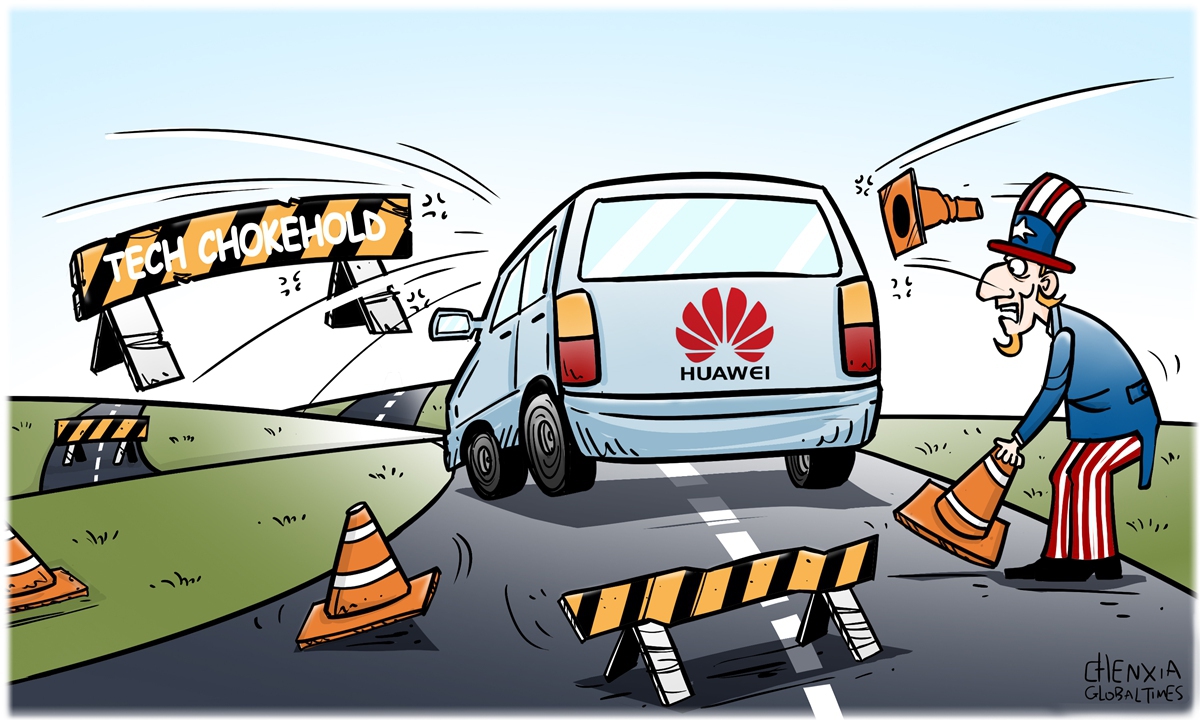

Breaking through barriers. Illustration:Chen Xia/GT

Announcing its third quarter financial results, Finnish telecom equipment vendor Nokia said its sales dropped by a staggering 20 percent year-on-year, and the once high-flying ICT player will be forced to axe between 9,000 and 14,000 jobs by 2026 to reduce production costs and better survive facing fiercer competition from rivals. The company blamed slowing demand for its 5G equipment in markets such as the US, Canada, India and Europe.Nokia, according to media reports, aspires to to cut costs by between $950 million and $1.36 billion by 2026. The company said the cuts belong to a "difficult business decision" and is "a necessary step to adjust to current market uncertainty", which includes elevated inflation in the developed economies and higher interest rates adopted by major central banks that hit the bottom line of its customers.

Meanwhile, Sweden's Ericsson, another major vendor of mobile networks, reported a net loss of $2.8 billion in the third quarter, as its global sales dropped by more than 5 percent. Ericsson said in its quarterly financial report that the "dismal market conditions will continue into 2024" and the company will focus on reducing costs including cutting the payroll.

