‘China’s 2023 growth target within reach’ as robust industrial output, retail sales data posted in Nov

Photo:VCG

China on Friday reported a number of economic indicators for November, with industrial output expanding at a better-than-expected 6.6 percent, also the fastest in almost two years, and retail sales also gaining a steady 10.1 percent growth year-on-year, according to data from the National Bureau of Statistics (NBS).

Observers and officials said the raft of upbeat data, while factoring in a low base effect, arguably offers a fresh sign underscoring that the world's second-largest economy has been sustaining "continued recovery and progressing for the better," as macro policies yield more results and the country unswervingly addresses multiple challenges head-on - ranging from geopolitical tensions and insufficient domestic demand to a slowing property sector.

To date, China has released major economic figures for the first 11 months. Based on the clearly-painted economic map, officials and observers said China is poised to achieve its pre-set annual GDP goal of around 5 percent this year and continue serving as a locomotive for the global economy.

The reading on Friday also marks the first key economic data released after the tone-setting Central Economic Work Conference (CEWC), which analysts believe would give new clues for Chinese policymakers to fine-tune more targeted measures next year. If those policies kick in on time, it is likely that economic recovery will continue running at full swing in 2024, and GDP could expand above 5 percent, dismissing Western pessimism over the Chinese economic outlook, economists said.

The 6.6-percent growth in industrial output in November beat market expectations of 5.6 percent, and is also the highest pace since February 2022, according to media reports.

Retail sales, a gauge of consumer spending, logged a 10.1 percent growth in November in year-on-year terms, a significant growth from the 7.6 percent in October. It is also the fastest pace of growth since May.

Fixed-asset investment, an important measure of capital spending in China, rose 2.9 percent on a yearly basis in the first 11 months. The growth rate was unchanged from the January-October period.

NBS spokesperson Liu Aihua said at a press briefing of the State Council Information Office on Friday that "as the macroeconomic policies have shown effects in November, the Chinese economy has continued to recover and progress."

She said that the main development goals this year are expected to be achieved. And despite challenges including a complicated, severe and uncertain external environment, insufficient domestic demand, and low social expectations, "China's favorable conditions for development outweigh adverse factors."

"There are a slew of key takeaways from the data, indicating that the downsides dragging on the economy have been eased, and economic recovery fundamentals are consolidating and improving," Tian Yun, a veteran economist based in Beijing, told the Global Times on Friday.

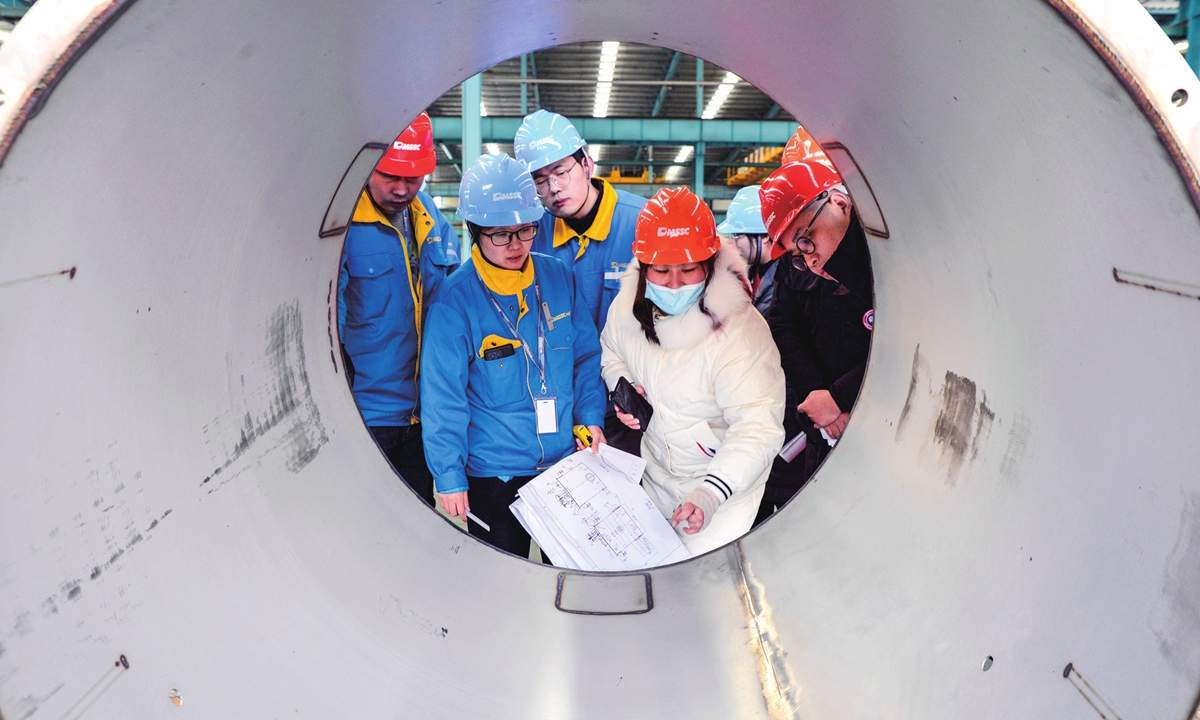

Workers check lithium battery manufacturing parts at a local factory in Wuxi city, East China's Jiangsu Province. Photo: VCG

