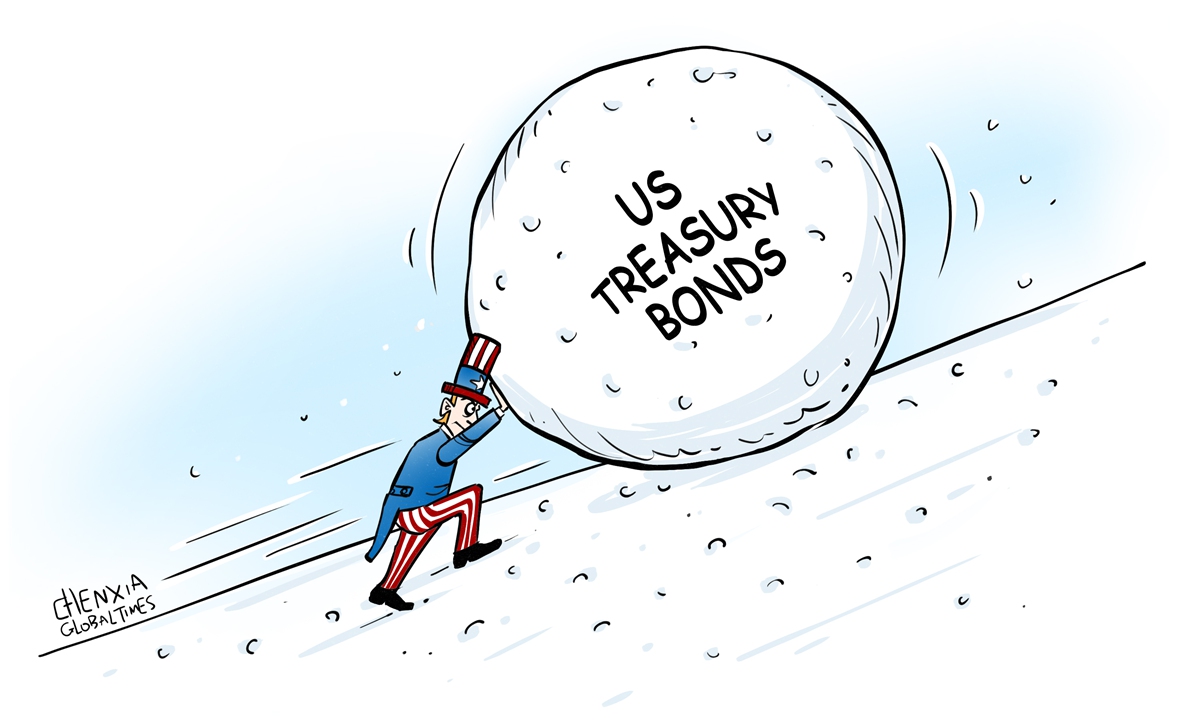

Illustration: Chen Xia/Global Times

China has been paring its holdings of US government bonds for months, as the country's total stockpile of US Treasury debt narrowed to less than $770 billion in October.

Overseas media pundits speculated that the motive behind China's reduction is to "retaliate" against the economic coercion and technology suppression by the US of recent times. But they are too evasive, by not telling the world the more obvious reason - that the US national debt is now reportedly approaching $34 trillion, which may trigger another financial system crisis soon.

Not only is China downscaling its US Treasury holdings, many other countries are dumping these bonds too, because purchasing US debt is no longer considered to be investing in a "safe haven" asset.

According to the Treasury International Capital data released by the US Department of the Treasury on December 19, as of the end of October, China held a net $769.6 billion of US government bonds, down $8.5 billion from one month earlier. October also marked the seventh consecutive month that China's purchases fell.

The public chorus for reducing the country's holdings of US Treasury debt has been getting louder since Washington moved to cut off crucial supplies to a group of Chinese technology companies - both private-sector and state-owned ones. When Fitch Ratings lowered the US government's credit rating from AAA to AA+ in August, more countries were agitated and jumped on the bandwagon of cutting their US assets.

It is a precautionary and also prudent decision for China and other countries to trim their US Treasury holdings, given the deteriorating fiscal crunch faced by the Biden administration, as well as the rising possibility that the US Federal Reserve's reckless monetary policy tightening and high interest rates may cause an economic downturn or even a recession next year. For instance, the US Congress has just approved a staggering defense budget of $886 billion for 2024, which is set to aggravate and worsen the US debt woes.

US Treasury bonds used to be the prime choice of China and other emerging economies like Brazil to park their foreign exchange reserves. But what made these countries run away from the traditional "safe haven" asset to store their hard-earned trade surplus?

There are two culprits: Uncle Sam's accelerating fiscal deterioration and the weaponization of the US dollar by Washington politicians.

US government debt has kept exploding, especially when the country decided to spend relentlessly out of a nightmarish financial system meltdown in 2008. To support a broken economy at that time, the US Federal Reserve adopted record loose monetary policy. It is senseless and outlandish for the Biden administration to keep splurging like his two predecessors in government spending since Day One in the White House, causing the US national debt to surpass $33 trillion, in addition to creating runaway inflation.

Foreign investors are increasingly unnerved with the trajectory of the US debt and the country's fraught fiscal governance. Washington's overspending is projected to keep pushing up its debt to unsustainable levels, with some economists warning of some form of a fiscal default in the near future.

Massive US budget deficits are a growing risk to the country's and world's financial stability. In the first half of this year, three US banks - Silicon Valley Bank, Signature Bank and First Republic Bank - collapsed when bank runs were triggered after they were forced to sell their Treasury bond portfolios at large losses, because the bonds had lost significant value as market interest rates rose.

To prevent the contagion from affecting more banks and spreading to the world, the US Fed and several other central banks intervened to provide extraordinary liquidity.

A rising number of governments have warned against the weaponization of the US dollar, particularly after media reports said Western countries, including the US, are exploring ways to justify seizing Russian central bank assets that are frozen in the financial system. More countries have chosen to diversify their foreign reserves by purchasing more gold and non-US assets.

With regard to China, there is another reason for the country to cash in from selling US Treasury debt - to stem capital flight in 2023 caused by the US central bank's steep interest rate hikes to the current yearly 5.25-5.5 percent. A slight depreciation of the yuan is normal, as a widening interest rate gap between the two countries drove foreign investors to pull money out of China. To prop up the yuan, it was necessary for the country's central bank to shed US Treasury holdings.

Chinese economists also worry about the security of China's overseas assets, the country's US Treasury holdings in particular, because Washington's "decoupling" or "de-risking" maneuvers haven't really stopped. Gold, a global safe-haven asset, will provide China with a more resilient means to navigate market headwinds. As of the end of October, China had had gold reserves of 71.20 million ounces, increasing for the 12th straight month, data from the State Administration of Foreign Exchange (SAFE) showed in November.

Security is always a major goal highlighted by the SAFE, which oversees the country's foreign exchange reserves. The US government has tilted toward brandishing its sanctions club in conducting state-to-state relations, so it is warranted and imperative for other governments to shed risky and perilous assets.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn