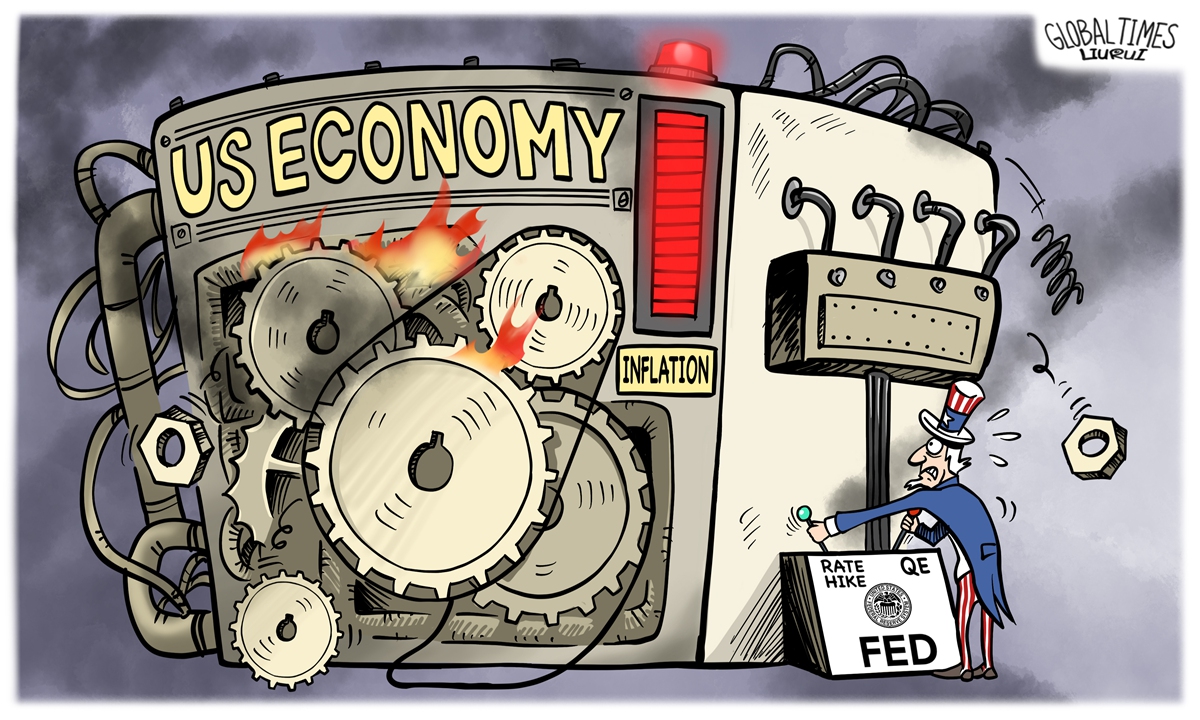

US economy Illustration: Liu Rui/GT

One year after the collapse of Silicon Valley Bank and several other US lenders, another regional bank has crumbled, reigniting concerns about the adverse impact of the US Federal Reserve's monetary tightening.

US regulators seized Republic First Bancorp and agreed to sell it to Fulton Bank, which will assume substantially all deposits and purchase all the assets of the troubled lender to "protect depositors," Reuters reported on Saturday.

While Republic First Bancorp is not a big one in the US, its sudden collapse may still serve as a reminder that even after the wave of bank failures witnessed last year, the US regional bank crisis may still be far from over, as long as the Fed's policy rates stay elevated at a range from 5 to 5.25 percent.

Republic First Bancorp is one of the banks that have been under growing pressure from persistently high interest rates and rapidly decreasing values on commercial real estate loans. For instance, PNC Financial and M&T Bank recently reported double-digit profit declines in the first three months this year as higher interest rates eat into their profits.

If anything, the plight faced by regional US banks is a microcosm of the negative impact the Fed's tightening policy has brought to the country's financial market. The Fed's high interest rate policy is supposed to tame inflation and maintain economic stability, but it has proven to be ineffective for those purposes. Now with US inflation exceeding expectations for a third month in a row, hopes for a rate cut in the short term have been dashed, highlighting the dilemma of the Fed's policy choices. More worrying, the Fed seems to have no clue about how to address the messy situation.

Meanwhile, the negative spillover effect of the Fed's high interest rates on the global economy and capital markets is bound to accumulate and worsen. The longer the Fed's high interest rate policy persists, the greater the constraints on the US economy will become, not only exerting rising pressure on the domestic financial system but also on global financial markets, particularly the emerging markets.

In a high-rate environment, the emerging market economies have to contend with the pressure of capital flights, increased foreign debt servicing costs, and a heightened risk of currency depreciation.

For example, since the middle of April, the currencies of many Asian economies have experienced growing volatility, leading to concerns about a possible currency war. The depreciation of these currencies has also sparked turmoil in stock markets in some countries, evoking ugly memories of the 1997 Asian financial crisis.

From China's perspective, while the yuan has displayed resilience in the foreign exchange market in recent days, it is essential for China to closely monitor the impact of US monetary policy on broader Asian markets. The impact of the strong dollar on Asian markets is a complicated issue, encompassing monetary policy, international trade and capital flows, among other factors.

In the case of another bad scenario in Asia, China needs to get prepared with effective measures to bolster its own financial risk management system and actively engage in regional and global cooperation to protect its financial and economic security.

China has a range of policy tools at its disposal to counteract the impact of external shocks on its economy, including implementing a cautious fiscal policy, promptly adjusting monetary policy in response to external shocks, and utilizing various measures such as interest rate adjustments, reserve requirements and other tools to maintain stability in the financial market with the support of the central bank.

China could also strengthen international dialogue and coordination with other countries and regions by participating in various multilateral mechanisms such as the G20 and APEC, so as to jointly coordinate policies, address financial risks and safeguard the stability of global financial market.