Policies boost China’s attractiveness to foreign investors: official

Despite global challenges, firms step up investment in Chinese market

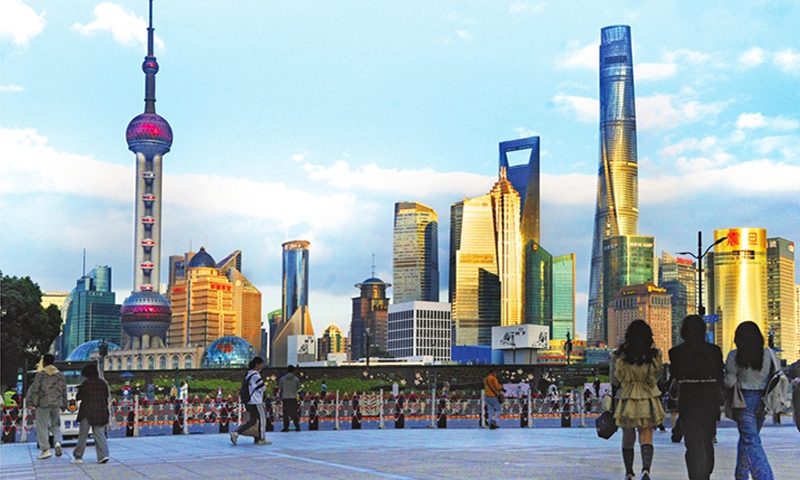

A view of Shanghai, China's major financial hub and destination for foreign investment Photo:VCG

While foreign investment into China has been declining since the second quarter of 2023 due to a downturn worldwide, Chinese officials and analysts remain confident that China is still a top destination for global investors, thanks to measures to expand market access and improve the business environment.

China's top policymakers have made stabilizing foreign capital inflows a top priority for economic work in 2024 and pledged opening-up measures in several areas. With these policies taking effect, China's attractiveness for global investors will be further boosted and more foreign businesses will enter the Chinese market, contrary to claims of "foreign capital fleeing China," officials and analysts said on Monday.

The Ministry of Commerce (MOFCOM) said on Monday that it will foster new engines for foreign trade, including digital trade, further expand market access and create world class business environment in 2024, according to a statement released after a national commerce meeting conference.

"As the impact of the COVID-19 pandemic fades and investment attraction policies continue to be implemented, China's attractiveness to foreign investors will continue to increase," Zhu Bing, director of MOFCOM's department of foreign investment administration, said in an interview with the Xinhua News Agency published on Monday.

Beginning in the second quarter of 2023, foreign investment in China reversed from rising to falling, prompting speculations about China's attractiveness for global investors. In the third quarter of 2023, for example, direct investment liabilities - a broad measure of foreign direct investment (FDI) - showed a deficit of $11.8 billion, according to the State Administration of Foreign Exchange.

Commenting on the FDI decline, Zhu said that there were several factors, both economic and non-economic. He said that the impact of the epidemic has not dissipated yet, which affected foreign businesses' investment decision-making. Zhu also pointed to "certain fluctuations" in cross-border capital flows due to geopolitics and contractions in global international cross-border investment.

Data from the United Nations Conference on Trade and Development reflected a global downturn. Global total cross-border FDI dropped by 12.4 percent in 2022 to $1.3 trillion, about 60 percent of the record high of $2 trillion-plus in 2016, and it's believed the figures fell further in 2023.

"Despite this, the fundamentals of China's long-term economic growth have not changed, and the advantages of China's super-large market and relatively complete industry and supply chains are all attractive to foreign investors in the long run," Zhu said.

Chinese policymakers have many measures to expand market access and improve the business environment, in order to stabilize foreign capital inflows. The Central Economic Work Conference, a top meeting that set economic priorities for 2024, vowed that market access for telecommunications, medical and other service industries shall be eased, among other measures to boost China's opening-up.

Analysts said that China will remain the world's most attractive FDI destination in 2024, with more foreign investment expected to flow into the country as its economy is basically back on the recovery track. This is likely to be shown in economic statistics in the second quarter, and the business climate will continue to improve.

"As China is stepping up efforts to attract foreign investment, it is also paying greater attention to optimizing the business environment. It will not only attract large projects, but also attract more investment from overseas small- and medium-sized enterprises," Wei Jianguo, former Chinese vice minister of commerce and executive deputy director of the China Center for International Economic Exchanges, told the Global Times.

Despite the fall in FDI, the number of new foreign entities established in China maintained a robust growth. Between January and November 2023, that number increased by 36.2 percent year-on-year to 48,078, according to Xinhua.

That increase is a valuable reference point showing foreign capital's confidence in the Chinese market, according to Gao Lingyun, an expert at the Chinese Academy of Social Sciences.

"Setting up new entities and operating in a foreign country are long-term investments, which means that a company is optimistic about the market. Therefore, the number of newly established and current foreign-funded enterprises in China reflects their optimism about China's long-term economic prospects," Gao told the Global Times on Monday.

China's foreign trade has also been under pressure due to weakening external demand. Still, China's exports ended a six-month declining trend in November, and imports grew for a 10th consecutive month.

Despite a global downturn, "China's foreign trade not only maintains stability in total volume, but also has new growth points, demonstrating very strong resilience and competitiveness," Zhang Wei, vice president of the Chinese Academy of International Trade and Economic Cooperation under the MOFCOM, told Xinhua.

Beyond the growth in quantity, the quality of China's exports has also seen a major upgrade, with exports of the "new three" top exports - new-energy vehicles, batteries and solar panels - jumping 41.7 percent in the first three quarters of 2023.

Hu Qimu, a deputy secretary-general of the digital-real economies integration Forum 50, said that over the past several years, the strong resilience of China's trade sector was reflected in its ability to withstand the so-called decoupling push by the US.

"China is the world's largest trader of goods, which will not be shaken in the short term. In addition, once international personnel flows become more frequent, China's trade in services will prosper," Hu told the Global Times on Monday.