Illustration: Tang Tengfei/Global Times

Japan aims to develop a next-generation passenger aircraft by around 2035, with a plan to mobilize a combined 5 trillion yen ($33 billion) in public and private investment over the next 10 years, Kyodo News reported on Wednesday.Japan's aviation ambitions are noteworthy, as they demonstrate that the country is doubling down on high-end manufacturing to reboot its economy despite challenges, which may generate a spillover effect on the Asia-Pacific supply chain.

Earlier this month, Japan's central bank finally ended its era of negative interest rates following signs that the country's decades-long deflation or low inflation is coming to an end.

Another significant recovery has been seen in the stock market, with its main index climbing past its all-time high after a 34-year wait. Some optimists believe that Japan's economy is awakening from its decades-long torpor, and confidence levels have hit a new high.

Against this backdrop, some analysts believe high-end manufacturing will become a focus of Japan's efforts to restart its economic engine. As a restructuring of the Asia-Pacific industrial chain seems to have accelerated, Japan might have realized that it must rely on high-end manufacturing, as well as scientific and technological innovation, to seize new development opportunities in the increasingly intense international competition.

At this moment, Japan announced plans to develop a next-generation passenger jet. It seems that analysts guessed the trend correctly.

Citing officials of the Ministry of Economy, Trade and Industry, Kyodo News said the aircraft industry is expected to be a growth driver for Japan. The country's new aircraft development project is likely to involve multiple companies, leveraging Japan's technologies and experience in areas such as aircraft bodies, engines and equipment.

In the mid-1990s, Japan had a highly diversified manufacturing economy. However, in the following three decades, some traditional manufacturing industries, such as fax machines, digital cameras, electronic watches and home audio systems, gradually declined. Now, it's become increasingly clear that Japan is attempting to revive its manufacturing industries, especially in high-end sectors.

The Japanese government has implemented several initiatives to revitalize the semiconductor industry. According to the Japan Times, the country is expected to drastically hike investment in chip gear by $7 billion this year, citing an industry association - an 82 percent increase from last year.

After its "lost decades," Japanese society experienced a sense of frustration and powerlessness, but now its confidence is recovering. Japan was once a leader in world production, known for its expertise in cutting-edge technologies such as comprehensive hydrogen energy utilization. Therefore, Japan's current efforts to develop high-end manufacturing are worthy of attention. This will potentially intensify the already fierce competition in the Asia-Pacific region.

However, Japan faces significant challenges - from talent reserves to the integrity of the supply chain - in attempting to rebuild its manufacturing influence, especially in high-end sectors.

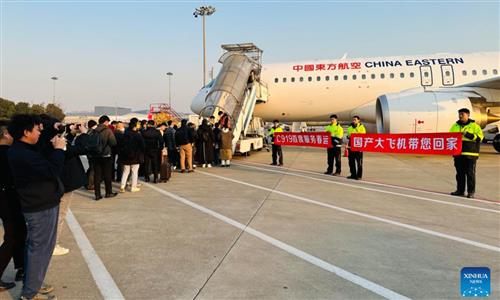

For instance, Japan's new effort to develop a next-generation airliner by 2035 is bound to encounter obstacles. Its previous attempt to establish itself as a commercial aircraft maker failed in 2023. Now, the country's renewed push for a homegrown airliner is likely to face similar challenges and difficulties.

Nevertheless, Japan has shown its determination to develop high-end manufacturing. China, as an important participant in the Asia-Pacific supply chain, is also ramping up efforts to develop advanced manufacturing. We should be aware that Japan's development could make competition in the global market more intense, and be prepared to cope with it.

A key issue is how to prevent competition from moving toward a zero-sum game. To solve this problem, all participants in the Asia-Pacific supply chain, including Japan, need to open up their markets, curb trade protectionism, oppose economic decoupling, and strengthen industrial chain cooperation.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn