Warren Buffett calls US tariff policy ‘a big mistake’; remarks resonate with worried global investors: Chinese expert

Warren Buffett Photo: VCG

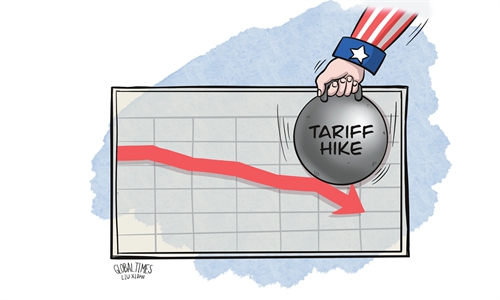

Berkshire Hathaway CEO Warren Buffett on Saturday US time harshly criticized the use of trade as a “weapon,” calling the US administration’s tariff policy “a big mistake,” and saying that trade and tariffs “can be an act of war,” according to US media reports.

Buffett’s criticism of the US’ tariffs came as Berkshire Hathaway reported a worse-than-expected drop in operating earnings in the first quarter and as the US famed investor announced that he is stepping down as the CEO of the firm.

“Trade should not be a weapon,” Buffett said during Berkshire Hathaway's annual shareholder meeting in Omaha, the US state of Nebraska, on Saturday, according to CNBC. “I do think that the more prosperous the rest of the world becomes, it won’t be at our expense, the more prosperous we’ll become, and the safer we’ll feel, and your children will feel someday.”

Trade and tariffs “can be an act of war,” Buffett added. “And I think it’s led to bad things. Just the attitudes it’s brought out. In the United States, I mean, we should be looking to trade with the rest of the world and we should do what we do best and they should do what they do best,” according to CNBC.

Notably, the remarks drew a round of applause from the audience.

Trade was the first question raised to Buffett at the Berkshire Hathaway’s annual shareholder meeting, highlighting a widespread concern among global investors, according to Yang Delong, chief economist at Shenzhen-based First Seafront Fund, who told the Global Times on Sunday after attending the event for the seventh time.

"The ability of the US to continue championing free trade has fundamentally shifted, which I think is one of Buffett's greatest concerns, and a worry shared by investors everywhere,” Yang said.

Buffett explained that protectionist policies could have negative consequences over the long term for the US, CNBC reported. “It’s a big mistake, in my view, when you have seven and a half billion people that don’t like you very well, and you got 300 million that are crowing in some way about how well they’ve done – I don’t think it’s right, and I don’t think it’s wise,” Buffett said.

At the shareholder meeting, Berkshire Hathaway reported that its operating earnings, which include the conglomerate’s fully owned insurance and railroad businesses, dropped by 14 percent to $9.64 billion during the first three months of the year, CNBC reported.

The company further noted that the US tariff policy and other geopolitical risks created an uncertain environment, warning that “our periodic operating results may be affected in future periods by impacts of ongoing macroeconomic and geopolitical events, as well as changes in industry or company-specific factors or events.”

Buffett also announced at the shareholder meeting that he would step down as CEO at the end of the year. Greg Abel is expected to take over as CEO, pending board approval.

Buffett received a standing ovation from thousands of attendees at the meeting after making the announcement, and many became emotional as they were apparently reluctant to see the end of the “Buffett era” amid rising uncertainty, according to Yang.

“The future is filled with uncertainty,” Yang said, noting growing concerns about the US government's debt and the uncertainties caused by the US’ tariff war.

Global Times