Illustration: Chen Xia/Global Times

Prices for gold - traditionally seen as a safe-haven asset - have been on an uptrend in the last few months, rising about 17 percent so far this year. Against such a backdrop, US Treasury securities may lose some of their safe-haven appeal if the yellow metal continues its historic rally.Gold traditionally has an inverse relationship with US Treasury securities, as both are major safe-haven assets and therefore have a competitive relationship with each other. Overall, gold plays a crucial role in the global financial system, providing an alternative to assets denominated in US dollars.

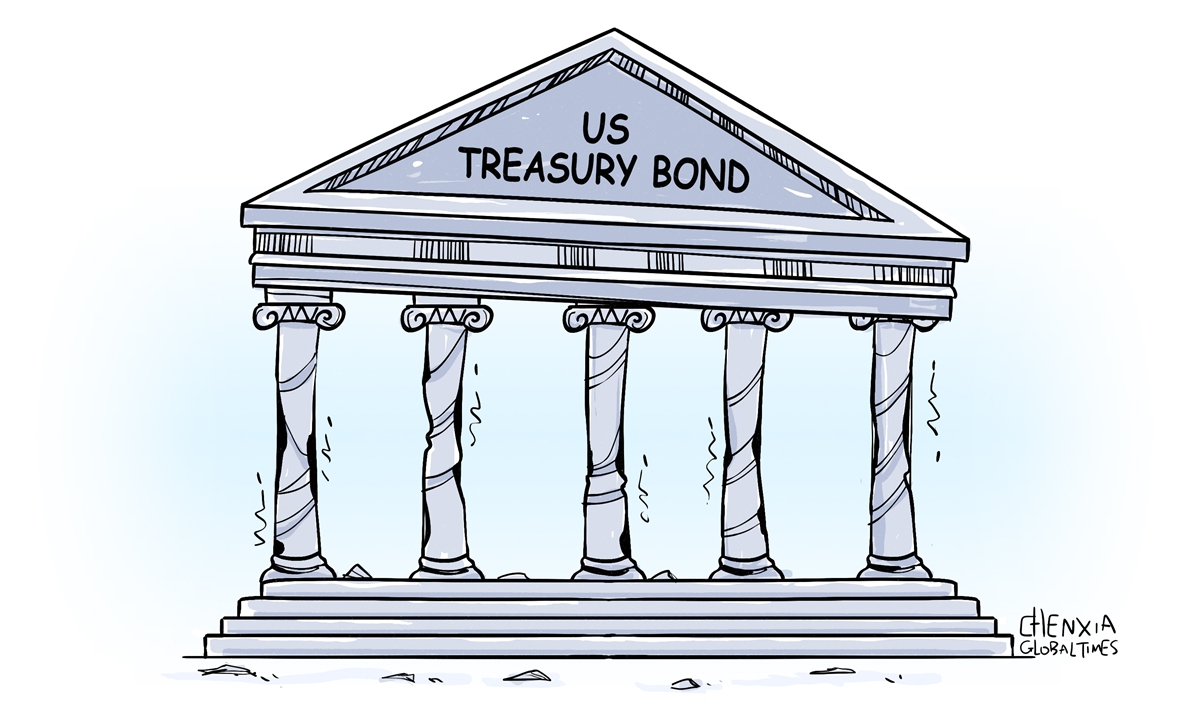

The US is facing a debt storm. The Wall Street Journal published an article on Sunday with the headline "America's Bonds Are Getting Harder to Sell." A series of weak auctions for US Treasury securities stoked investors' concerns that markets will struggle to absorb an incoming rush of US government debt, the report said.

From the supply-side perspective, investors are widely expecting the US Treasury to soon announce an increase to its sales of long-term debt. As reported, the debt load of the US has grown at a quicker clip in recent months, increasing by about $1 trillion nearly every 100 days. US debt, which is the amount of money the federal government borrows to cover operating expenses, stood at about $34 trillion as of January.

When US federal government spending exceeds revenue, creating a budget deficit, the US covers the gap by selling securities, such as Treasury bonds. The past decades have seen an oversupply of these bonds. Now, the problem is even more serious.

Last year, ratings agency Fitch downgraded the US government's credit rating, citing fiscal deterioration over the next three years and repeated down-to-the-wire debt ceiling negotiations that threaten the government's ability to pay its bills.

The oversupply of Treasury bonds issued by the US government is a result of years of irresponsible fiscal policy. Such irresponsible policies and practices have exposed the global financial system to huge risks.

From the perspective of the demand side, the challenges remain unsolved, too. For instance, the world's central bankers who manage trillions in foreign exchange reserves are loading up on gold, as multiple factors force them to rethink their investment strategies. Central bank purchases, as well as other related issues, have driven the rise in gold prices since 2022. With growing demand for gold, the pressure faced by US Treasury securities is likely to continue.

Over the past few years, the US experienced its most dramatic burst of inflation in four decades, as rising prices hit nearly every sector of the economy. The consumer price index rose 3.5 percent in March.

Stubborn US inflation has dented hopes for an imminent interest rate cut. As a result, some analysts believe gold will hit a new high as investors seek a hedge against stubborn inflation. With gold's rally, the demand for US Treasury securities is likely to continue to fall.

In times of economic turbulence, US Treasury debt was once seen as a safe harbor in an economic storm, but now, the US is confronting a possible debt crisis.

The role of US Treasury securities as the world's safe-haven asset has long benefited the US economy. It allows the US government to refinance debt easily.

But, as central banks start to diversify away from US Treasury securities and markets reassess their positions, the risk is that faith in US Treasury securities is shaken. Gold's rally may accelerate the process of a snowballing confidence collapse in US Treasury securities.

The memory of the global financial crisis is still fresh for many people - that's when the collapse of Lehman Brothers in September 2008 morphed the US financial meltdown into a global economic downturn.

The world needs to be prepared for all outcomes, including the worst-case scenario, from the irresponsible US fiscal policy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn