John Quelch Photo: Courtesy of John Quelch

China-US trade relations have historically been mutually beneficial. While China runs a trade surplus in goods, the US maintains a sizable surplus in services and benefits from substantial returns on its investments in China. Trade balances, however, are often oversimplified metrics for evaluating the health of this complex relationship.

Economic cooperation between the US and China underpins global stability. Our supply chains, capital markets, and innovation ecosystems are deeply intertwined. For American firms, China is both a major market and an essential part of the global production network; for Chinese companies, the US is a key source of advanced technologies and know-how.

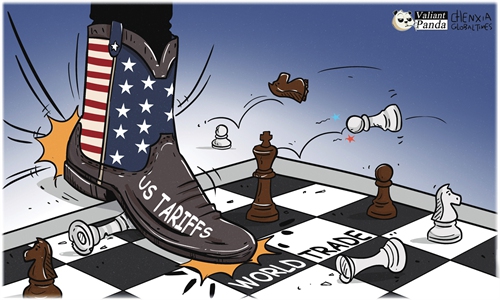

When our economies work in tandem, the benefits cascade globally - through lower consumer costs, faster innovation, and shared prosperity. Given the scale and influence of both economies, a constructive trade relationship between the world's two largest economies is not only mutually advantageous but also vital for global growth. Any disruption, whether through tariffs or export restrictions, generates uncertainty and undermines business confidence worldwide.

'A welcome step forward'

From June 9-10, the first meeting of the China-US economic and trade consultation mechanism was held in London. The recent talks represent a welcome step forward. The participation of both the US Commerce Secretary and the US Trade Representative indicates that export controls and tariffs are being negotiated in parallel - a shift that underscores how central strategic technologies have become to the trade agenda.

Increasingly, export controls - especially on high-end semiconductors and rare earths - are proving just as significant as tariffs. The presence of the US Commerce Secretary in the London discussions is particularly notable, given his jurisdiction over export controls, while the Geneva talks were led by the U.S. Trade Representative who has primary responsibility for tariffs.

While these conversations have only produced preliminary understandings, the professional and measured tone is encouraging. I remain cautiously optimistic that both sides will move forward with parallel, good-faith measures. Trust is best built through reciprocity, not sequential concessions. If this spirit of dialogue holds, we may see further de-escalation and gradual normalization of trade relations.

Strategic autonomy is a rational response to perceived over-dependence, and both countries are understandably seeking to reduce vulnerabilities in key sectors, especially in areas like semiconductors and critical minerals. However, interdependence remains a source of strength, not weakness, and full-scale decoupling would be deeply disruptive and economically inefficient.

Businesses rely on predictability, scale, and integration - conditions that decoupling would severely undermine. The rare earths sector is a case in point: China currently dominates the global refining capacity, and efforts by the US to develop domestic alternatives face environmental and financial hurdles.

Selective diversification is prudent; wholesale disconnection is not. The global community should be concerned not about competition itself, but about fragmentation that could produce unintended consequences.

According to a recent survey released by the American Chamber of Commerce in China, although tariffs pose rising challenges to US companies in China, most companies are not planning to exit China, none report shifting production back to the US.

This finding aligns with what many of us observe on the ground. Despite rising costs and geopolitical tensions, China remains a vital market and manufacturing base for many US firms. The fundamentals - its vast consumer base, skilled talent and manufacturing ecosystem - are not easily replicated elsewhere and thus continue to attract investment.

Most companies are pragmatic: they will adapt to shifting political dynamics by localizing supply chains, enhancing compliance and diversifying operational risks, but a wholesale exit from China is neither practical nor advantageous in most cases. Tariffs are a drag on costs and substitute products at competitive prices are not readily available, but they have not yet reached the threshold where companies are willing to forfeit their competitive positioning in China.

'A measure of reassurance'

In times of global economic uncertainty, stability and policy continuity in major economies serve as important anchors for international confidence. China's ability to maintain stability and steady growth has provided a measure of reassurance to investors, trading partners and developing economies. Encouragingly, the US administration has also shown signs of flexibility at recent talks in London and Geneva, opening the door to constructive, regular dialogue - an approach that could help stabilize global markets.

At the same time, with greater influence comes greater responsibility. Global stakeholders increasingly expect all major economies to uphold principles of openness, regulatory transparency, and fair, reciprocal trade. Meeting these expectations will be key to sustaining trust and deepening global economic cooperation.

A resilient global trading system depends on predictability and adherence to rules. In response to unilateral tariff actions, other economies should re-commit to multilateral cooperation and bolster regional trade frameworks. Efforts to restore the credibility of institutions like the WTO are also essential. At the same time, maintaining open dialogue and resisting retaliatory escalations is critical.

Moreover, governments should prioritize building diversified supply chains, particularly in areas vulnerable to geopolitical leverage.

Over the long term, the best hedge against policy shocks is a diverse, well-functioning global trade and cross-border investment framework.

The author is the executive vice chancellor, American president and distinguished professor of social science at Duke Kunshan University in China and the John deButts professor of practice at Duke University's Fuqua School of Business in the United States. bizopinion@globaltimes.com.cn