Soybean Photo: VCG

China is the world's largest importer of soybeans, and the reported developments of its soybean industry chain have garnered significant attention, particularly against the backdrop of some international media outlets attempting to discern the latest developments in China-US trade supply chain.China is quietly reshaping its soy trade by stepping up exports of soybean oil and testing deliveries of soybean meal from Argentina, Bloomberg reported on Monday.

Compared with China's colossal soybean imports, the volumes of soybean oil exports and soybean meal imports from Argentina are relatively small, but they carry significant symbolic and strategic weight. In the first half of 2025, China's soybean oil exports reached 139,000 tons, surpassing the total exports in 2023 and 2024. Moreover, Chinese traders have recently made multiple purchases of Argentine soybean meal, with the latest batch standing at 30,000 tons, bringing the total to 90,000 tons in recent procurements, according to Chinese media reports.

In the context of global trade instability, these developments can be seen as part of China's broader strategy to diversify its soybean supply and improve its industry chains.

China will continue to import soybeans from the US, but China's autonomous choices on trade issues will become increasingly evident.

Through measures such as diversifying import channels, increasing domestic pressing capacity, and optimizing feed formulas, its dependence on soybeans from a single country has significantly decreased. China has expanded its soybean import sources to the US, Brazil, Argentina, Russia and Kazakhstan, giving China more choices in soybean imports.

On the domestic supply side, China's efforts to revitalize its domestic soybean industry are equally noteworthy. To alleviate import pressure, the government has introduced policies to promote domestic soybean production. In 2019, the Ministry of Agriculture and Rural Affairs launched the plan for soybean revitalization. The 14th Five-Year Plan (2021-25) for National Crop Planting set ambitious targets. This year, the soybean planting area is expected to reach about 160 million mu (10.67 million hectares), and output is projected to reach about 23 million tons, with China aiming to boost soybean self-sufficiency.

Technological innovation has also played a crucial role in adjusting China's soybean demand. In recent years, the widespread application of low-protein feed formulation technology in the breeding industry has directly reduced the demand for soybean meal.

Diversifying import sources is a necessary measure to ensure the stability of soybean imports. Customs data showed that in 2024, China imported a total of 105 million tons of soybeans. Brazilian soybeans accounted for about 71 percent of imports, while US soybeans accounted for about 21 percent. Additionally, imports of Argentine soybeans reached 4.1 million tons, doubling from 2023. This shift was not only the result of China's adjustment in its soybean industry chain but also a response to global market uncertainties.

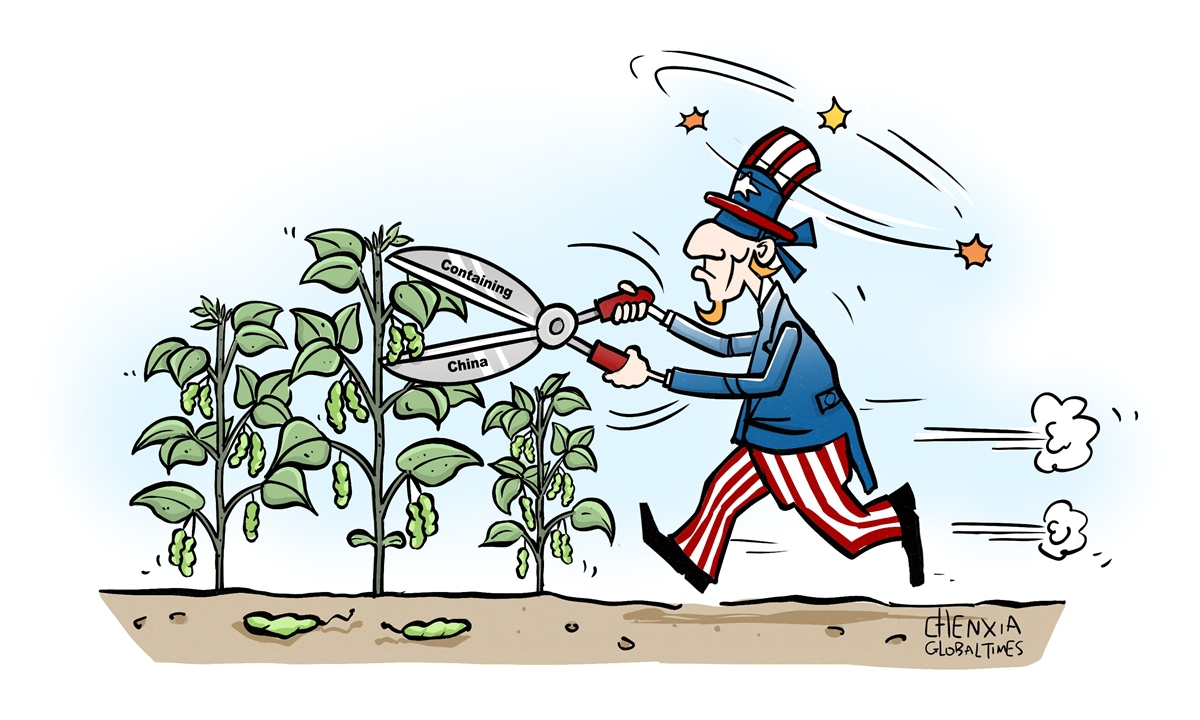

From a broader perspective, US tariff policies have created a complex and unstable bilateral trade environment. China needs a stable soybean supply to safeguard people's livelihoods and industrial development, while the US relies on the Chinese market to absorb its soybean production and achieve economic gains. The trade relationship between the two countries is interdependent, with closely intertwined economic interests. Soybean trade is just a microcosm of the broader China-US economic and trade relationship. As the two largest economies in the world, China and the US share extensive common interests in the economic and trade fields.

This enhancement of agricultural supply chain autonomy is a strategic choice to cope with external environmental changes and also reflects the evolving state of the interdependent relationship between China and the US.

In this context of change, the US needs to recognize that economic "decoupling" is not a viable solution and would likely lead to a lose-lose situation. Whether it is the continuous optimization of soybean trade or the deepening of cooperation in other areas, only by grounding cooperation in mutual benefit and win-win outcomes can both sides find a stable fulcrum amid global economic uncertainties.