China advances high-level opening-up of financial sector amid global economic shifts: report

Policy report highlights reforms, resilience against external pressures

Wang Yongli, co-chairman of digital China Information Service Group Co makes a speech at a sub-forum of the 2025 Tsinghua PBCSF Global Finance Forum, held on May 18, 2025 in Shenzhen, South China's Guangdong Province. Photo: Courtesy of Tsinghua PBCSF

China achieved notable progress in 2024 in developing a more scientific and stable financial regulatory system while advancing high-level opening-up of its financial sector, according to a key policy report released on Sunday. Economists said that structural adjustments in the domestic economy, driven by tariff shocks, will further enhance China's competitive position globally.

The China Financial Policy Report 2025, as China's first comprehensive annual report on financial policy, was issued at a sub-forum of the 2025 Tsinghua PBCSF Global Finance Forum, held over the weekend in Shenzhen, South China's Guangdong Province.

The country's ambition to become a financial powerhouse with Chinese characteristics has seen progress in six key areas: financial regulation and control, financial markets, financial institutions, financial oversight, financial products and services, and financial infrastructure, according to the report.

Ding Zhijie, director general of the Financial Research Institute of the People's Bank of China and also one of executive editors of the report program, emphasized China's progress in establishing a sound and scientifically robust financial regulatory system.

In 2024, China's financial policy adhered to a prudent and progressive approach, strengthening counter-cyclical and cross-cyclical adjustments, Ding stated while presiding over the report release ceremony.

"The central bank has effectively utilized tools such as open market operations, medium-term lending facilities, smooth short-term interest rate fluctuations, and provided robust support for the reasonable growth of social financing and monetary credit," Ding noted.

The report also highlighted breakthroughs in financial policies regarding stabilizing the total scale of financing and optimizing its structure.

Through establishing a coordination mechanism for small and micro-sized enterprise financing, the balance of inclusive small and micro-sized loans grew 14.6 percent year-on-year in 2024, while medium- and long-term manufacturing loans increased by 11.9 percent, achieving targeted support for key sectors, per the report.

"Since the issuance of the 'Nine-Point Guideline' on April 12 last year, China's capital markets have entered a new phase of high-quality development," said He Haifeng, executive editor of the report program and former chief economist of Guotai Junan Securities Co.

"The fundamental mission of the financial sector remains serving the real economy and achieving China's high-quality development," He told the Global Times on Sunday during a sidelines interview at the forum.

Now and in the foreseeable future, China's most critical and important concrete task is supporting technological innovation and industrial upgrading to accelerate the establishment of a modern industrial system, He noted.

Regarding financial security, the report emphasized that China continued to make progress in resolving local government debt risks in 2024, with risks at small and medium-sized financial institutions significantly receding.

Additionally, the yuan's two-way exchange rate fluctuated within a reasonable range, with foreign exchange reserves remaining above $3.2 trillion as the end of 2024, according to data in the report.

In 2025, China will continue deepening its financial system reforms by optimizing financial resource allocation, strengthening supervision and advancing high-level financial opening-up, Ding anticipated.

The report further highlighted that amid intensified global economic volatility and restructuring of the international trade order, China's financial reform stands at a new critical juncture.

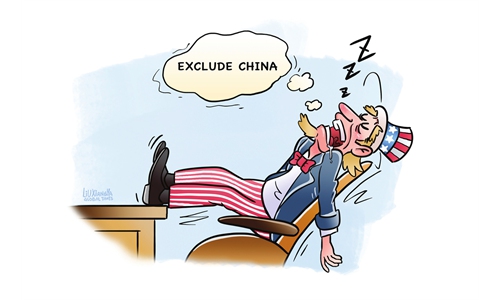

"Tariff measures are merely the first policy tool the US will employ going forward. We may see American pressure tactics against other countries expanding from tariffs to the monetary and financial domains," Ding warned. The report also stressed that China's domestic economy faces challenges, including insufficiently stable demand.

Ding urged China's financial system to accelerate the pace of reform and enhance its systemic resilience amid internal and external pressures.

He Haifeng emphasized the importance of continuously advancing financial openness while balancing risks amid external uncertainty, stating that for China to become a financial powerhouse, it is essential to attract global institutions' attention to Chinese financial assets and encourage greater investment in them, which is critical for the development of China's financial market.

History shows that China's economy has risen to a new level after each external shock, Wang Yiming, vice chairman of the China Center for International Economic Exchanges, said during the forum.

"If China's economy achieves effective structural adjustments during this round of shocks, its competitiveness and its status and influence in the global economy will reach new heights," Wang added.