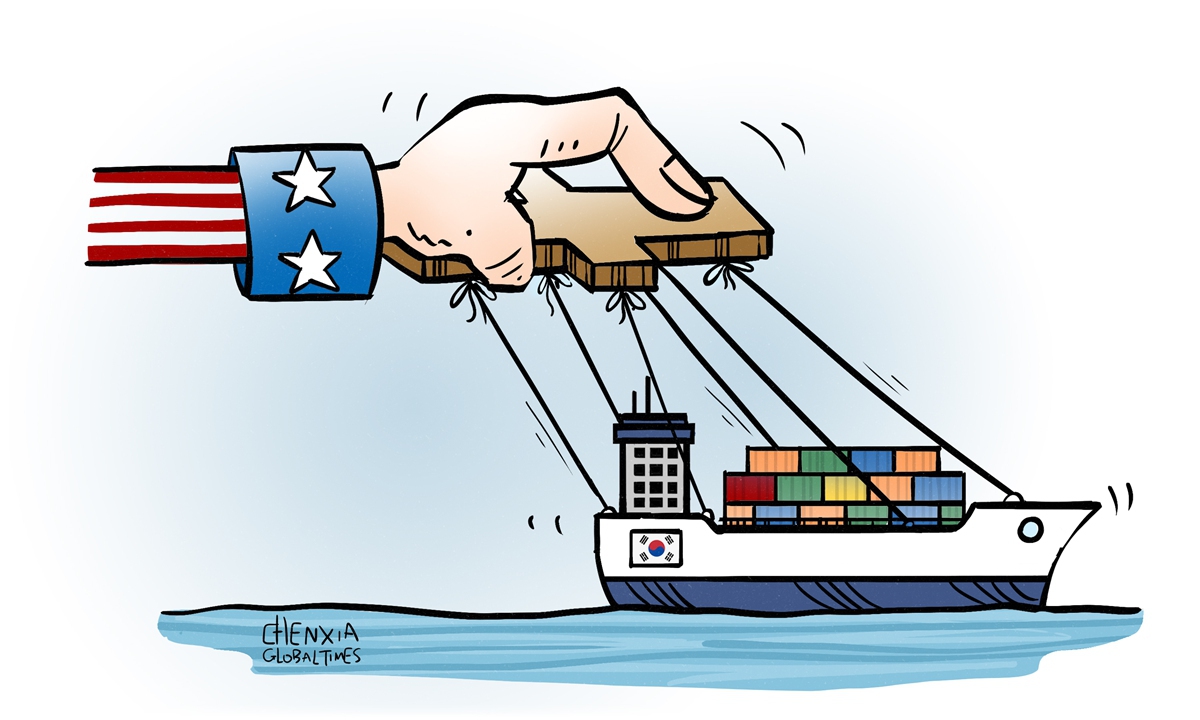

Illustration: Chen Xia/GT

American lawmakers are using a trip to South Korea and Japan to explore how the US can tap those allies' shipbuilding expertise and capacity to help boost its own capabilities, the Associated Press (AP) reported on Sunday. While the US seeks to bolster its own capabilities, this approach may not align with South Korea's and Japan's interests, potentially diverting resources from their own priorities.According to the AP, US senators plan to meet top shipbuilders from the world's second- and third-largest shipbuilding countries. During these discussions, US officials reportedly want to examine the possibilities of forming joint ventures to construct and repair noncombatant vessels for the US Navy and bring investments to American shipyards.

Although the AP reported that the discussions involve noncombatant vessels, these ships can still be broadly considered part of the defense industry since they serve the US Navy. By focusing on revitalizing the shipbuilding industry, the US seems increasingly inclined to integrate South Korea and Japan into its defense industry, which is primarily aimed at advancing US strategic and military interests.

Given the complex geopolitical environment in the Asia-Pacific region, this situation can be seen, to some extent, as a strategic tactic by the US to draw these two major shipbuilding nations into its defense framework. By exploring cooperation in shipbuilding, the US not only leverages South Korea's and Japan's technological expertise and financial investment to serve its strategic military goals but also introduces a potential risk: if these products, marked by South Korean or Japanese logos, are used in US military operations against a third country, these logos could potentially cause trouble for South Korea or Japan. These two countries should be wary of such scenario.

It is noteworthy that the visit by American lawmakers coincides with the repeated US emphasis on revitalizing and rebuilding its domestic maritime industries to enhance national security and economic prosperity. While the US urgently needs to boost its shipbuilding capabilities, for South Korea and Japan, increasing investment in the US and converting their own talent, technology, and capital into growth for the US shipbuilding industry may not necessarily be a profitable venture.

