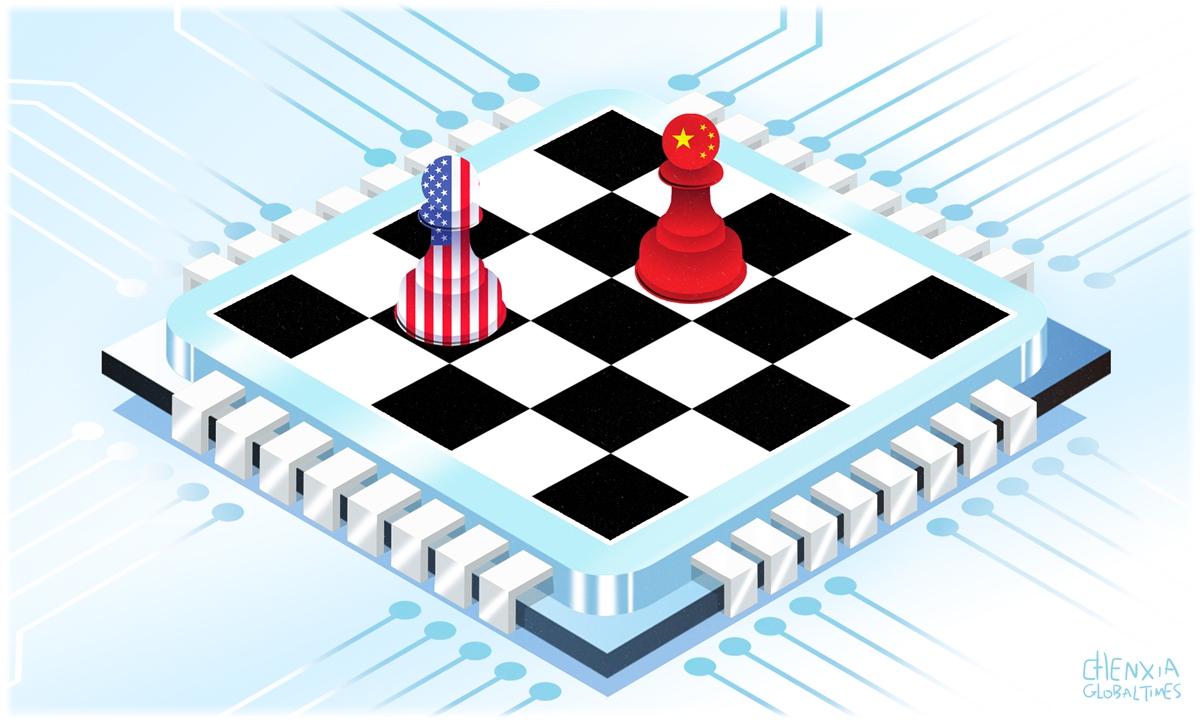

Illustration: Chen Xia/Global Times

The US has sought to restrict exports of semiconductor technologies and chipmaking equipment to crush China but, so far, the effect has been limited. As a result, it seems the US has begun to adjust its strategy, consulting its allies to combat China's chip exports.Washington's ill-intentioned chip war may have entered the second half but it won't be easy for the US side to score points.

Bloomberg published an article on Monday with a headline "EU Weighs Joining US in Reviewing Risks of Chinese Legacy Chips." The news has not been confirmed, but it has attracted attention because many believe that Washington is consulting its allies to label Chinese-made chips as a threat to national security, and hopes that US allies could reduce purchases from Chinese semiconductor manufacturers.

In recent years, the US has expanded controls on exports of semiconductors, chipmaking equipment, and other cutting-edge technologies to China, but those controls have not stifled China's technological progress. On the contrary, they have forced China to pursue a path of independent innovation and overcome challenges in commercializing semiconductor technologies.

It's undeniable that Washington's chip war has imposed pressure, but China's manufacturing capacity for semiconductors, especially for mature or lower-end chips, has improved. As a result, the US is constantly adjusting its policy in response to China's changes.

Beyond export controls, there is something new in recent developments. More focus is likely to be put on restricting sales of semiconductors produced in the Chinese mainland. This may open a new chapter in Washington's ill-intentioned chip war: after the US failed to restrict China's semiconductor production capacity, it may put more focus on restricting semiconductor sales.

However, Washington will find it more difficult to crack down on the sales of semiconductors, even if it pressures its allies to label those chips as a threat to national security, partly due to the chips' price advantages over their Western counterparts.

Chips made in the mainland are often considered more affordable compared with chips made in Western countries. The price advantage of made-in-China products can be attributed to multiple factors, including a complete industry chain, relatively low labor costs and scientific and technological innovation. China has mastered technologies for mature or lower-end chips, so local chipmakers can utilize China's manufacturing advantages and collaborate with China's supply chain, transforming them into price advantages.

As reported by the VOA, the cost of manufacturing semiconductors in the US may be 30-45 percent higher than the rest of the world. Some industry insiders believe China's manufacturing costs are much lower than those of the US.

Currently, 28-nanometer versions are the most widely used chips in manufacturing applications. According to a report released by research firm TrendForce in January, China has 44 operational semiconductor wafer fabs, with an additional 22 under construction. By the end of 2024, 32 Chinese wafer fabs will expand their capacity for 28-nm and older mature chips.

TrendForce predicts that by 2027, China's share of mature process capacity in the global market will increase from 31 percent in 2023 to 39 percent, with further growth potential if equipment procurement progresses smoothly.

An electric vehicle can easily have more than 3,000 chips. So, the price of semiconductors is a significant factor in determining industrial products' price competitiveness in the global market. Chips are critical components in a wide range of consumer and industrial products. It is unwise for any economy to block cheap chips, because such a decision will cause incalculable losses to the economy.

China and the EU have strong complementarity in strengthening cooperation in the field of semiconductors. Hopefully European policymakers can maintain strategic sobriety and rationality, and provide a stable and fair environment for foreign mature or lower-end chips.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn