Loaders arrange cargo for the China-Europe freight train service inside a logistics depot at Ganzhou, East China's Jiangxi Province on January 18, 2024. The dry port at Ganzhou handled 273,000 standard containers of goods in 2023, bringing local goods to more than 100 cities in more than 20 countries.Photo: VCG

China-Europe freight trains under the Belt and Road Initiative (BRI) have gained rising influence in cross-continent trade against the backdrop of the Red Sea tensions, as insiders said there's a high demand for cargo space on the trains.

Tommy Tan, president of Shanghai EPU Supply Chain Management Co, told the Global Times on Wednesday that the volume of both imports and exports via the China-Europe freight train operated by his company in January saw double-digit growth month-on-month.

After a decade of high-quality development, China-Europe freight trains can complete a single trip from China to Europe in about 12 days with simpler clearance and loading procedures, which is much faster than sea trips that take about 35 to 45 days, said Tan.

Yuan Xiaojun, general manager of Xi'an Free Trade Port Construction and Operation Co in Northwest China's Shaanxi Province, the operator of the regular Chang'an China-Europe freight trains, told the Global Times on Wednesday that bookings for cargo space on trains heading toward Europe doubled in January 2024 from the previous month.

Compared with maritime transport, the safety, stability and efficiency of the China-Europe freight trains are widely recognized by foreign clients, and it only takes 10 days to get to Europe, Yuan noted.

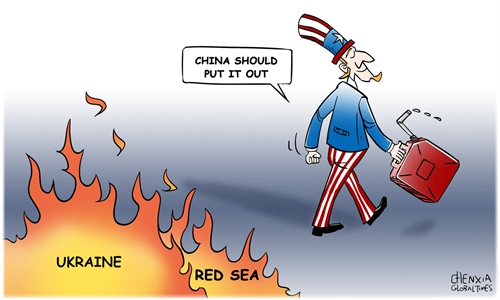

"With regard to the Red Sea tensions, the advantage in the safety of land transport via China-Europe freight trains will be further reflected," Bai Ming, a research fellow at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Wednesday.

Business insiders told the Global Times that it's normal to see more international traders turn to railway transport as sea shipping is disrupted.

China-Europe freight trains offer another option for shipments, Bai noted.

The Red Sea is one of the most important arteries in the global shipping system and global supply chains, with one-third of all container traffic flowing through it. About 40 percent of Asia-Europe trade usually passes through the region, according to AP.

Most global shipping firms have suspended Red Sea routes in recent weeks and ships were re-routed around the southern tip of Africa, or the Cape of Good Hope. The Global Times learned from industry insiders that this shift has led to a delay of shipments from Asia to Europe by 10 to 14 days, and a doubling in cost.

Kang Shuchun, a director of the China Federation of Logistics and Purchasing, told the Global Times on Wednesday that the situation in the Red Sea demonstrates the importance of diversifying transportation options.

"Accelerating the construction of the transport network crossing the New Eurasian Land Bridge can reduce the dependence on maritime transport and improve the stability and efficiency of international logistics," said Kang.

As one of the major transport hubs of the China-Europe freight train, Chongqing Municipality and Southwest China's Sichuan Province operated more than 5,300 freight trains to Europe in 2023, carrying more than 430,000 standard containers, the Xinhua News Agency reported.

In the past decade, the development of the China-Europe freight train was largely facilitated by the construction of the New Eurasian Land Bridge, the only transport corridor connecting China and European developed countries under the BRI.

The share of transported goods in total trade between China and Europe increased from 1.5 percent in 2016 to 8 percent in 2022, official data showed.