China issues action plan to stabilize growth in steel sector

Move to balance supply-demand for healthy development: expert

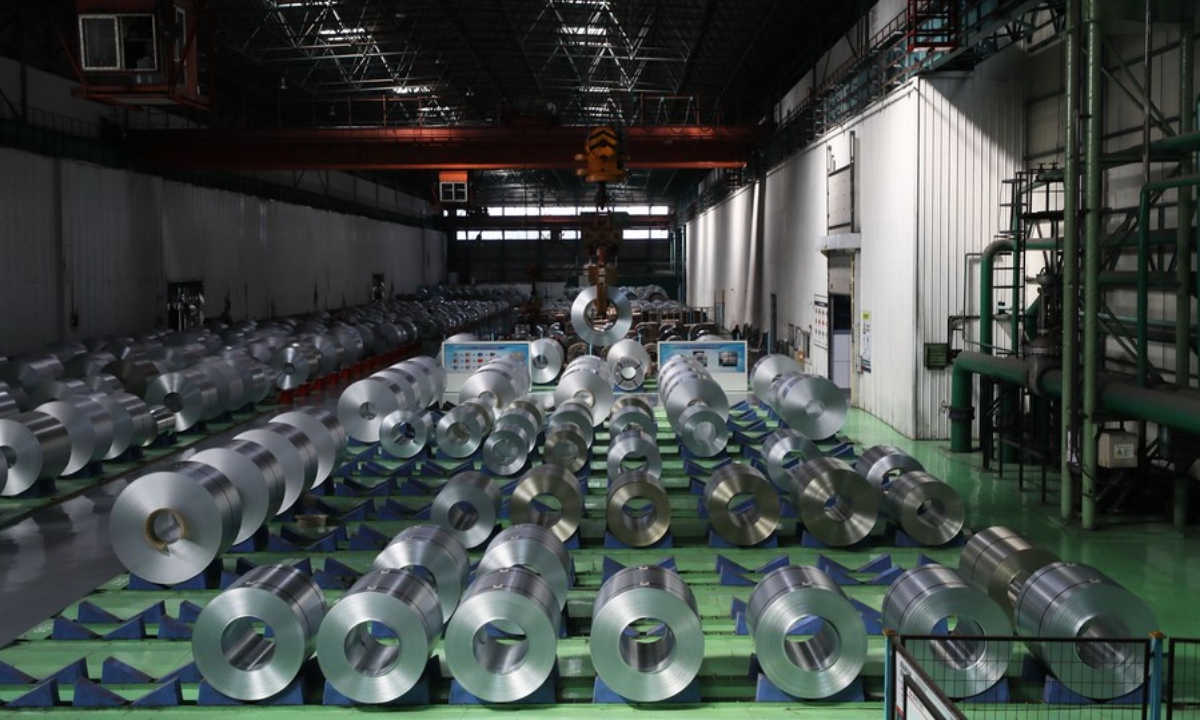

Steel rolls Photo: Xinhua

China's Ministry of Industry and Information Technology (MIIT) and four other government departments on Monday jointly released an action plan on stabilizing steel industry growth in 2025-2026, which includes a 4 percent cap on the annual average growth of value added and vows to terminate obsolete capacity.

As a fundamental pillar of the national economy, the steel industry plays a key role in stabilizing growth, but it faces declining demand, rising export uncertainties, and intensified competition from high supply levels, according to the plan posted on the MIIT's WeChat account.

The industry is operating on thin profit margins with an unstable growth foundation, while tightening environmental requirements make the green and low-carbon transformation more urgent, bringing heavy investment and funding pressures, said the document.

The action plan listed 10 specific measures covering five aspects, which prioritize the challenges of peak consumption and weakening demand. The plan calls for strengthened industry management, precise regulation of capacity and output, and tiered management of steel enterprises to promote supply-demand balance and phase out obsolete capacity.

The action plan emphasizes improving supply quality and calls for stronger technological innovation, enhanced capacity for high-end products, upgrades in bulk product quality, stabilized raw material supply, and an overall boost in effective supply capability.

It also aims to promote industrial transformation and upgrading by calling for expanded effective investment, accelerated renovation of processes and equipment, faster digital transformation, and stronger efforts in green and low-carbon development to drive overall industry upgrading.

The steel industry is encouraged to tap into consumption demand, such as deepening cooperation in sectors such as shipbuilding, and promoting the application of steel structures in housing, public buildings, and small- to medium-span bridges, per the plan.

The action plan aims to address key industry challenges, primarily by targeting the steel sector's oversupply and weak prices, and seeking to rebalance supply and demand and promote healthy industry development, Wang Guoqing, research director of the Beijing Lange Steel Information Research Center, told the Global Times on Monday.

From January to August, China's steel output stood at 982.17 million tons, up 5.5 percent year-on-year, according to data from the National Bureau of Statistics. Wang said that by 2026, achieving 4 percent growth will require controlling supply, aligning it with demand to stabilize prices, and relying on export growth.

From the supply side, in addition to controls on capacity expansion, the industry should collaborate with companies and institutes and enhance the supply capacity of high-end steel products, said Wang, noting that the action plan aims to prevent oversupply of ordinary steel from driving down prices and profits, helping the steel industry achieve sustainable and dynamic development.

The action plan also focuses on opening-up and cooperation, calling for stricter export management, fair competition, optimized product structure, law-based trade, and coordinated expansion of products, technology, and services to boost international growth.

According to China's General Administration of Customs, China exported 77.49 million tons of steel from January to August, up 10 percent year-on-year. Wang said that China's steel industry continues to face the impact of trade frictions, and exports in September are likely to remain high, though year-on-year growth may come under pressure.

"From the perspective of prices and the recovery of global manufacturing, China's steel exports still hold an advantage," said Wang.