Illustration: Liu Xiangya/GT

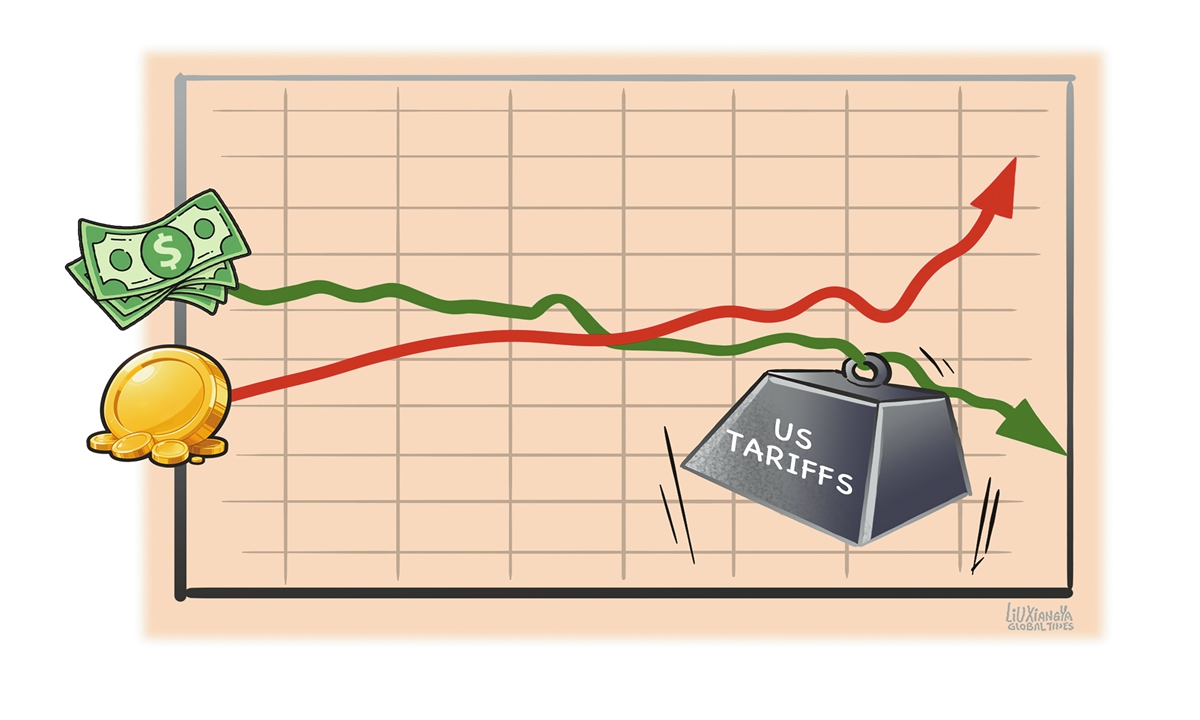

On Monday, gold prices experienced a consistent rise, both internationally and in domestic markets. Several gold futures contracts on the Shanghai Futures Exchange surpassed the 800 yuan ($109.7) per gram mark, reaching new highs. This increased interest in gold is not just a reflection of rising demand for safe-haven assets; it may also hint at deeper structural shifts emerging within the global financial markets.The growing interest in gold is driven by a combination of intricately linked factors, painting a picture of a global economic landscape grappling with escalating uncertainty. A key contributor to this uncertainty is the current US tariff policy, which in turn has triggered a domino effect in various economic dimensions, such as diminishing consumer confidence and escalating inflation expectations, prompting investors to turn to safe-haven assets for protection.

Traditional safe-haven assets, such as gold, the US dollar and US Treasury bonds, have long been favored by investors seeking stability. However, with the US dollar recently facing a downturn, there has been a gradual shift toward gold as the preferred safe-haven asset. An analyst from China Futures was quoted by news portal stcn.com as saying that, given gold's role as an important component of central banks' foreign exchange reserves worldwide and its stable creditworthiness, the trend toward de-dollarization is expected to drive up demand for gold. This is likely to underpin gold prices for the foreseeable future.

Some studies indicate that there is a loosely inverse relationship between the US dollar and gold prices. This suggests that, in most cases, when gold prices increase, the US dollar tends to weaken.

This is precisely what is happening now. Markets on Monday continued to reverberate from US tariff policies, with the US dollar losing ground further. According to the New York Times, the US dollar fell more than 1 percent against the euro on Monday, to the lowest in more than three years. The US dollar also fell against the Japanese yen, to its lowest level since September.

A persistent weakening of the US dollar is stoking fears that US tariff policies may have damaged the currency's safe-haven status, with consequences for the US economy, the Wall Street Journal reported recently.

As the uncertainty surrounding the US economic outlook intensifies and trade tensions escalate, some analysts predict that the role of the US dollar and US Treasury debt as safe havens is weakening. This doesn't imply an immediate shift of the US dollar into a purely risk asset. Yet, it's clear that, on a global scale, there's a reevaluation of the dollar and dollar-denominated assets' role as safe havens. In this context, due to a decline in confidence, numerous factors, including Federal Reserve policies, could lead to increased volatility in the financial markets.

In an article published by Fortune on April 11, it was reported that analysts are warning of a global "de-dollarization" in response to Washington's foreign policy decisions. George Saravelos, global head of FX research at Deutsche Bank, stated in a note that "we are entering unchart[ed] territory in the global financial system."

We may be observing a gradual erosion of US financial credibility. This downturn could precipitate turbulence across international financial markets, exemplified by the volatile gold prices, among other indicators of instability. If the US persists in wielding tariffs aggressively, thereby injecting further instability into the global economy and financial systems, and prompting a continuous depreciation of the dollar, the erosion of US financial credibility may extend over a prolonged period, ultimately triggering spontaneous adjustments in the international financial system to ensure the overall stability and efficiency of the system.

In this context, predicting the trajectory of asset prices, including gold, becomes increasingly complex. The international financial markets might face a period of uncertainty. In response, global economies need to strengthen their financial infrastructures to safeguard against potential volatility and ensure stability.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn