China, Brazil cement agricultural cooperation, with their annual grain trade hitting new record now

China, Brazil cement farming cooperation, with their grain trade hitting new record

Imported Brazilian corn is unloaded at a port in Nantong, East China's Jiangsu Province on January 22, 2024. Photo: VCG

Chinese agricultural companies have ratcheted up collaboration with Brazilian counterparts through mergers and acquisitions, reflecting closer economic relations and China's imperative to secure and diversify food supplies, as the two countries celebrate their 50th anniversary this year.

As part of the latest efforts to deepen cooperation, Chinese companies such as Syngenta and Yuan Longping High-Tech Agriculture Co have made their moves this year in lining up to acquire stakes in Brazilian seed companies, according to media reports.

Chinese experts have said that the latest moves by the Chinese industry conglomerates showed their strong willingness to expand supply chain cooperation with the South American country in a wide range of areas, including trade, investment, business operations, technology interactions and more.

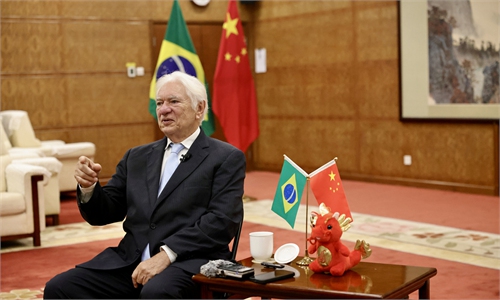

The cooperation has been strengthened after the bilateral relations have become closer than ever, with the visit by Brazilian President Luiz Inácio Lula da Silva in April, 2023. Agricultural cooperation was an important focus during Lula's trip.

Food security

Experts said that with food security being placed at the core of Chinese government agenda, the bilateral cooperation in the field will only get deeper and wider. Both Syngenta and Yuan Longping High-Tech Agriculture Co have strengthened their presence in Latin America through acquisitions since this year.

Yuan Longping High-Tech Agriculture Co will acquire 90 percent of the shares of the Cereal Ouro soybean seed processing plant located in Rio Verde, Brazil, according to jiemian.com on February 18, a move marks that the Chinese industry player's business in Brazil enters a new market segment.

This was not the first time that Yuan Longping High-Tech Agriculture Co expands the Brazilian market. The company has already opened up the South American market through a number of acquisitions. For example, in 2023, it opened research and development (R&D) centers in places such as Maranhao and Goias, while the R&D center in Parana is expected to be completed in 2024.

Similar to Yuan Longping High-Tech Agriculture Co's development path, Syngenta Vegetable Seeds announced its completion of the acquisition of Feltrin Sementes, a Brazilian vegetable seed company serving smallholder growers and home gardeners, in 2023.

Currently, Yuan Longping High-Tech Agriculture Co ranks third in the Brazilian corn seed market, behind Corteva of the US and Bayer of Germany.

Through cooperation, such as business mergers and acquisitions, Chinese companies can contribute to the advancement of the Brazilian farming industry by providing needed capital and technologies, Li Guoxiang, a research fellow at the Rural Development Institute of the Chinese Academy of Social Sciences, told the Global Times.

These mergers and acquisitions can also enhance the management of the supply chain, leading to further stabilization in the quality and quantity of agricultural products including soybeans, Li said.

Currently, the US and Brazil both serve as primary sources for China's soybean imports, with China's proportion of agricultural imports from Brazil steadily increasing.

Total soybean imports into China in 2023 reached 99.41 million tons, marking an 11.4 percent increase year-on-year. Among them, Brazil's share rose to 70 percent, while the US share decreased to 24 percent, according to public data.

In 2023, agricultural products exports from Brazil to China hit a record high to $58.618 billion, accounting for 24.85 percent of China's overall agricultural imports, according to data from the General Administration of Customs.

Key factors driving this trend include Brazil achieving a historic high in soybean production last year, leading to sustained price declines on the market.

Concurrently, soybean yields in the US dropped compared with the previous autumn, compounded by lower water levels in the Mississippi River impacting barge transportation in the Gulf of Mexico, and low water levels in the Panama Canal affecting transit shipping. These factors slowed down export momentum to China, prompting Chinese buyers to expedite procurement in Brazil to secure grain supplies, Li said.

Cooperation potential

This year marks the 50th anniversary of diplomatic relations between China and Brazil, with more cooperation expected to take place at the governmental and business levels. With this backdrop, experts said there is a much larger scope for cooperation that the two agricultural powers can explore.

China's robust demand for imported soybeans, often utilized as animal feed, has been greatly bolstered by the rising demand for pork.

In 2023, China's soybean imports remained above 60 percent of the world total. Experts anticipate the trend will persist with the expectation of a sustained market recovery after the pandemic.

On the other hand, Brazil is seeking to gain more access to substantial markets like China and attract more investment from China to facilitate the sale of its products and stimulate economic recovery, Wang Youming, director of the Institute of Developing Countries at the China Institute of International Studies in Beijing, told the Global Times.

"The potential for cooperation is indeed substantial for both parties," Wang said, citing the example of how Chinese companies can meet their business development needs by taking part in the construction of Brazil's infrastructure, in line with local policies.

Brazil primarily transports its agricultural products from production areas to ports via railways and waterways, but these systems are outdated and insufficient, severely hampering the development of Brazil's foreign trade, Wang said.

Currently, Chinese companies have successfully applied advanced technologies such as cloud computing, big data, remote sensing and artificial intelligence in agricultural production. This has enabled real-time monitoring of crops and soil while effectively reducing pest and disease rates, and improving crop yields and quality.

"Brazilian companies can collaborate with Chinese counterparts to apply these advanced technologies to agricultural production in Brazil," Li said.