Chinese mainland companies can leverage Hong Kong's strength to connect with global market, build corporate brands: HKSAR Chief Executive

Hong Kong file photo

Chinese mainland-based companies can leverage Hong Kong's strength to connect with global buyers and build international brands, while Hong Kong will step up efforts in assisting Chinese mainland technology companies in raising funds in the city, Hong Kong Special Administrative Region (HKSAR) Chief Executive John Lee Ka-chiu said, delivering his annual Policy Address on Wednesday.

Chinese mainland enterprises going global can establish Corporate Treasury Centers (CTCs) and regional headquarters in Hong Kong for cross-boundary settlement, remittance, financing and related functions, Lee said.

They can tap Hong Kong's professional high value-added service in fields such as accounting and law to help them explore overseas market. In addition, they can leverage Hong Kong's strength in marketing to connect with global buyers and build international brands, Lee added.

Lee noted that China's external direct investment exceeded 1 trillion yuan in 2024, underscoring the growing global demand for "Made in China" products. Enterprises on the Chinese mainland are accelerating their pace to "go global."

With a shift in strategic focus, Chinese mainland enterprises are proactively exploring many emerging markets, said Lee, noting that the HKSAR Government will capitalize on the advantages of Hong Kong as an export platform to unlock new areas for economic growth.

In the past three years, Hong Kong has moved up one slot to become the third-ranked global financial center and has climbed four spots to rank third globally in overall competitiveness, Lee said.

As part of the measures in continuously strengthening the city's stock market, Lee revealed that the city will leverage the Technology Enterprises Channel to assist Chinese mainland technology firms in raising funds in Hong Kong, strengthening financial support for the nation's development as a science and technology powerhouse.

"We will encourage more overseas enterprises to seek secondary listing in Hong Kong, support China Concept Stock companies to return from overseas markets, with Hong Kong as their preferred destination," Lee said.

Moreover, the Hong Kong Monetary Authority (HKMA) will encourage the banking sector, especially banks in the Chinese mainland, to establish regional headquarters in Hong Kong, where Hong Kong's strengths can help them expand into markets such as Southeast Asia and the Middle East, providing more comprehensive cross-boundary financial solutions, Lee revealed.

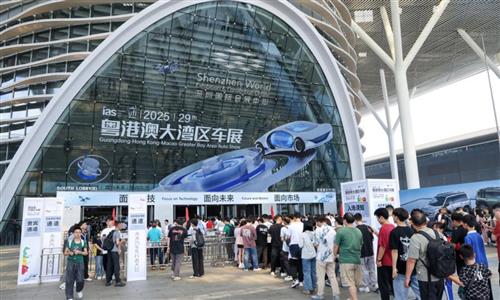

The HK SAR is also intensifying efforts for greater integration in the Guangdong-Hong Kong-Macao Greater Bay Area.

The Financial Services and the Treasury Bureau (FSTB) is working with Shenzhen and Qianhai in South China's Guangdong Province to promote digital finance and support deeper integration of technology and finance between Shenzhen and Hong Kong. Measures are expected to be announced later this year, Lee noted.

In the first half of 2025, the Hong Kong IPO market boomed, according to data from Wind. A total of 43 IPOs were completed, up 13 projects year-on-year, Paper.cn reported.

Global Times