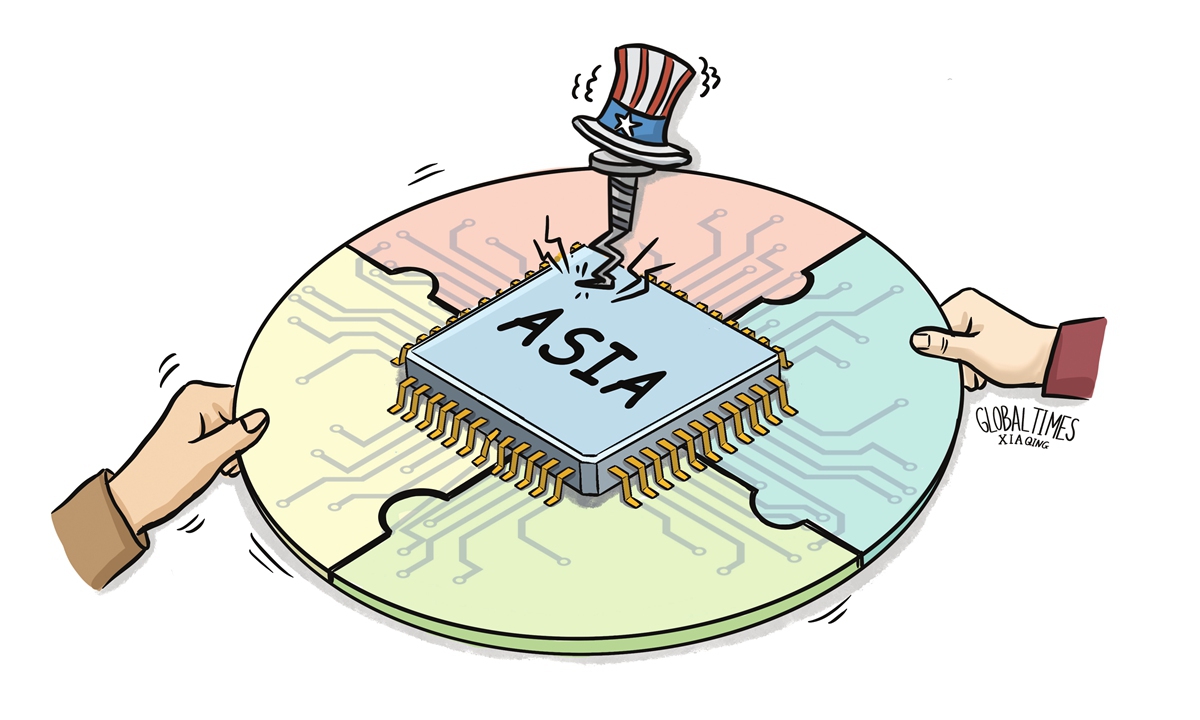

According to a report by the Center for Strategic and International Studies, as cited by the AP, the US commercial shipbuilding sector accounted for 0.1 percent of global capacity in 2024, while China produced 53 percent, followed by South Korea and Japan. This data shows that the shipbuilding industry and high-quality production capacity are currently concentrated in East Asia, which is home to an efficient manufacturing network. This network includes everything from ship plates to paint and cables. Investing in the US, away from this complex local supply chain, presents uncertainties in terms of investment efficiency and returns.

In May, the New York Times reported that it takes far longer to build ships in the US than in Asia, and costs nearly five times as much. While the US aims to revitalize its struggling shipbuilding industry to "compete with China," some shipping experts believe this goal is so challenging that it may ultimately be unattainable.

In this context, if the US, South Korea, and Japan strengthen their cooperation in the shipbuilding industry, the economic outcomes are uncertain and may not necessarily be profitable. For South Korea and Japan, shifting investment and production could potentially reduce the growth of their domestic capacity, thereby weakening their competitive edge.

The AP reported that the US is looking to South Korea and Japan for shipbuilding expertise to compete with China. Clearly, if this is true, it does not align with the interests of the shipbuilding industries in South Korea and Japan.

Official data showed that in 2024, China's shipbuilding industry accounted for 55.7 percent of completed ships, 74.1 percent of new orders, and 63.1 percent of order backlogs in the global market. China's shipbuilding success has never relied on isolation or trade barriers but has steadily advanced through resource sharing and supply chain collaboration. The East Asian shipbuilding industry is rich in cross-border cooperation. This open and inclusive supply chain benefits all participating countries.