Green transition is expensive for US economy, more expensive without China: scholar

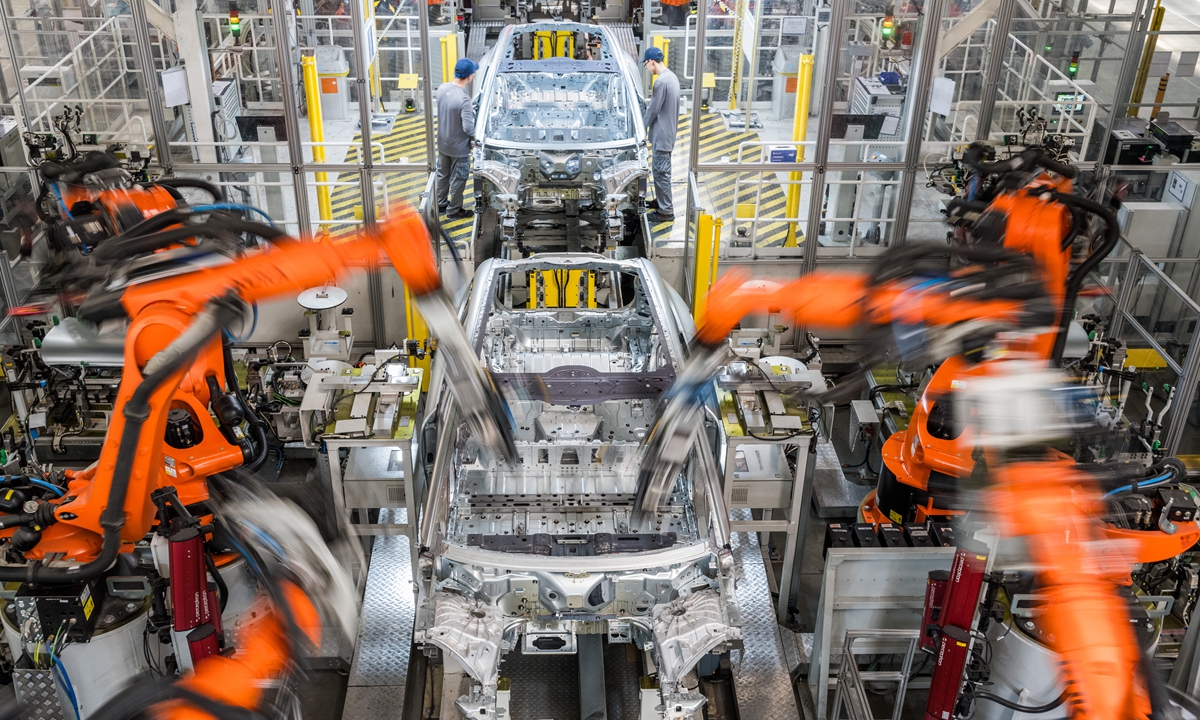

This photo taken on Feb 24, 2023 shows the assembly line of GAC Aion, an NEV subsidiary of Guangzhou Automobile Group Co., Ltd. (GAC Group), in Guangzhou, south China's Guangdong Province. Photo: Xinhua

The Biden administration has been justifying this move with hype of "overcapacity" and "unfair competition," allegingthat Chinese new energy product exports threaten US manufacturers.

It seems that US politicians have wokenup after decades of consumerism hangover, during which they cared only aboutconsumption and not for production. Now, they want to rebuild their manufacturing capacity, but the horse has already bolted. The solution would be exactly the opposite of what they are doing, that is, they should rebuild their industrial capacities with the help of - while not suppress Chinese industrial power.

As to the effects on the US economy, green transition is rather expensive and it will be even more expensive without Chinese products.

In the logic of the so-called green transition, which aims to de-carbonize the economy in the shortest time possible in order to mitigate climate change, opposing Chinese exports of new energy products makes no sense. Chinese products, in fact, being more affordable and available "off the shelf," would make the transition cheaper and faster.

Any factor that can reduce such costs, such as Chinese technology and Chinese products, should be welcomed by economists and decision-makers.

Behind the overhyped"overcapacity"narrative, I also see a geopolitical reason and a way to blame China for Washington's failures. The US has decided to hinder China's growth under the baselessassumptions. Some US politicians are afraid of losing the dominant political, financial and technological position in the world.

Does China have an "overcapacity" in green production?

Overcapacity should reflectan imbalance between demand (lower) and supply (larger), but it is often misused. If we look at the global demand for new and clean energy, we have an under-capacity. Especially in Africa some of its 1.4 billion people currently lack access to electricity. Most of them are in Sub-Saharan Africa, in countries which, even if they want to, have neither the financial or the physical means to satisfy that demand.

It is obvious that the technology must be brought in from countries like China and other industrializednations. I do not call that "overcapacity" but rather theexport of capital goods, and Chinese new-energy products are competitive because of economy of scale and innovation.

Another argument often used against Chinese firms is that they do not compete on a "level playing field" with US companies. Chinese firms are often accused of enjoying government subsidies that allow for unfair competition with US firms, which supposedly do not receive subsidies. This is not true.

US producers of solar panels, EVs and other "new energy" products have enjoyed, directly or indirectly (sometimes through electricity prices or purchase bonuses), government subsidies. Or take the case of CO2 certificates, which are one way in which companies such as Tesla are massively subsidized by producers of conventional cars.

The article was compiled based on an interview with Claudio Celani, economic editor of news magazine Executive Intelligence Review. bizopinion@globaltimes.com.cn