GT Voice: Vietnam’s chip goals call for more cooperation, not geopolitical struggle

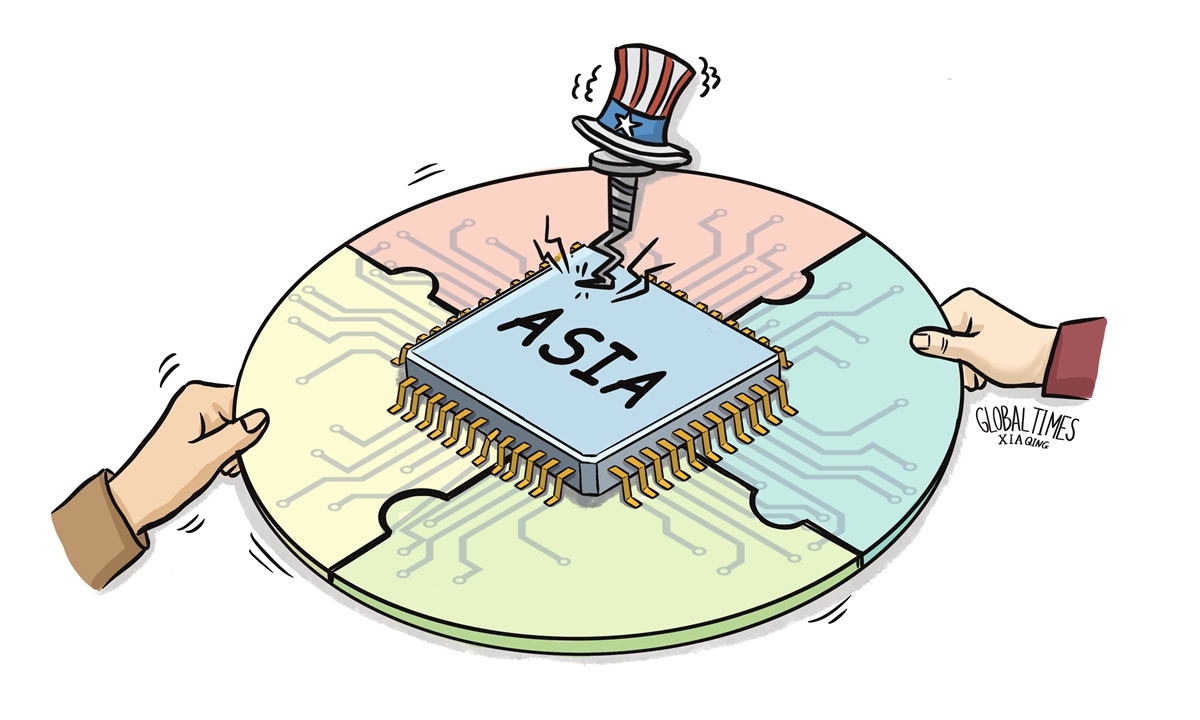

Illustration: Xia Qing/Global Times

While the US "carrot" of chip assistance dangling in front of Vietnam seems very tempting, if the Southeast Asian nation really wants to develop its semiconductor sector, it needs to first dilute the geopolitical influence on its industrial development as much as possible.Cooperation with China's industry chain will be a prerequisite for Vietnam's drive into any strategic emerging industries.

Washington is prepared to pump funds into Vietnam's chip sector to shore up supply chains and wants the country to "take advantage" of its bid to reduce reliance on China, Japanese media outlet Nikkei Asia reported on Monday.

The US is targeting seven countries for part of its CHIPS and Science Act, which provides $500 million for improving semiconductor training, cybersecurity and business climates globally, said Jose Fernandez, US undersecretary of state for economic growth, energy and the environment.

"Vietnam was one of the first countries that we thought about," he said.

It is no secret that the US has been wooing Vietnam to contain China by promising support to boost Vietnam's semiconductor industry, especially after US President Joe Biden's visit to Vietnam in September 2023. But instead of really helping with Vietnam's development, the US only wants to use Vietnam to exert pressure on China's development by drawing a piece of cake.

While the piece of semiconductor cake US politicians are offering Vietnam looks enticing and promising, it is questionable whether Vietnam can really enjoy the cake or will just be led by the nose by empty talk. For instance, since the US announced funding plans to lure chipmakers to build factories within its borders, it has been acting at a slow pace in actually providing the subsidies it promised.

More than 170 companies have applied for subsidies under the CHIPS and Science Act, which has more than $50 billion to support the domestic semiconductor industry, according to The Wall Street Journal, but only two relatively small subsidy agreements have been granted for chipmakers.

Due to the tough conditions for getting subsidies, TSMC and others announced one after another that their US plants would be delayed.

Even if the US does play a role in Vietnam's development of the chip sector by offering limited funds and other types of assistance, where will the market for Vietnam-made chips be? The reason why this is a question is because as the US tries to reduce its reliance on China by shifting chip production to Vietnam, its assistance is clearly conditional and will probably not allow semiconductor industry chain cooperation between China and Vietnam.

That may be a key issue for Vietnam to think about before accepting a piece of the American chip support pie. Given its export conditions to the US and European markets, it is advised to consider the uncertainties surrounding the downstream market for its future chips.

Vietnam's exports to the EU and the US in 2023 were estimated at about $166 billion, down 9.6 percent compared with 2022. Most of its exports to the US are items like textiles, wood products, leather shoes and bags, and agricultural products, plus some electronic products.

Not only Vietnam but other countries and regions, such as the US, the EU, India, South Korea and Japan, are looking for ways to build their own chip production capacity, but the question is: Will there be enough demand for the coming supply surge?

The US may be trying to reduce reliance on China when it comes to chip production, but ultimately, chipmakers will have to rely on big manufacturing hubs and consumer markets like China to digest the chip supply.

For Vietnam, despite its technological and cost obstacles, the country has a unique advantage in developing its semiconductor sector because of its proximity to Asia's industry chains, particularly its close ties with Chinese manufacturing. If anything, Vietnam's chip sector must be built on deeper regional industry chain cooperation, not on the US geopolitical goal of suppressing China's industry chains.