Illustration: Liu Xiangya/Global Times

After the US International Development Finance Corp (DFC) announced it will provide $553 million in financing for a Colombo port terminal project, partly owned by India's Adani Group, Western and Indian media interpreted this move as Washington's response to "China's growing influence in the Indian Ocean." If the speculation is true, Washington is likely to be disappointed.During the past decade, China funded the construction of massive infrastructure projects in Sri Lanka meant to boost the island nation's economy. However, mutually beneficial infrastructure cooperation has been maliciously described by the US-led West as a "debt trap," and their real purpose is to contain China's economic rise.

The so-called China-made "debt trap" is a lie concocted by certain forces to disrupt and jeopardize China's cooperation with other developing countries, China's Foreign Ministry spokesperson Wang Wenbin said on Tuesday during a regular press briefing.

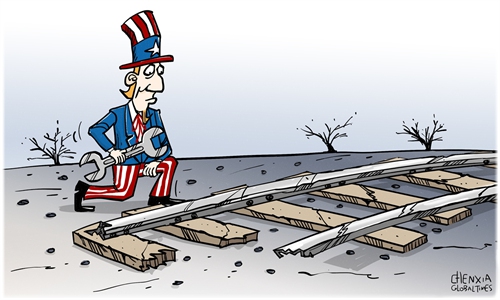

It's a bit ironic that, on the one hand, the US is trying to politicize China's infrastructure cooperation with developing countries, and defeat China in an imaginary "infrastructure competition," but on the other hand, the US has repeatedly proven incompetent and ineffective in financing infrastructure projects amid a competition that it initiated. The US imagines a war, but it has lost the imaginary war.

The DFC can be seen as America's development bank. The US faces a long-run fiscal deficit associated with economic challenges that will require spending cuts. Many members of Congress seek to cut foreign assistance in light of current federal budgetary constraints. From fighting climate change to development aid, the Global South has received too many unfulfilled promises and false hopes from the US.

For Sri Lanka, which has huge financing gaps when it comes to infrastructure construction, US financial support is not enough to meet its development needs.

Meanwhile, India's Adani Group has made the situation more complicated. Adani Group, which has seen significant turbulence in the past months after short-seller Hindenburg Research made allegations of corporate governance lapses, said in a press release that this is the first time the US government, through one of its agencies, funded an Adani project, which is "a ringing endorsement of the group," the Business Standard reported.

To put it more bluntly, some observers said that the US government agency's support comes as a reprieve to the conglomerate that has been facing questions since the Hindenburg allegations earlier this year.

As reported, shares of Adani Ports and Special Economic Zone rose more than 2 percent after the US government-backed DFC announced its plans to fund its joint venture in Sri Lanka.

DFC CEO Scott Nathan said in a statement that DFC's commitment of $553 million in private-sector loans for the West Container Terminal will expand its shipping capacity, creating greater prosperity for Sri Lanka. However, in reality, we cannot rule out the possibility that DFC's financing support will become a tool for Adani to deal with its crisis, rather than a springboard for Sri Lanka's economic development.

China's booming infrastructure cooperation with developing countries has stimulated infrastructure investment from the US-led West to the Global South. The US-led West views infrastructure projects through a geopolitical lens and ignores other factors such as economic sustainability.

Chinese companies' price-competitiveness has continued to rise. Compared with their Chinese competitors, Indian companies still lag behind in the field of infrastructure construction, as can be seen from India's dilapidated infrastructure.

Developing countries, including Sri Lanka, will become victims of infrastructure competition initiated by the US, if this competition is aimed at curbing China's investment into developing countries and thus containing the rise of China's economic influence.

The US-led West should stop hyping the so-called debt trap from a geopolitical perspective and stop undermining China's infrastructure cooperation with developing countries. Investing in Indian companies cannot help the US win an imaginary war against China's growing infrastructure influence.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn