Illustration: Chen Xia/GT

From policy restrictions to a myriad of trade barriers, South Korea's industrial development is increasingly influenced by Washington's "America First" strategy, which prioritizes its national interests above all else. The persistent emergence of these risks is sounding an alarm, highlighting the vulnerabilities in South Korea's reliance on the US market while also underscoring the need for the Asian nation to reflect on its industrial development strategy.Online documentation from the Office of the United States Trade Representative (USTR) showed on Sunday that South Korea's Ministry of Trade, Industry and Energy and the Ministry of Oceans and Fisheries made a request in an official comment submitted to the USTR, asking for an exemption from the implementation of a fee on non-US-built vehicle carriers, the Yonhap News Agency reported on Monday.

While it remains uncertain whether South Korea will be granted this exemption, this development, though seemingly centered around the fee on vehicle carriers, has again dealt a blow to South Korea's automobile industry, which is highly dependent on the US market.

With a surge in exports to the US, South Korea has become the second-largest supplier to the US imported automobile market, coming only after Mexico, according to Economic Daily. In 2024, South Korea's exports of automobiles to the US stood at $34.7 billion, accounting for 49 percent of its total auto exports, according to Reuters.

Notably, the 25 percent tariff on imported cars imposed by the US in early April has posed a severe challenge to South Korean automakers. Now, the additional charge on vehicle carriers threatens to further weaken the price competitiveness of South Korean cars in the US by increasing logistics costs.

This situation epitomizes the "America First" strategy, which prioritizes domestic interests over those of allies. On the one hand, the US erects trade barriers, such as tariffs and now port fees, to squeeze the market share of South Korean products. On the other hand, it lures South Korean industries to relocate through subsidies and preferential policies.

For instance, in March, Hyundai announced a $21 billion investment in the US, which includes $9 billion by 2028 to boost production capacity to 1.2 million vehicles in the US and a new $5.8 billion Hyundai Steel plant in the state of Louisiana that will produce more than 2.7 million metric tons of steel annually, Reuters reported.

What is particularly significant is that the trend extends beyond individual South Korean companies making investments in the US; it also encompasses an exodus of Hyundai's suppliers relocating their operations to the US. Shinsung Petrochemical, a leading auto sealant company, will invest $11.2 million in a new manufacturing facility in Toombs County, which will be a key supplier for Hyundai's new Metaplant in the US state of Georgia, according to Electrek.co.

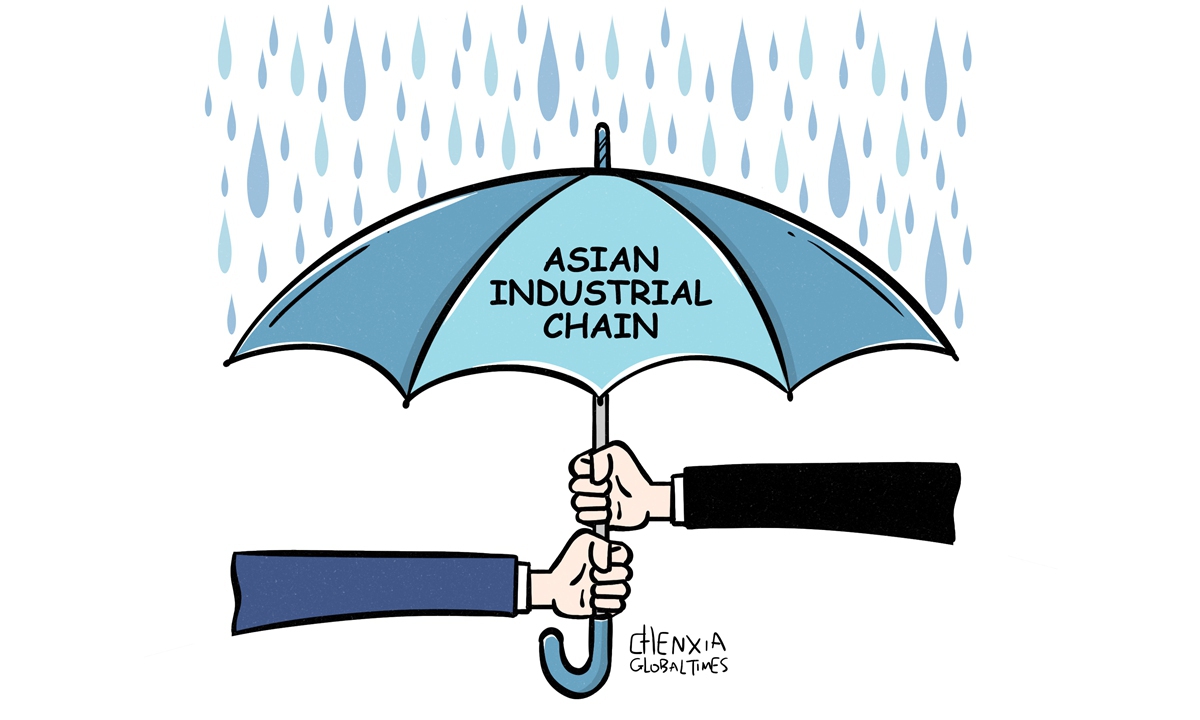

From a broader perspective, the US' self-centered economic and trade policies are pushing South Korea toward the dangerous status of industrial hollowing-out. To maximize its own interests, the US has treated partners as instruments for MAGA objectives, completely disregarding the interests and development of its allies. South Korea, renowned for its semiconductor, automotive, and electronics industries, risks losing its industrial backbone.

However, Washington's protectionist trade policies have continuously squeezed the operating space of South Korean industries, forcing enterprises to readjust their global industrial chain layouts. As high-quality resources and advanced manufacturing capabilities flow to the US, South Korea's domestic industrial chain integrity will be severely damaged, weakening its supporting industrial capabilities. This could have a long-term impact on the competitiveness of South Korea's industries if the trend doesn't stop.

South Korea needs to re-examine its foreign economic and trade development strategy and consider how to reduce industrial risks by diversifying and expanding international markets. At the same time, the South Korean government needs to strengthen its industrial policy guidance, increase support for domestic industries, and enhance the competitiveness and risk-resistance capacity of its industries.