Examining November data

Analysts highlighted the noticeable uptick in the industrial side, which they said was a combined result of a climb in overseas demand, other stabilizing policies as well as last year's low base. Also, manufacturers generally expand inventories at the end of the year and exports accelerate ahead of Christmas, also constituting a lift for factory production.

In terms of other highlights of the Chinese economy, Steven Alan Barnett, senior IMF resident representative in China, emphasized China's strong household consumption, and cited it as another reason behind the IMF's recent upgrading of the Chinese economy.

The IMF recently raised its forecast for China's GDP growth this year to 5.4 percent from 5 percent in October. OECD also predicted in November that China's GDP will grow by 5.2 percent this year.

"Consumption explained around 80 percent of China's economic growth in the first three quarters of the year…. Continuing this pattern - household consumption growing faster than GDP - would be one key aspect of highlights for 2024," he told the Global Times in an exclusive interview.

Likewise, economists also have high hopes for domestic demand, whose recovery still lags behind that of the production side to the year end.

According to a readout of the CEWC, Chinese policymakers have pledged to put great focus on economic growth next year, and expanding domestic demand was put in second place on the list of economic work priorities.

According to Tian, the growth in fixed-asset investment - which weighed on the economy in 2023 and is thus critical for continued economic recovery going forward - has also reversed its plunge and stabilized in November.

Barnett told the Global Times that in terms of supportive macroeconomic policies, "the 1-trillion-yuan special bond to finance disaster prevention and reconstruction following recent floods was an important factor behind" the financial organization's recent upgrade of forecasts on Chinese economy.

The National Development and Reform Commission, China's top economic planner, unveiled the first batch of projects which will receive support from additional government bonds in 2023 this week.

"If the bonds issuance is executed in a steady manner, it will inject new impetus into investment. More new projects will be launched in December, which could ensure that the Chinese economy gets a head start next year," Tian added.

Among the sub-indices of fixed-asset investment, investment in real estate development was down by 9.4 percent, reflecting continued downward pressure, NBS data showed.

In response to market concerns over a property downturn, Liu said at the press briefing on Friday that a number of measures for the real estate market have led to signs of marginal improvement recently under optimizing measures. And while the sector is still at an adjustment stage, it is expected to gradually improve with the deepened implementation of relevant measures.

"If the persisting pressure on the property sector is ameliorated next year, the growth of fixed-asset investment could return to a normalized track of 5 percent," Tian forecasted.

Lujiazui area in Shanghai Photo:Xinhua

Next year's work

After the conclusion of the CEWC, global discussions on how China's economy would navigate in the coming year have come under the spotlight. It is believed that the economic data in November will provide a beacon for policymakers to prescribe a targeted policy package that proactively addresses upcoming economic headwinds in 2024.

While recognizing foreseeable challenges, Chinese top leadership has displayed strategic focus and great confidence in steering the world's second-largest economy across choppy waters. The country has been drawing up policies in an organized way, leaving plenty of room for further policy maneuvers when necessary.

In a targeted effort to bolster the real estate market, the Beijing and Shanghai municipal governments on Thursday made major adjustments, including lowering down payment requirements and cutting mortgage interest rates, in a bid to better support demand for first-home purchases and upgraded housing.

Barnet suggested that on the fiscal front, reorienting policy toward supporting household consumption could lift growth without increasing the fiscal deficit. "This could include measures to increase programs that support lower-income households and strengthen the social safety net," he said. As for monetary policy, further easing through additional interest rate cuts would provide support for the economy.

The next step is to closely watch how Chinese authorities, both at the central and local levels, set growth targets for year 2024, and deploy the economic work under the guidance of the CEWC during the "two sessions" next year, according to Tian. He forecast that if major policies are rolled out at a key juncture, GDP growth in the first half of 2024 could even hit around 5.5 percent.

Analysts also dismissed the Western media's constant undermining of China's economic prospects, saying that there is no need to worry about its long-term stable development, adding that patience is needed for targeted policies to produce more effects.

"The Chinese economy remains resilient, with new productive forces, new economic areas and new business models showing rapid development," Cao Heping, an economist at Peking University, told the Global Times.

"We will see how the economic blueprint pans out by the end of the first half of 2024. A robust growth by that time would rebut any pessimism fallacy over the Chinese economy, such as the 'Chinese economy collapse' theory and 'Chinese economy sees widening gap with the US' rhetoric," Tian added.