Foreign financial institutions eye opportunities in China as nation committed to high-level opening-up

Institutional advantages, vast market & industrial system continue to support economic growth

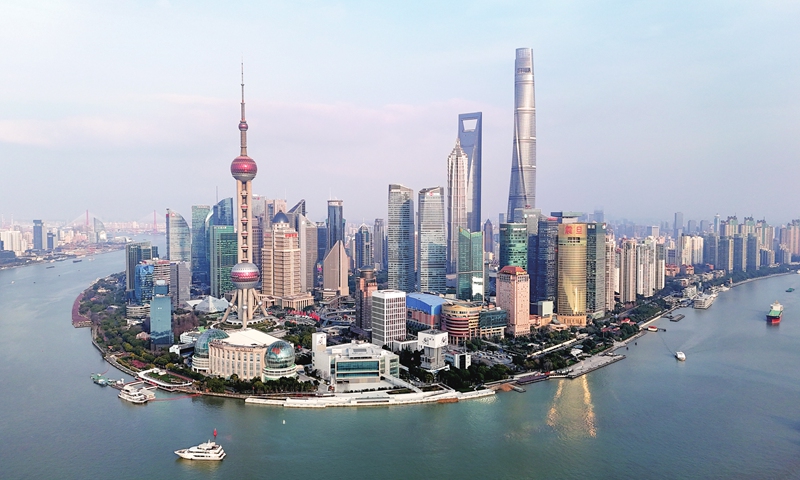

A view of Shanghai's Lujiazui area, a major financial zone in China Photo: VCG

Despite the complex and volatile international environment, foreign financial institutions continued to increase their investment in China since the beginning of 2024, representing a vote of confidence in the prospects of the Chinese economy and eyeing more opportunities brought about by the country's high-level opening-up.Standard Chartered Securities (China) Ltd (SCSCL) - the first newly established wholly foreign-owned securities company in China - officially opened for business in Beijing recently, according to a press release the company sent to the Global Times on Tuesday.

"China's capital markets are very promising as they are increasingly market-oriented and law-based. By bringing high-standard professional services, SCSCL will contribute to the development of capital markets and enhance the markets' role in supporting economic growth," said John Tan, SCSCL's chairman.

Thanks to China' concrete action toward opening-up, many global financial institutions have stepped up their presence in the Chinese market this year. On February 26, the Shanghai operations of three world-leading international financial institutions - AllianceBernstein Fund Management Co Ltd, Amundi Fintech (Shanghai) Company Limited, and KKR Investment Management (Shanghai) Co Ltd - held a collective opening ceremony in Shanghai, according to the local municipal government.

In January, Chinese authorities said that 10 more foreign-funded institutions had been approved as lead underwriters or underwriters of debt financing instruments for non-financial enterprises.

The expansion of a growing number of international financial institutions in China not only highlights the country's firm commitment to opening up its finance industry to international players, but also underscores great interest among these institutions in China's massive financial market and the huge potential it represents.

Positive on China's prospects

"Despite numerous challenges facing the global economy, we remain confident in the steady improvement of China's economy and its sustainable high-quality development," EY China Chairman Jack Chan told the Global Times on Sunday on the sidelines of the China Development Forum, which concluded on Monday.

China's institutional advantages, vast market, comprehensive industrial system, and abundant talent pool will continue to support economic growth in 2024. Additionally, a robust toolkit of macroeconomic policies will provide powerful impetus for consumption, investment and foreign trade, Chan said.

In 2023, China continues to be the world's largest growth engine with a growth rate of 5.2 percent leading major economies worldwide. Stable foreign trade in 2023, resilient amid a complex and austere external environment, has laid a solid foundation for the Chinese economy.

China has fared well and has showed strong resilience under the huge combined pressure over the past years. We still believe that China was, is, and will remain the factory of the world thanks to the improved productivity levels, broad and deep industrial clusters, and well-established infrastructure, Denis Depoux, Global Managing Director at Roland Berger, told the Global Times in a recent interview.

"The combination of a broad local market and the strong legacy export base make China difficult to replace," Depoux said, noting that China's fundamentals will be solid in the long run amid continuous transformation of new growth drivers.

During this year's two sessions held in early March, China set a growth target of around 5 percent for its economy in 2024, which exceeds expectations of some international institutions, demonstrating that the country's top policymakers remain confident in maintaining stable growth in the world's second-largest economy despite downward pressure both at home and abroad.

As a result, even Western media outlets that tend to bad-mouth China's economy start to make positive reports on the world's second-largest economy. CNBC published a story on March 13 entitled "HSBC is 'very positive' about the future of China's economy, CFO says."

"We're looking at major economic transition, which is taking place, which gives us very strong grounds to be very positive about the medium- and long-term outlook," said HSBC CFO Georges Elhedery, according to the report.

Stepping up reform & opening-up

Over recent years, China has rolled out a series of reform and opening-up measures in the financial sector. Of milestone significance in the reform of China's capital market was China rolling out its across-the-board registration-based IPO system in February 2023. The development of the Beijing Stock Exchange entered the fast lane of development amid the country's ramped-up efforts to strengthen financial support for technological innovations.

In October 2023, the top-level Central Financial Work Conference held in Beijing stressed that it is imperative to accelerate the building of a nation with a strong financial sector, vowing to promote high-quality development of the financial sector.

Meanwhile, China has been steadily promoting high-level opening-up in the financial sector, with more than 50 measures introduced, including allowing international investors to invest in the country's capital market via more channels and lifting ownership caps for foreign institutions for securities, futures and funds.

Lately, the State Council, the country's cabinet, announced 24 specific pro-foreign investment policies, including targeted measures to expand market access, enhance appeal to foreign investment, foster a level playing field, facilitate the flow of innovation factors, as well as better align domestic rules with high-standard international economic and trade rules.

Although China's foreign direct investment (FDI) declined in 2023, it remained at historically high levels, exceeding the 1 trillion yuan ($139 billion) mark, demonstrating the continued appeal of the China market to foreign investors. The surge in the number of foreign-backed companies indicates ongoing momentum in foreign companies' interest in China, with multinational corporations remaining optimistic about China's growth prospects, Chan said.

China's efforts to create a more favorable market environment by strengthening its advantages, promoting innovation, and international cooperation in areas such as green development are notable. The continuous optimization of its business environment, plus the great potential of the China market, provides broad space for the development of multinationals, Chan said.