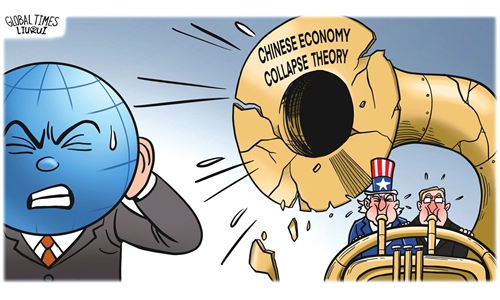

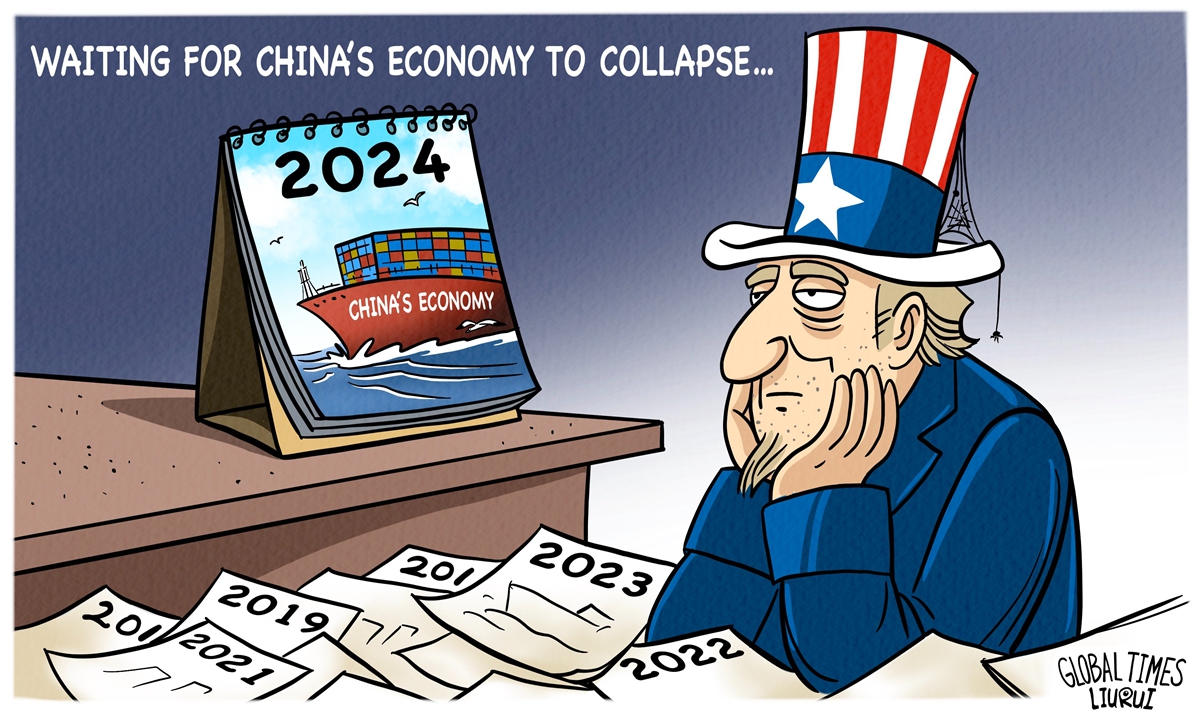

Illustration: Liu Rui/Global Times

Why shouldn't people trust The Wall Street Journal (WSJ) reports on China's economy? Because if they do, then they are likely to fall into a cognitive trap that often leads to wrong judgment, missing out on the opportunity to benefit from China's growth dividends.It is no secret that Western media outlets have largely lost the ability to objectively assess China's economic performance. The WSJ is a typical case of using sensational headlines to vacillate between the "China collapse" theory and the "China threat" theory.

From August 2023 to early 2024, the WSJ published more than 160 articles with most of them badmouthing the Chinese economy, including "The World Is in for Another China Shock," "China's 40-Year Boom Is Over. What Comes Next?" "How China Made a Youth Unemployment Crisis Disappear," "Is China's Economic Predicament as Bad as Japan's? It Could Be Worse," and "China's Economy Is Stuck in a Vicious Cycle."

But is the Chinese economy really as troubled as the WSJ claims? Those who look deeper into these reports will find these arguments are clearly short-sighted and only focus on the negative factors, turning a blind eye to the fact that China's economic growth rate still exceeds many other major economies while pushing forward with its economic transition toward high-quality development.

According to the World Bank's estimates of the growth rates of major economies in 2023, China's economic growth was about 1.5 times that of the US and about 16.5 times that of the eurozone.

When examining its China reports over the longer term, it is not hard to find that the newspaper's coverage of different periods of the Chinese economy revolves around themes like criticizing China's economy over everything.

For example, last month it published an article headlined "In China, Deflation Tightens its Grip," while almost at the same time last year, it claimed that China's economic rebound would push inflation higher and "ripple through global markets."

The perception these WSJ reports leave is that either the Chinese economy is on the brink of collapsing or it is rising so fast that it poses a threat to the world. Both serve the same goal of smearing China's economic performance and weighing on investor confidence.

The fact that the paper speaks for US financial capital and the US government is the reason why it repeatedly tries to mislead the public about the Chinese economy.

Since Western countries believe that China's economic development has moved its "cheese," the publication's stance makes it impossible to provide an objective picture of the Chinese economy.

This is why the WSJ does not mention that the "decoupling" push has created widespread losses for China and the world, and that the Chinese economy is at a critical period of recovery and industrial upgrading, which has the potential to generate more growth momentum for the world.

It only focuses on short-term fluctuations in the Chinese economy, deliberately amplifying the risks and challenges in an attempt to justify the "de-risking" or "decoupling" policy toward China.

But this biased view cannot hide the bright spots in China's economy, which is still on a recovery track with an overall improvement in major macro indicators, massive consumption, a complete industrial system and huge potential for technological innovation.

Specifically, in 2023, China's total electricity consumption was 2.3 times that of the US and its vehicle sales were nearly twice those of the US.

Also, China's crude steel output was 12.6 times that of the US, and its shipbuilding completion volume was more than 70 times that of the US.

With such manufacturing comparisons, the WSJ's "China collapse theory" is doomed to collapse again.