China’s price level offers room for counter-cyclical adjustments; Western slandering untenable

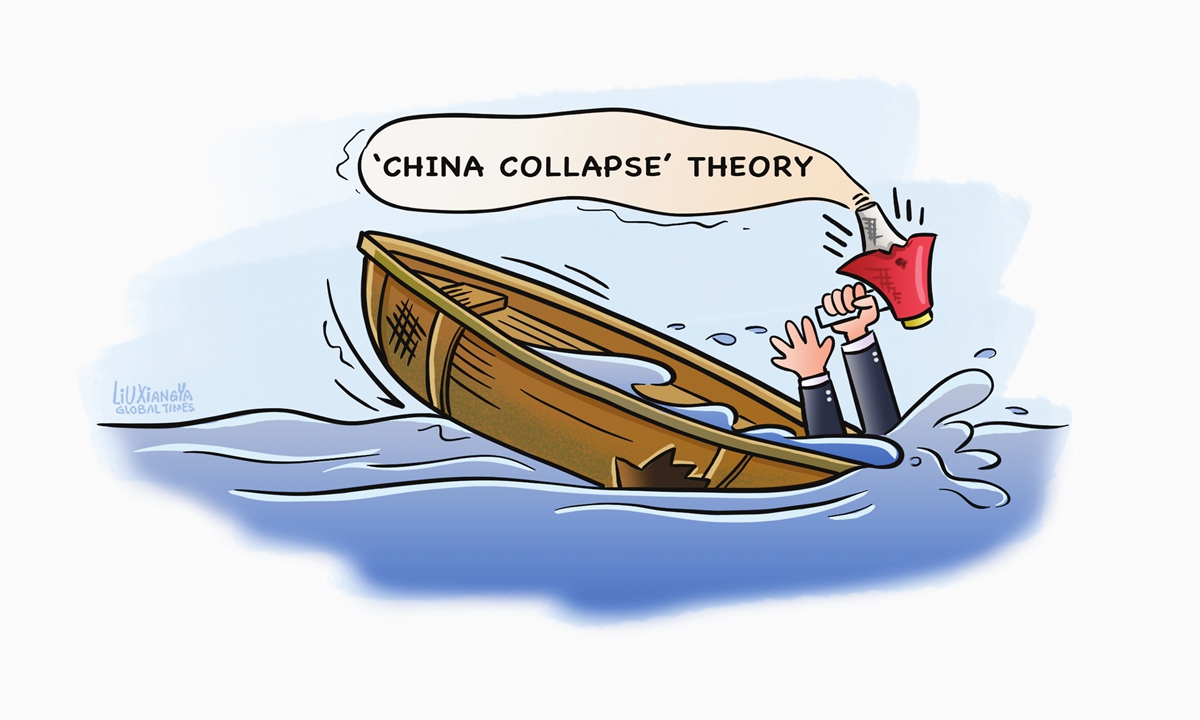

Illustration: Liu Xiangya/Global Times

China's National Bureau of Statistics is scheduled to publish the Consumer Price Index (CPI) data for January on February 8. For a period of time, some Western media outlets have been continuously hyping so-called deflation risks across China's economy. However, the relatively lower price level of Chinese economy does not represent the risks Western media hyped. Instead, it has given ample room for China's counter-cyclical adjustments to bolster economy.In a recent article entitled "Deflation worries deepen in China," The Wall Street Journal claimed that "with domestic demand weak, fears are growing that China will try to export its way out of trouble, raising trade tensions." However, this claim has severely distorted the facts.

In fact, China's consumption data of 2023 shows that domestic demand has made a significant contribution to economic growth, whereas the export data of the year reflects a weak external demand. According to official data, China's economy grew by 5.2 percent in 2023, with consumption contributing 82.5 percent to the growth. In comparison, China's exports declined slightly in dollar terms which dragged down GDP growth by 11.4 percent. Evidently, weak demand is more an external issue amid global gloom in 2023 rather than a domestic issue.

In 2023, the global economy continued to suffer from the aftershock of COVID-19. In many Western countries, with high inflation, importing cost-efficient goods from China is beneficial for their economies. It is believed that even an ordinary person without an economic background can come up with the correct conclusion to this issue. However, why do Western media and some politicians distort the truth? This is due to protectionism, clearly politicizing economic and trade issues.

When some Western media hyping up the risk of "deflation" in China through sensational headlines, the fact is that the persistently high inflation in Western countries for some time has been the main source of concern for the world economy.

The lower price level means that China has sufficient room to adopt countercyclical policies to promote economic development, while helping other countries alleviate inflationary pressures. China can fully leverage its advantages in economic capacity and tap into its potential in other areas.

The People's Bank of China (PBC), the central bank, will strengthen cross-cycle and counter-cyclical adjustments in the use of monetary policy tools to create a favorable monetary and financial environment for economic growth and price stability, Pan Gongsheng, the central bank's governor, noted at a press conference on January 24. Clearly, the ample room for policy maneuvering reflects the overall resilience of the Chinese economy.

It should be noted that the relatively lower price level of China's economy is a result of a series of factors including high base factors, cyclical factors and external factors. It is temporary and periodical. It is not "long-lasting or irreversible" or even "debt-deflation spiral" as stated by many Western media.

China's core CPI remains stable, and market confidence is steadily increasing. The PBC's third-quarter report on the implementation of monetary policy in 2023 stated that prices will remain low in the short term and return to normal levels in the future. In the medium to long term, China's economy is overall balanced in terms of supply and demand, and the monetary policy remains prudent. The inflation expectations are stable, and there is no basis for long-term deflation.

More and more new signals have emerged, indicating a rebound in demand and a steady increase in market confidence. In January, China's e-commerce logistics index was 112.8 points, up 0.4 points compared with the previous month. The e-commerce logistics total business volume index reached 125.3 points in January, reaching a new high in nearly two years, according to data from China Federation of Logistics and Purchasing.

As 2024 begins, many economists are suggesting that China should adopt stronger countercyclical adjustments, and the fiscal deficit ratio can be increased to fully leverage the advantages of the Chinese economy. The favorable conditions for China's economic development in 2024 outweigh the unfavorable factors, and there remains a strong foundation for economic recovery, which is expected to gradually overcome the lingering effects of the pandemic. The level of prices will naturally reflect the continuous recovery momentum as well.

The Western doomsayers' hype of the "China collapse theory" has failed again and again. Regardless of whether they target the price level of the Chinese economy or any other aspect, they cannot distort the facts: China's economy is facing global economic uncertainties but still demonstrates strong stability and makes significant contributions to the world economy. It is hoped that Western pessimists can put an end to this harmful and self-defeating smear campaign and actually contribute some positive energy to the world economy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn