Foreign financial firms bet on China as nation sets sights on financial strength

Officials at Beijing forum vow to accelerate institutional opening-up to attract long-term investors

Photo taken on November 10, 2023 shows the Beijing Financial Street Photo: courtesy of Financial Street Forum

Foreign financial institutions, including those from the US, remain optimistic about the long-term development prospect of Chinese economy and aim to explore more investment opportunities in the country, as the country's high-level opening up in the financial sector offers wider access to the huge market.

The Annual Conference of the Financial Street Forum 2023 pulled down its curtain in Beijing on Friday, where over 400 attendants from more than 30 countries and regions shared their views on global economic development opportunities as well as challenges.

They believe that strengthening financial sector cooperation and opening up is pivotal for accelerating win-win growth, and the forum underlies China's confidence and commitment to financial opening up and cooperation.

"The strategic importance of the Chinese market cannot be underestimated," Patrick Liu, Asia Pacific President of New York-based Neuberger Berman Group told the Global Times in an interview on Friday.

Neuberger Berman is an early participant in the A-share market through Qualified Foreign Institutional Investor mechanism, and is a pioneer in applying for a WFOE (wholly foreign-owned enterprise) foreign private equity license. The company is also the second newly established wholly foreign-owned mutual fund company in China to receive approval for obtaining a mutual fund business license, Liu said.

Neuberger Berman's core development strategy involves establishing a local team that leverages its global experiences to conduct more comprehensive analysis and research work in China, he said.

Helen Huang, managing director for China of the US-based asset management firm Fidelity International, said that "China is one of our strategic markets in the world, and we are optimistic about China's development in the long term."

It has become more convenient for foreign financial institutions to deeply participate in the Chinese market and increase their investment in the market, as Chinese capital market opening up continues to gain pace now, Huang told the Global Times in an interview on Friday.

Steadfast opening-up efforts

As one of the first global asset management companies to enter China, Fidelity has operated in the Chinese market for nearly 20 years. In December 2022, the company obtained approval to conduct business in the country's mutual fund industry.

"With our global market tradition and experience, especially our excellent experience in pension fund management and environmental, social and governance (ESG)-related investments, we hope to contribute to the development of China's capital market," Huang said.

The Central Financial Work Conference held in Beijing from October 30 to 31 urged for ramped-up efforts to expand opening up in the financial sector and facilitate cross-border investment and financing, so as to attract more foreign financial institutions and long-term investors to China.

"China won't halt its efforts in accelerating financial sector opening up, and the resolve to share its development opportunities with the outside world won't change, either," Li Yunze, head of the National Financial Regulatory Administration, said at the Financial Street Forum on Wednesday.

Li announced that two foreign-funded insurance brokerage companies - BMW (China) Insurance Brokers Co Ltd and ERGO-FESCO Broker Company Ltd - have recently received approval to operate insurance brokerage businesses in the Chinese mainland.

"With the broader opening-up of the capital market, we believe one of most significant opportunities for international investors is related to green financing," Liu said, adding Neuberger Berman is committed to leveraging its experience to introduce more ESG-related financial products to the Chinese market and step up new products innovation tailored for the local market, including green financing in China.

Along with the joint construction of the Belt and Road Initiative, China's influence in the global financial system will increase, Li Yang, director of the National Institution for Finance and Development, said at the closing ceremony of the Financial Street Forum on Friday.

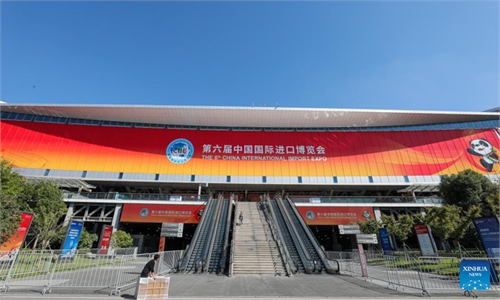

Photo taken on November 10, 2023 shows a decoration for the Annual Conference of Financial Street Forum 2023 in Beijing Photo: courtesy of Financial Street Forum

Optimism on growth potential

Li Yang said that China has developed relatively fast in its number of active financial institutions and total market size, but its financial service commission rates remain high and its stock market is growing relatively slowly. However, China has greater capability, flexibility and resilience to deal with various challenges, he added.

One of the major factors attracting overseas financial institutions to come and settle in China is the country's steady economic recovery and high-quality economic development in the long run, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies under the Renmin University of China, told the Global Times.

The IMF recently raised its forecast of China's GDP growth this year to 5.4 percent from 5 percent in October, based on a better-than-expected third-quarter economic performance and the flurry of targeted government policies announced recently to fuel up the economy.

"In the face of global uncertainties, the Chinese market still has a huge potential to be explored, as China's macro-economic fundamentals are stable and resilient to cope with external challenges," Huang said.

In addition, inflation in China is well under control, and the country has a large macro-policy maneuvering room since it can adopt more relaxed monetary and fiscal policies to bolster growth, Huang said.

China is the world's second largest economy, but the weight of the Chinese A-shares accounts for just 3 percent of the total value of equities in the world. This means that there exists a huge growth room for China's capital market, Huang said, while the country's continuous financial sector opening-up will attract more long-term money to flow to the Chinese market.

"We believe that there is still a considerable room for China's equity growth in the global capital market, largely hinging on the openness of the Chinese capital market," Liu said.

"Overseas institutional investors, such as corporate and government pensions in the US, typically allocate less than 5 percent of their global portfolio to buying Chinese assets. And, the proportion of direct foreign investment in yuan assets remains relatively smaller. But, with the country's persistent efforts at advancing opening-up and restructuring its capital market, we anticipate a steady inflow of overseas capital to China in the coming years," he said.