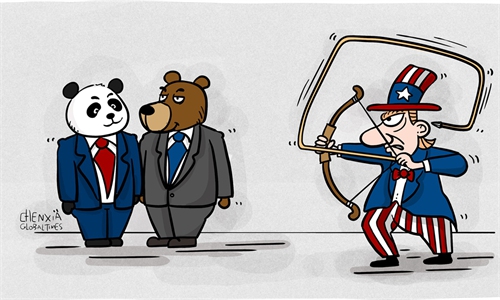

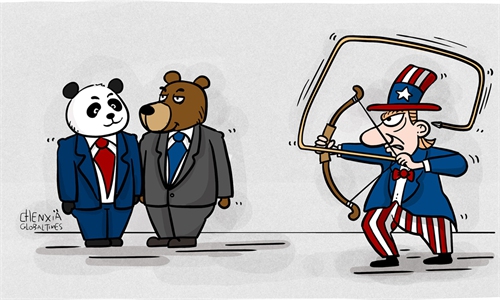

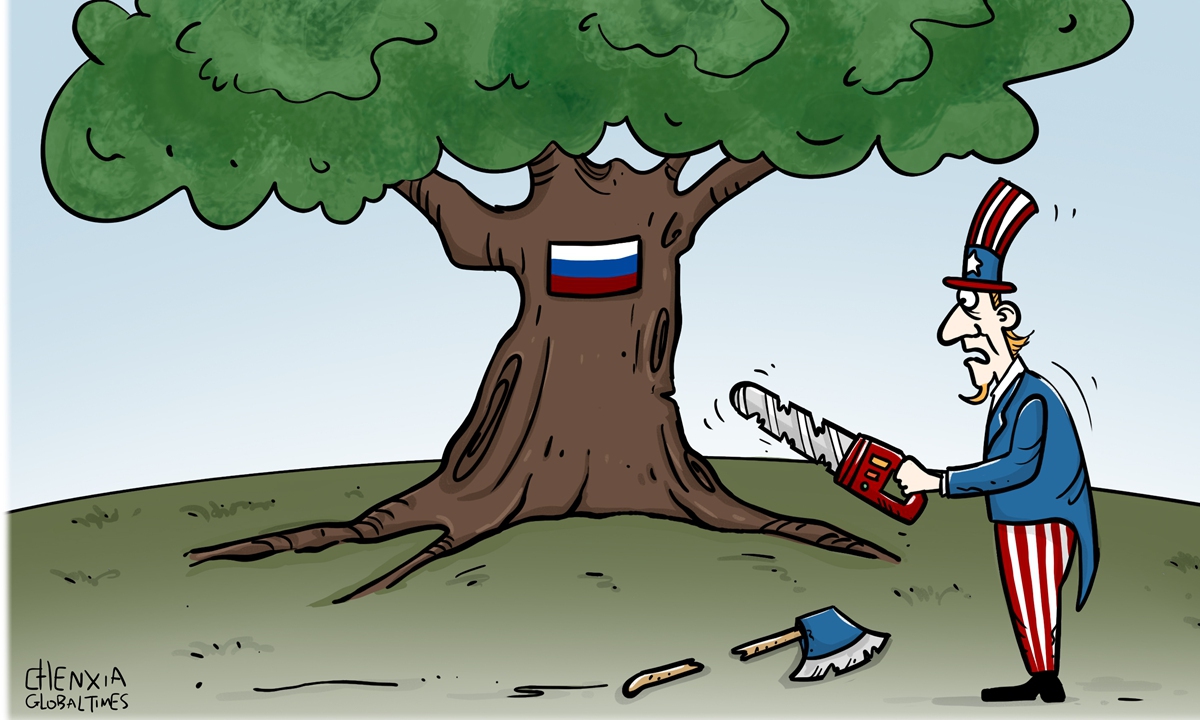

Illustration: Chen Xia/GT

The 21st Century Peace through Strength Act, which would empower the US executive branch to seize and transfer frozen Russian assets held in the country to Ukraine, was passed by the US House of Representatives with a bipartisan vote of 360-58, CNN reported on Saturday.If the bill ultimately becomes law and goes into effect, it will set a disastrous precedent against the existing international financial order.

The bill is now headed for the Senate, so the US still has a chance to avoid escalating conflicts in the field of finance. As reported, a bill must be passed by both the House and Senate in identical form and then signed by US president to become law. It is hoped that US politicians can maintain strategic sobriety, prevent the bill from being acted upon, and protect the international financial order from more shocks.

Western countries have imposed sanctions on Russia since February 2022, freezing both sovereign and private assets. According to Reuters, more than $288 billion of Russian assets remain in the G7 countries, the EU and Australia, of which 200 billion euros ($217 billion) is in the EU, mainly in Belgium.

The vast majority of Russia's assets that were frozen by Western countries are held by the EU, with the US only holding a small part. However, Washington has been the most aggressive in making proposals about how to use frozen Russian assets to "rebuild Ukraine."

It is believed that political elites in Washington are fully aware that the potential confiscation of Russian assets would undermine international finance, but many of them still support radical measures. They may have an illusion that the US will suffer little from the worsening situation, and all the country needs to do is move on after stirring up troubles by setting a precedent. They should wake up from their daydreaming.

Instead of addressing any of the problems in the Russia-Ukraine conflict, confiscation will only complicate the situation, resulting in severe consequences for the international financial system. Speaking at the Council for Foreign Relations on Wednesday, European Central Bank President Christine Lagarde stressed that seizing some $260 billion in Russian assets currently frozen in Europe would undermine the international rule of law, with unforeseeable consequences, media outlet Politico reported.

"Moving from freezing assets to confiscating and disposing of them is something that needs to be carefully considered," Lagarde was quoted as saying.

The warning deserves serious attention from top US officials, but unfortunately, they will likely remain indifferent as usual. The US, as a principal beneficiary of the current international order, is undermining international rule of law and order. This behavior will have a negative impact on the global financial system, resulting in financial conflicts or even financial wars. The US economy is likely to suffer losses, with significant spillover effect in global financial systems.

In comparison to confiscating assets currently frozen in Western countries, some politicians are discussing milder measures such as using them as collateral for loans to Ukraine, or using profits or interest earned on the assets to "help Ukraine." It should be noted that these measures also undermine international rule of law.

Regardless of how the West justifies confiscating Russia's sovereign assets and legalizing the process by changing laws and regulations, unilateral sanctions cannot solve problems and will only escalate tensions. If Western countries confiscate Russian assets, the funds obtained will not be used to promote peace, but rather to provoke financial conflicts. Ultimately, this money will fall into the pockets of American military companies.