony.

The connection of fintech supervisory tools will be beneficial to the integration of the GBA, the upgrading of the fintech industry and the prevention of financial risks, Wang Peng, associate researcher at the Beijing Academy of Social Sciences, told the Global Times on Thursday.

"The new network will be conducive to mobilizing the resources of all parties and truly realizing the better flow of resources of fintech innovation within the GBA. Meanwhile, the cooperation is conducive to better achieve regulatory coordination, so as to maintain market stability in the GBA and thus boost economic growth," said Wang.

Global Times