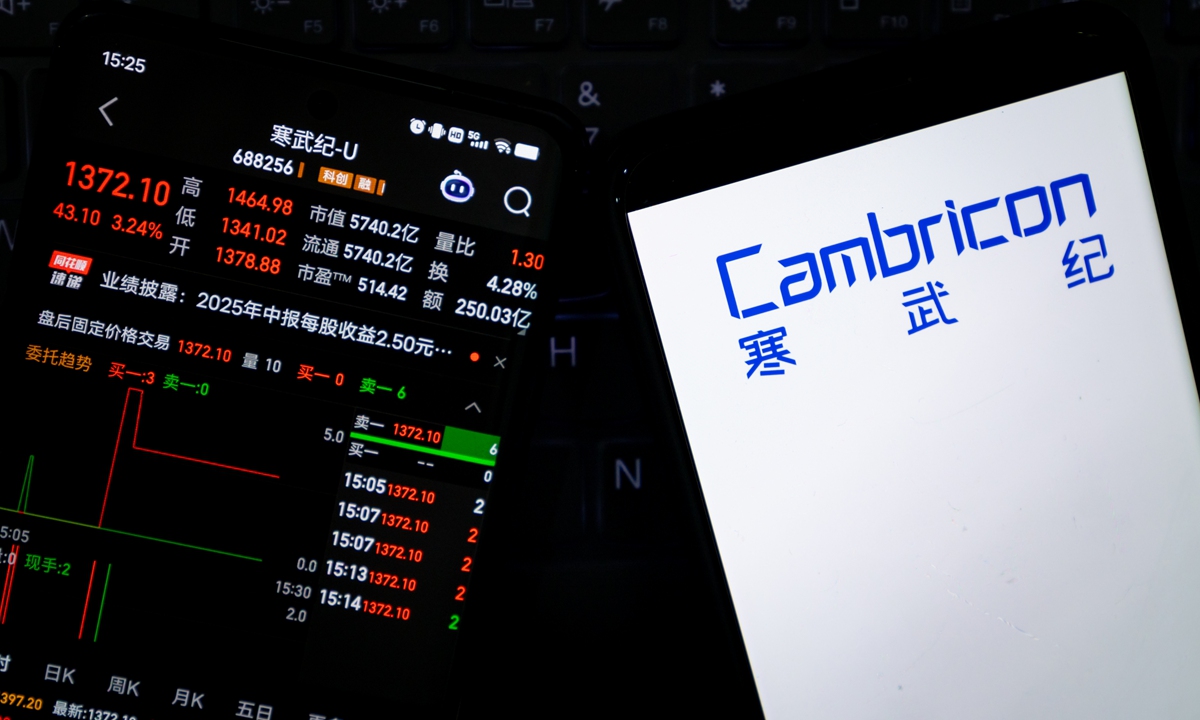

Cambricon’s stock briefly replaces Kweichow Moutai as China’s most expensive onshore stock on Wed following 4000% growth in H1 revenue

Photo: VCG

Stock of China's artificial intelligence (AI) chip provider Cambricon on Wednesday briefly replaced liquor giant Kweichow Moutai as China's most expensive onshore stock, after the chip company released its earnings report in the first half of this year, with revenue surging more than 4,000 percent year-on-year to 2.88 billion yuan ($402.6 million).

In the afternoon of Wednesday, Cambricon's shares continued to strengthen, surging by approximately 10 percent, with the share price peaking at 1,464.98 yuan per share, briefly surpassing Kweichow Moutai, and reaching a total market capitalization exceeding 600 billion yuan, the Securities Times reported.

The company's stock performance came after it released the earnings report in the first half of this year on Tuesday night. According to the report showed on the website of the Shanghai Stock Exchange, the company saw operating revenue increase to 2.88 billion yuan compared to the same period last year, a year-on-year growth of 4,347.82 percent.

The net profit attributable to the parent company reached 1.038 billion yuan, and the net profit after deduction of extraordinary items was about 913 million yuan, both achieving a turnaround from losses to profits, the report showed.

In the first half of 2025, the demand for AI computing power continued to grow. Leveraging the core advantages of its AI chip products, the company deepened technical collaborations with leading enterprises in cutting-edge fields such as large-scale models and the internet. With its outstanding product adaptability and pragmatic approach to open cooperation, the company promoted application implementation through technical collaboration, which in turn expanded market scale, resulting in significant revenue growth, said the report.

In the report, the company noted that in the field of artificial intelligence chips, only by continuously increasing R&D investment can technological breakthroughs be achieved, ultimately forming a product system with market competitiveness and securing a leading edge in intense industry competition. In the first half of 2025, the company's R&D investment reached 456.49 million yuan, a year-on-year increase of 2.01 percent.

The report came as China's State Council, the cabinet, on Tuesday released a guideline on deepening the implementation of the AI Plus Initiative to promote the in-depth integration of AI and various industries, vowing to achieve extensive and deep integration of AI with six key areas including sci-tech and consumption by 2027.

The guideline stipulated that by 2027, the popularization rate of applications such as next-generation intelligent terminals should exceed 70 percent while the scale of core industries of the intelligent economy should achieve a high growth rate.

On August 21, DeepSeek announced the DeepSeek-V3.1 model, which uses the UE8M0 FP8 Scale parameter precision. In the comment section of its WeChat account article, the company stated, "UE8M0 FP8 is tailored for the upcoming next-generation domestic chip."

Ma Jihua, a veteran telecom industry observer, told the Global Times that following the US restrictions on China's semiconductor sector, Chinese companies have ramped up efforts to strengthen self-reliance in semiconductor supply, with many firms accelerating their shift to domestic suppliers such as Cambricon and Huawei. He noted that Chinese tech companies are gradually adapting to this shift, particularly in the field of AI computing power.