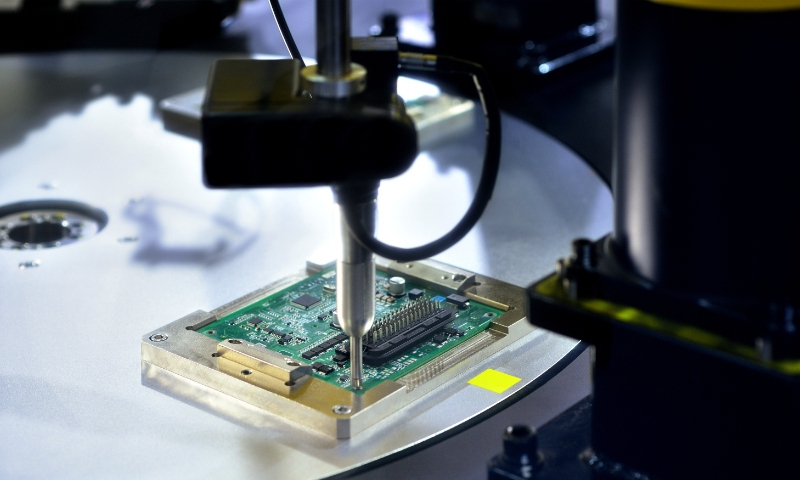

chip Photo:VCG

The US Department of Commerce (USDC) said Thursday local time it will launch a survey of Chinese-sourced chips which are part of the US semiconductor supply chain. Experts argue that this move, under the guise of so-called national security, is an escalating move to target China's chip industries and will further disrupt the US semiconductor supply chain.

The survey aims to identify how US companies are sourcing current-generation and mature-node semiconductors, also known as legacy chips and how deeply reliant US companies have become on the technology from China and reduce so-called national security risks, according to the USDC.

In January of 2024, the Bureau of Industry and Security (BIS) within USDC will launch the survey, which focuses on the use and sourcing of China manufactured legacy chips in the supply chains of critical US industries, according to an announcement on the USDC website.

US Commerce Secretary Gina Raimondo said "over the last few years, we've seen potential signs of concerning practices from (China) to expand their firms' legacy chip production and make it harder for US companies to compete."

In response to the US move, Chinese Foreign Ministry spokesperson Wang Wenbin on Friday urged the US to respect international trade rules and the principle of market economy and create enabling conditions for China-US economic and trade cooperation.

"The global industrial and supply chains are shaped and developed by the laws of market and business choices combined. Any deliberate intervention to instrumentalize and weaponize economic and trade issues is a violation of the principles of market economy and fair competition and will pose risks to the security of global industrial and supply chains. It will hurt the interests of the whole world, including the US itself," Wang said.

The citing of national security is just a pretext to maintain US competitiveness in legacy chips, where China has advantages including lower costs, faster research and development progress, and more diverse application scenarios compared to the US, Ma Jihua, a veteran telecom observer, told the Global Times on Friday.

Ma said that with the survey the US is currently conducting research and testing to assess the feasibility of finding suitable substitutes. However, it is unlikely that they will be able to find a viable alternative in the near term, as building chip factories and establishing an entire supply chain require time and resources.

By 2027, China's share in mature process capacity is expected to reach 39 percent, with room for further growth if equipment procurement proceeds smoothly, according to high-tech industry consulting firm TrendForce.

Due to export controls on advanced equipment by countries like the US, China has shifted its focus toward expanding investment in mature processes, specifically the 28nm and more mature processes, which can be applied for most scenarios across the semiconductor industry.

If the US restricts domestic companies from using Chinese-made chips, it would have significant consequences and economic loss for the US compared with previous chip restrictions given the large sales and usage of mature-node in the industry, which account for over 90 percent of the overall chip market and are used in various manufacturing industries, Ma added.

Imposing restrictions would undoubtedly lead to a backlash and dissatisfaction among these companies. Additionally, the competitiveness of their products would suffer, placing significant pressure on the US economy, Ma explained.

The investigation targeting mature chip supplies is a significant move by the US to curb China's chip industry, following the recent expanded export control on AI chips.

It shows that previous restrictions imposed by the US on China's chip industry did not achieve the desired effect but instead harmed the business of US companies, Ma said.

"Export controls will have a negative effect on our China business, and we do not have good visibility into the magnitude of that impact even over the long term," Chief Financial Officer of Chip designer Nvidia Colette Kress, said during a conference call with analysts in November.

The US is losing the first round in its attempts to curb China's tech progress, with Huawei's Kirin 9000s serving as an example of a breakthrough against US sanctions.

"As Chinese companies continue to scale up their operations, they will definitely have the ability to move up the value chain. This is true for most technology products," Ma said.