In sharp contrast, China's Huawei Technologies posted revenues of 457 billion yuan ($63.5 billion) during the first nine months this year, which is up 2.4 percent from a year earlier. And, company profit rose by 177 percent in the period to reach 73 billion yuan, thanks to its surging sales of the high-quality 5G networks, an expanding coterie of digital devices, as well as cloud-based software solutions.

The market rivalry among the world's top three telecom equipment vendors is trending toward different directions, with Huawei apparently gaining the upper hand thanks to its vision to resolutely exploring and diversifying its business magnitude, despite many years of ruthless attack by the US government.

An enterprise should always adhere to the long-term investment strategy, to ensure that the businesses it has invested have leading competitiveness, and excellent product quality with maximum cost control capabilities. In a word, the company, no matter which industry it is must be competitive with forward-looking vision and sustainable business model.

Unlike its European competitors, Huawei has been blazing a new trail of business development too, capitalizing on its strengths in mobile communication networks by integrating them deeply into the applications of traditional infrastructure, and at the same time a flurry of new innovational breakthroughs are achieved, effectively expanding the company's business domains.

Some observers say that technologies and industries, in the near future, may emerge into a technology cluster, consisting of several cross-cutting technologies or become cloud-like in structure. Once the essential technology enables a breakthrough, it will drive the growth of the entire industry cluster, and the company or the nation that leads the best practice model will become the global leader. Huawei has the capability to become such a leader. Its expertise in 5G and its forays into mobile operating systems and advanced cloud services position the company to capitalize on the global transition to an increasingly digitally integrated world.

The company's release of the popular 5G-capable flagship smartphone series in August, armed with an advanced semiconductor chip made at home, and the soaring sale of its advanced electric vehicle Aito-7 and Aito-9 are expected to contribute strongly to its quarter-4 results. More than 1.6 million Mate 60 series phones have been sold during the first six weeks of sales, according to Counterpoint Research. And, bookings for Aito-7 and Aito-9 smart cars have surpassed 140,000 within 40 days of their premiere. Huawei shipped a total of 14.3 million smartphones in China in the first half of 2023, up 40 per cent compared to the same period last year.

Since the US government imposed harsh export bans on Huawei in 2019, cutting off its access to high-end semiconductor microchips and US-based software, many in the world thought the "good old days for Huawei's consumer business" was coming to an end, because it was really harder for Huawei to compete in that field. And, others claim that there aren't many lines of business beyond the devices that are quickly scalable and can maintain high profit margins for the company. But Huawei has proved them wrong - the Mate 60 series and the smart vehicles armed with Huawei's autonomous-driving system are being snapped up by subscribers in the country.

In addition, to counter US sanctions, Huawei has revealed that its Harmony NEXT operating system is ready for launch, which will usher in a completely native HarmonyOS app ecosystem. Right now, major Chinese internet platform companies are scrambling to recruit app developers for projects based on Huawei's homegrown operating system. In August, the company said more than 700 million devices, mostly in China, have been equipped with its Harmony system.

During a recent product launch conference, Yu Chengdong, the CEO of Huawei's consumer business group, anticipated that a new era of mobile applications is on the horizon. He said that Huawei has devised a plan to invest a substantial amount of money to support the developer community, and create a more developer friendly environment. In the last four years, Huawei has built a robust Harmony ecosystem in the country. As a result, breaking away from Android support should not pose a challenge for Huawei.

At the same time, Huawei is diversifying its product portfolio, focusing on some 20 industries such as transportation infrastructure, autonomous vehicles, ports, mining, finance, education and health care. For most of these industrial sectors, Huawei is largely reliant on partners in each industrial line, to whom it supplies its technology.

As a matter of fact, Huawei has become a new and important pace-setter in high-tech innovation on the planet. The company is leading the whole country in the competition with the US in the digital sphere. China's international competitiveness in digital technologies such as high-speed broadband, cloud computing, the Internet of Things, robotics, big data and artificial intelligence is shored up by a group of Chinese companies spearheaded by Huawei.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn