Illustration: Chen Xia/GT

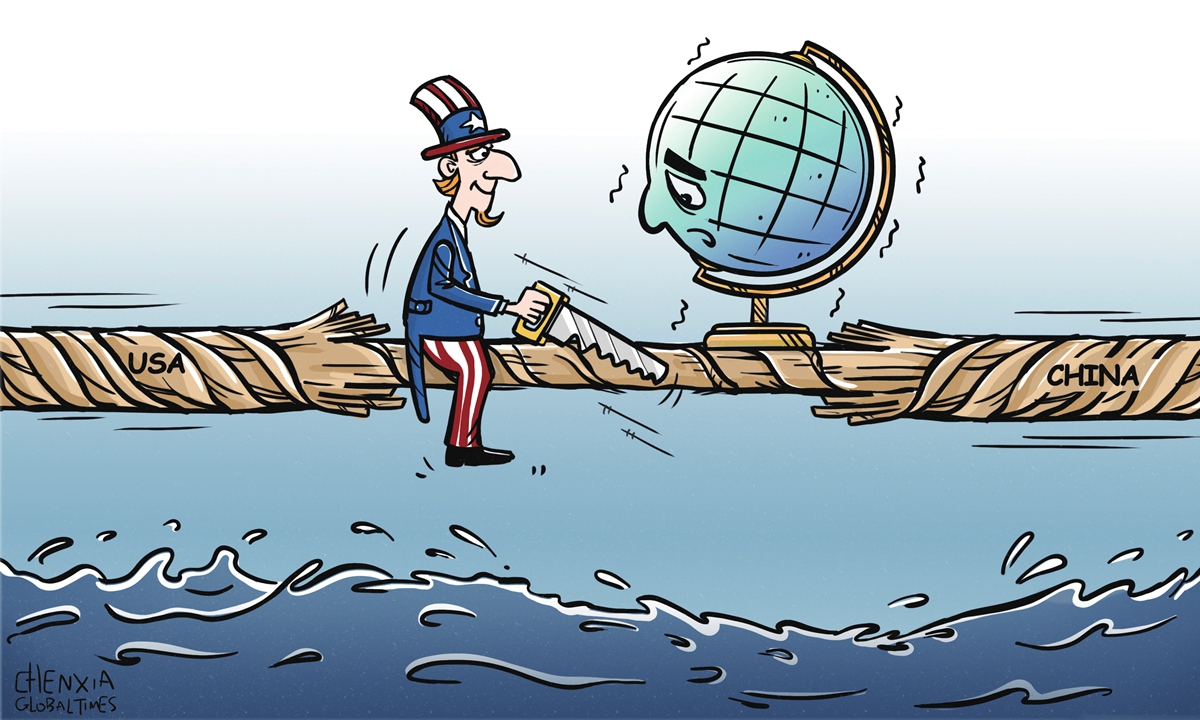

A public hearing hosted on Wednesday by the US Commerce Department on whether to designate Vietnam as a "market economy" laid bare the dilemma facing the US in its efforts to contain Chinese manufacturing and seek "decoupling" from China.Despite the Biden administration's bid to draw Vietnam closer as a strategic ally by upgrading it to market economy status, the move has faced opposition by some who claim that Vietnam's industries are highly dependent on investment and imports of inputs from China, Reuters reported on Thursday.

Whether Vietnam is granted market economy status will greatly affect the development of its economic and trade relations with the US. Market economy status could reduce trade barriers to the US market. For instance, goods from non-market economies are subject to higher tariff rates in anti-dumping duty investigations that use third-country proxy prices to determine a product's fair market value.

Ironically, the controversial nature of the decision lies not in whether Vietnam has met the criteria for being a market-driven economy, but the scrutiny over its economic ties with China. On the one hand, the US wants to divert more production activities to Vietnam by strengthening trade ties with the Southeast Asian nation, while on the other hand, it fears that the stronger economic ties could indirectly benefit Chinese companies investing in Vietnam.

To a certain extent, the dilemma faced by the US underscores the difficulties it encounters in containing Chinese manufacturing. Behind these difficulties lie the complexity of global supply chains, China's massive manufacturing capacity, the sophisticated Chinese industrial chain and the resilience of the Chinese economy.

It is no secret that the US has been trying to reshape international trade patterns and networks through unilateral policies aimed at suppressing Chinese manufacturing and squeezing China out of global supply chains, but this attempt has been facing obstacles. Chinese manufacturing holds a significant position in the global economy not only due to its vast market size and cost-effective labor force, but also because of its comprehensive industrial infrastructure and growing technological innovation capabilities. These combined factors enhance the global competitiveness of Chinese goods, making it difficult to be simply replaced by other countries.

Also, global supply chains are more complex and dynamic than anticipated. Take Vietnam as an example. With the increasing globalization of supply chains and the US "decoupling" push, Vietnam has gradually emerged as a key manufacturing hub in Asia, attracting investment and production activities from various countries. As Vietnam's economy has become more integrated with global supply chains, China-Vietnam trade and investment cooperation has played a role in this.

In the first four months of this year, Vietnam's total merchandise trade reached $238.88 billion, resulting in a trade surplus of $8.4 billion, according to Vietnamese media reports. While the US was Vietnam's biggest export market, China was its biggest source of imports. If anything, it is the most vivid example to prove that the geopolitical game played by the US cannot reverse the general trend of regional economic development, especially the consolidated economic and trade relations between China and Vietnam.

Washington's frustration in cracking down on Chinese manufacturing has been fueling its growing paranoia. The prioritization of whether a policy would be beneficial for Chinese businesses highlights a lack of confidence in competing with Chinese manufacturing, as well as a politicized understanding of the intertwined ties of global supply chains. For instance, due to US barriers, Chinese companies have moved to invest in Mexico and their end products are still exported to the US, reflecting its need for Chinese manufacturing.

More importantly, this distorted economic and trade policy orientation has exacerbated problems within the US economy. The increased costs resulting from high tariffs and trade barriers are a major factor contributing to persistently high inflation in the US.

If the situation continues and Washington doesn't change its mind, then more policy dilemmas could potentially wait for it.