China A-share listed semiconductor stocks surge amid growing demand of domestic substitution, integration with AI: experts

Domestic demand, AI integration drive gains: experts

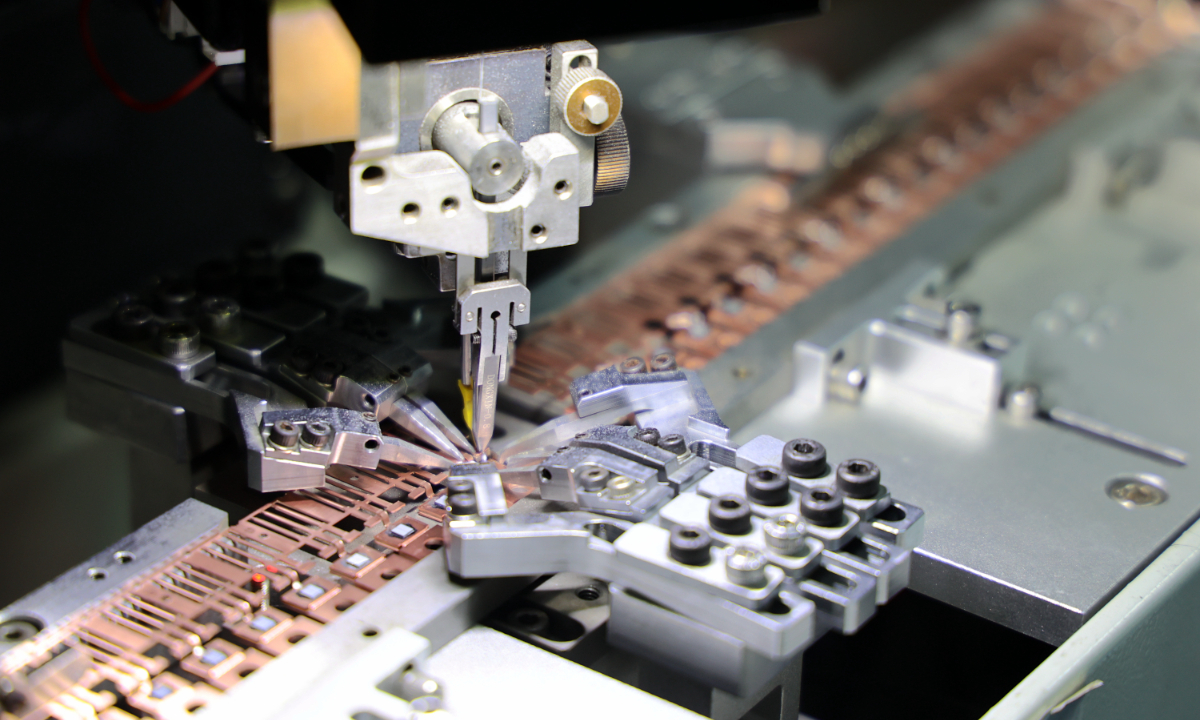

Machines process semiconductor products at a manufacturing company in Binzhou, East China's Shandong Province, on January 20, 2025. Binzhou produces more than 5 billion semiconductor parts annually, with products widely used in various fields such as mobile phones, computers, home appliances, chargers, LED electronics and automotive electronics. Photo: VCG

A-share listed stocks related to the semiconductor sector closed strong on Thursday, as analysts and industry reports noted growing market demand, the increasing pursuit of domestic substitution and accelerated industrial integration with artificial intelligence (AI).

Chinese AI chipmaker Cambricon Technologies Corp closed at 949 yuan ($132.27), up 10.35 percent. ShenZhen Longtu Photomask Co, an independent mask shop in the semiconductor industry, surged 12.98 percent to 53.72 yuan. Hua Hong Semiconductor, a pure-play foundry, was up 3.62 percent to 70.50 yuan. Semiconductor Manufacturing International Corp edged up by 0.9 percent to 89.46 yuan.

Rising market demand and expected product price increases are improving corporate revenue and profit outlooks, attracting capital inflows, Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Thursday.

In addition to AI, the industrial sector and consumer electronics are also entering a recovery phase, further expanding demand for semiconductors, said Chen Jing, a vice-president of the Technology and Strategy Research Institute.

The trend of domestic substitution in semiconductors is evident amid the current global landscape, with Chinese firms expected to benefit significantly from AI industry growth, offering vast market potential and drawing investor interest, Wang noted.

Chinese semiconductor companies have accelerated independent research and development amid the complex environment, achieving significant results. Leading domestic players provide foundational technology support for domestic AI chips, with multiple listed companies deeply engaged in the domestic ecosystem, Chen told the Global Times on Thursday, adding that policies have provided strong support for the development of the semiconductor industry.

The semiconductor cycle remains in an upward phase, with AI staying robust. AI will be the primary driver of semiconductor growth, with sustained cloud AI demand and accelerating terminal AI applications. Chinese semiconductor firms are expected to benefit significantly, with investment logic split into two main themes: cloud-focused domestic substitution and terminal-driven incremental demand, the Securities Times reported on Thursday, citing CITIC Securities.

Institutions noted that August is the semi-annual report period. Some industry players performed strongly in the first half of 2025, driven by AI demand and domestic substitution, with revenue and net profit growth. The World Semiconductor Trade Statistics reports the global semiconductor market at $346 billion, up 18.9 percent year-on-year, reflecting industry strength, the Securities Times noted.

As of the close on August 6, nearly 40 A-share semiconductor companies had released their first-half estimates or results. Only three reported a year-on-year decline in net profit, while the rest achieved profit growth, turned losses into gains, or narrowed their losses, the China Business Journal reported.

The rapid development of AI is significantly boosting the semiconductor industry. AI technologies, widely applied in cloud computing, big data, the Internet of Things, and large-scale models, have driven explosive demand for AI chips. Cloud-based AI requires high-performance, high-computing power chips for large-throughput data processing and model training, while terminal AI applications demand low-power, highly integrated chips for intelligent functions, Chen said.

Diverse types of domestic AI chips target various applications. Direct AI applications, such as smart driving, smart homes, and smart healthcare, also rely on chips, further expanding the market scale, according to Chen.

In the first half of the year, the added value of the electronics and information manufacturing industry above designated size grew by 11.1 percent year-on-year, outpacing overall industry growth by 4.7 percentage points and high-tech manufacturing by 1.6 percentage points. Meanwhile, integrated circuit production reached 239.5 billion units, up 8.7 percent year-on-year, according to data released by the Ministry of Industry and Information Technology.

As for the overall stock market, A-shares continued their strong performance, with the Shanghai Composite Index breaking through 3,700 points during trading for the first time since December 2021 and hitting a new phase high, according to the Securities Times. The index closed at 3,666.44 on Thursday.

Since 2025, despite intensified external shocks and slower domestic growth, various industries in China have maintained steady growth. In the first half of the year, GDP grew by 5.3 percent year-on-year, surpassing the initial target of around 5 percent, with the economy running steadily overall and showing strong macroeconomic resilience. Factors driving market strength are increasing, with growth-promoting policies gradually taking effect, boosting economic performance, Yang Delong, chief economist of the Shenzhen-based First Seafront Fund, told the Global Times on Thursday.