Nvidia ‘evaluating’ options, ‘effectively foreclosed’ from Chinese market without new product design approved by US govt, spokesperson tells GT

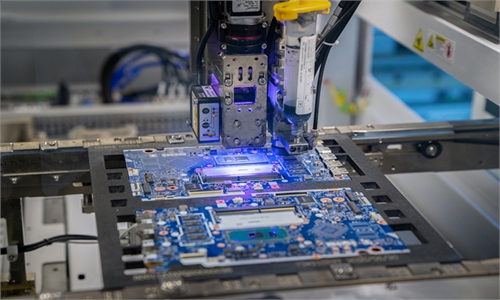

Nvidia Photo: VCG

A spokesperson for Nvidia told the Global Times on Sunday that the company was still evaluating its "limited options," and that it is "effectively foreclosed" from China's vast market until it settles on a new product design that is approved by the US government. The remarks came after a Reuters report said that the US chipmaker will release a custom artificial intelligence (AI) chip for China.

The move again highlighted the indispensable role of the Chinese market for the US chip giant and showed that the US government's arbitrary restrictions on chip sales are hurting its own firms, a Chinese expert said on Sunday.

Nvidia will launch a new AI chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, Reuters reported on Saturday, citing anonymous sources.

The graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, the report said, citing two sources.

Responding to the Global Times' request for comment on the report, a spokesperson for Nvidia said that "we are still evaluating our limited options. Until we settle on a new product design and receive approval from the [US] government, we are effectively foreclosed from China's $50 billion datacenter market."

The reported move came as Nvidia has been in the crosshairs of the US government's continiously escalating restrictions on chip sales to China. The H20, which had been Nvidia's most powerful AI chip cleared for Chinese sales, was effectively blocked from the market after US officials informed the company last month that the product would require an export license, according to a previous Reuters report.

"While we continue to evaluate our options, the H20 ban ended our Hopper datacenter series line in China - we are not able to change the Hopper design to sell to China. With the ban on H20, our competitors in China are now largely shielded from US competition and free to leverage that entire $50B market to build a strong AI ecosystem," a spokesperson from the company told the Global Times last week.

Despite facing strict export restrictions from the US government, the company has repeatedly sought to tailor its chips to meet the demands of the Chinese market in an effort to preserve its presence and revenue in the country, which fully reflects just how vital the Chinese market is to companies like Nvidia, Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Sunday.

China is one of the world's largest AI markets, and Nvidia has built a substantial customer base and market share in the country, Wang said, noting that even though Nvidia's market share in China has dropped significantly under Washington's export controls, the market remains too important for the company to walk away from.

On April 15, the US Commerce Department announced new export licensing requirements for Nvidia's H20 chips, AMD's MI308 AI chips and their equivalents destined for China. Nvidia stated that the latest curbs could cost the company $5.5 billion, according to CNBC.

Nvidia's share of the Chinese market has dropped sharply - from 95 percent before US export restrictions took effect in 2022 to about 50 percent today, according to CEO Jensen Huang. Huang also cautioned that continued US curbs would likely push more Chinese customers toward products produced by Chinese tech giant Huawei, Reuters reported.

"All in all, the export control was a failure," Huang said at a tech conference in Taiwan island, according to The New York Times.

Huang said on May 6 that China's AI market will likely reach about $50 billion in the next two to three years, and that missing out on it would be a "tremendous loss," CNBC reported on May 6.

Huang's remarks reflect a growing sense of reflection and criticism within the US chip industry over the current export control policies - not only have these companies seen their commercial interests hurt, but their ability to advance technology through competition has also been disrupted, Wang said, adding that the US restrictions have also helped accelerate the development of China's chip industry.

This year, the share of AI server chips sourced from abroad in China is expected to drop from 63 to 42 percent, China Media Group reported on Saturday.