Why is it hard for American manufacturers to disengage from China despite US tariffs?

Illustration: Xia Qing/GT

On Thursday, Zhuang Zhengsong, president of HP China, highlighted that despite global market fluctuations influenced by the international trade climate, China continues to hold a crucial position in HP's operations. As reported by Jiemian News, he affirmed HP's commitment to its localization strategy within China. Prior to this, the New York Times reported that even as the US imposed additional tariffs on China, its unfriendly tariff policies toward Asian countries and policy uncertainties have encouraged some companies to maintain their operations in China. This development is opposite to what Washington might have intended.In recent decades, globalization has significantly reshaped the manufacturing sector. It has prompted many manufacturers to move their operations from the US to Asia to take advantage of lower labor costs. But its effects go beyond just relocation. Globalization has fundamentally changed how industrial companies function. Today's manufacturing businesses are a far cry from the traditional factories of the past. They now act as integral parts of a global supply chain, depending on its efficiency to operate successfully.

Given the continuous evolution of modern industrial systems, why do many American enterprises, especially top-tier modern manufacturers, find it challenging to disengage from China?

First, China features a highly developed and remarkably agile supply chain system. After years of refinement, it has established a comprehensive modern industrial framework, encompassing 41 industrial categories and 666 subcategories, making it the only nation globally to cover all industrial sectors as defined by the UN. For modern manufacturers, the thought of leaving such a mature supply chain is nearly unfathomable, as it would inevitably lead to increased supply chain expenses.

Second, numerous American firms, having invested considerable time and resources in China, are not merely manufacturing here to export products back to the US. Rather, they have embraced a deep localization strategy, aiming to integrate into and capitalize on the local market. The burgeoning middle class in China, along with its increasing purchasing power, presents a significant market opportunity for these products. Concurrently, China's robust manufacturing capabilities, with more than 220 of its major industrial products leading in global output, create a substantial demand and market for intermediate goods, including semiconductors.

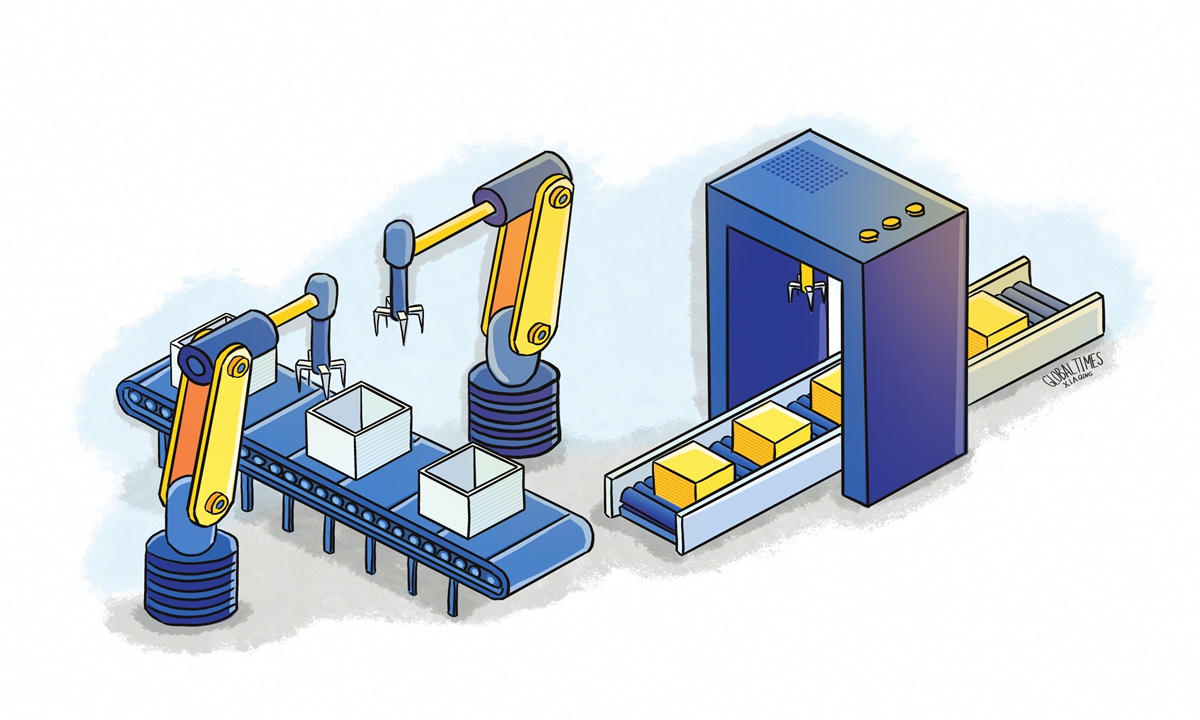

Third, China's industrial sector has reached a high degree of modernization after years of development, establishing the necessary infrastructure for manufacturing modernization, such as 5G and cloud services. Factories in China have surpassed those in many developed nations in terms of automation. This has also caught the attention of international public opinion. The New York Times reported on Thursday that with engineers and electricians tending to fleets of robots, these operations are bringing down the cost of manufacturing while improving quality.

The manufacturing benefits China offers cannot be easily negated by US tariff policies. Indeed, while US tariffs may have some short-term impacts, the strategic and economic advantages of manufacturing in China present a compelling case for American businesses to continue their operations here.

The US government has sought to revitalize manufacturing through measures like tariff increases; however, this approach appears to have fallen short. The tariff policy is not expected to help the US achieve its intended goals due to a variety of contributing factors. It is essential for the US government to reassess its tariff strategies and explore more effective methods to promote the growth of the manufacturing sector.

In an April 16 article headlined "The False Promise of Tariffs," on Project Syndicate, an international nonprofit media organization, international economist Dambisa Moyo noted that using tariffs to protect US manufacturing requires enormous government subsidies to rebuild and support uncompetitive domestic industries. The risk is that shielding American companies from global competition will undermine their incentive to innovate and evolve, ultimately weakening long-term US competitiveness.

Even with policy incentives, structural flaws in the US manufacturing ecosystem constrain the US manufacturing sector from revitalization. High labor costs, insufficient skilled workers and high environmental costs present significant challenges to US manufacturing. The supporting ecosystem for small and mid-sized manufacturers has thinned out so they are slow to adopt process and technology innovations, the Federation of American Scientists noted in an article in January.

The US government's tariff measures also underestimate the impact of emerging technologies like artificial intelligence (AI) in reshaping the manufacturing landscape. The US wants to revive US manufacturing, but that's not so easy, CNN reported on April 10. Today, in an age of automation and AI, factory floors are increasingly filled with robots doing the work instead. That means new and reopened US factories will require fewer workers with more specialized skills. Some experts believe the challenge for the US to revitalize its manufacturing will be training Americans to work in modern manufacturing roles - and getting them interested in doing so.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn