Illustration: Xia Qing/Global Times

The Office of the US Trade Representative recently initiated a probe into China's maritime, logistics and shipbuilding sectors, alleging China used "unfair, non-market policies and practices" to dominate those industries. This, coupled with the Biden administration's new threat to impose high tariffs on Chinese-made aluminum and steel, is again escalating trade tensions between the world's two largest economies.The probe and threat bear the US' often-used hallmark of leveraging protectionism to resist free trade in Washington's hope to protect its own industries and jobs. However, the competitive edge held by Chinese industries is due to the hard work and effort of the Chinese people, the persistent technological innovation of Chinese companies and their proactive participation in free market competition.

China's world-leading telecom equipment, high-speed trains, solar panels, and electric vehicle manufacturing, as well as its maritime, logistics and shipbuilding sectors, have gradually built up their strength through many years' expertise and Chinese enterprises' willingness to incorporate new tech breakthroughs and domestically developed software solutions.

Now, high-quality and less costly goods manufactured by Chinese companies are becoming increasingly popular across the world. Chinese technologies, such as 5G and green renewable energies, are helping the Global South develop their economies. Therefore, the American politicians' old playbook of using unilateral economic coercion to suppress and stymie the advance of Chinese economy will ultimately fail. Their desire to prolong or perpetuate American industrial dominance in the world will not come true, either.

As known to the world, protectionism and unilateralism won't bring back the lost manufacturing jobs to US shores. America's high labor costs and the Federal Reserve's insistence on an elevated interest rate of over 5 percent mean that American manufacturers can hardly compete with their Chinese counterparts. The cost-effectiveness of Chinese companies is nearly unparalleled in the world. For example, the cost of making an electric vehicle in China is approximately two times lower than in the US.

The Biden administration remains obstinate in playing the zero-sum game by implementing a policy the administration calls "small courtyard with high walls" to demarcate itself or decouple from China. It is odd to many in the world why the US stubbornly refuses to choose the road of win-win cooperation with China. Is it just to prolong America's dominance and hegemony in the world?

America's "decoupling from China" debate started about six years ago, and reached its climax in 2020. Over the past three years, the Biden administration has not tempered the decoupling or "de-risking" rhetoric, even though it knows that this decoupling will disrupt global supply chains and fragment global economy, leading to undesirable efficiency losses among American companies as well.

To slow China's economic growth, the US government, since 2018, has imposed high tariffs on up to $360 billion worth of Chinese goods, roped in its allies and "like-minded" countries to form exclusive trading blocs in key industrial sectors, pushed its businesses to relocate manufacturing operations away from China and blacklisted over 1,000 Chinese companies and research institutions. These trade barriers will hinder advancements in the world's sustainability agenda, which relies on unrestricted and seamless exchanges of both existing and emerging technologies.

In public, senior US officials, including Treasury Secretary Janet Yellen, professed disinterest in decoupling, but the Biden administration has pushed ahead with it in an attempt to isolate China and contain its rise. The US government has curbed Chinese investment in the US, banned imports of Chinese technology products such as solar panel components and 5G gear, and prohibited high-tech exports to China, including cutting-edge semiconductor chips and the tools to make them.

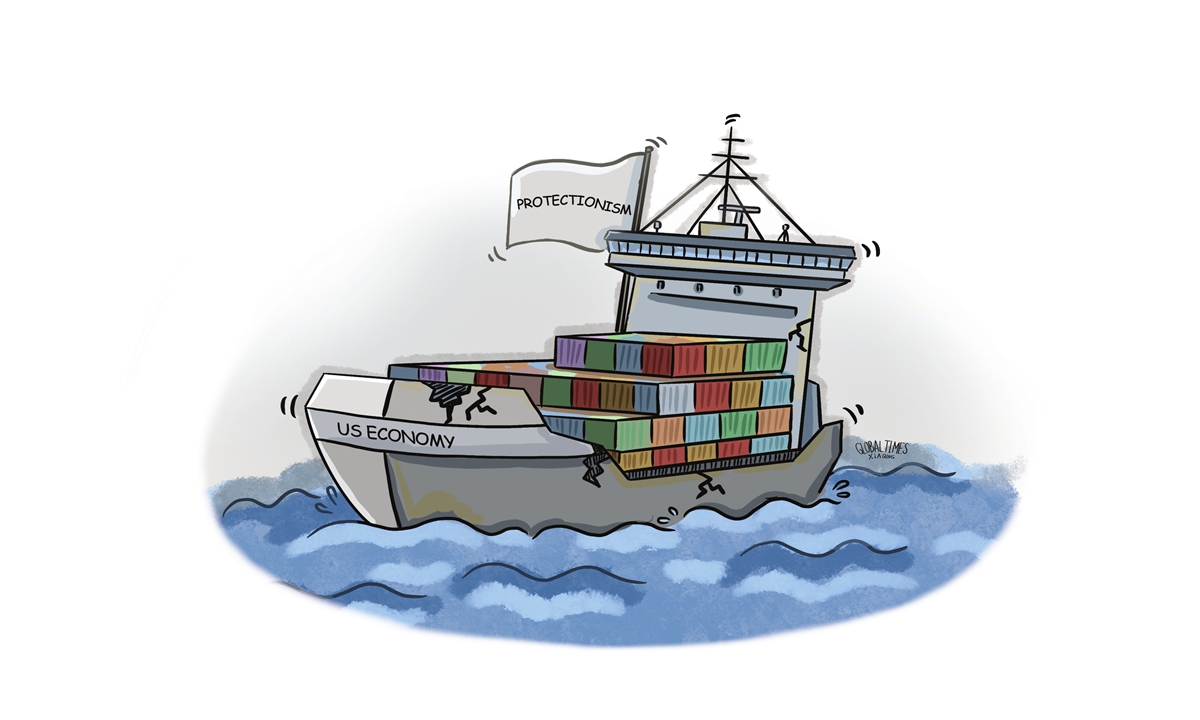

However, the two giant economies are so tightly intertwined that it is almost impossible for Washington to harm China without hurting itself, sometimes seriously. The US' decoupling strategy will only stand in the way of improving its corporate efficiency. As global supply chains are threatened by the decoupling policy, companies are complaining about a less elastic, less efficient and increasingly costly supply of components needed for manufacturing. Ordinary consumers in the US and the West are angered by expensive goods combined with high inflation.

The economic consequences of decoupling, raising trade barriers, or the push for de-globalization by the US are becoming a growing concern for global policymakers. Economists have started to estimate the economic costs for the world economy. Recently, the International Monetary Fund (IMF) listed rising economic fragmentation and an increase in trade restrictive measures as trends that could harm the medium-term outlook for the global economy.

Facing the relentless restrictions imposed by the US in recent years, China didn't choose to sit idle or throw in the towel. Thinkers and policymakers started to realize the risks of relying on foreign technology and instead focused on a strategic shift of great historic importance to decrease reliance on US technology and prioritize domestic research and innovation in order to safeguard China's economic security. Additionally, China decided to further open its economy to businesses from all countries and expand sectors available to foreign investors.

In contrast to the US, which has retreated from global economic integration, China has emerged as a leading advocate for globalization, free trade and inclusive development. History shows that shutting out foreign competition will never lead to success in the long run. The US' decision to build "high walls" to block Chinese goods and technology will not solve the underlying issues of inefficiency in its enterprises, leading to higher consumer prices and prolonged inflation for American citizens. Protectionism is not the solution to addressing the erosion of US competitiveness.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn