China’s economy sees positive changes as incremental policies take effect since last September

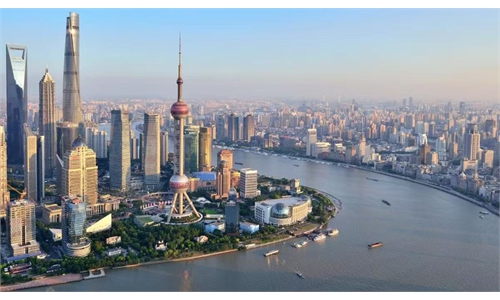

Aerial view of Shanghai's Lujiazui area Photo: VCG

China's benchmark Shanghai Composite Index reached 3,828.11 points on Friday, which is in stark contrast to a low point of 2,689 points in the second half of September last year.

In around a year, the index has risen by more than 1,000 points. What brought about the transformative changes is a series of incremental policies announced since late September last year.

On September 26, 2024, a meeting of the Political Bureau of the Communist Party of China (CPC) Central Committee urged efforts to intensify the introduction of new policies. After the meeting, Chinese government departments swiftly rolled out a package of incremental policies aimed at strengthening counter-cyclical macro policy adjustments, expanding effective domestic demand, increasing efforts to support enterprises, stabilize the real estate market and boost the capital market.

Thanks to the earnest implementation of those significant policies since last September, China's economy has demonstrated strong resilience, with positive changes emerging such as booming tech innovations, stable development of the capital market and unleashing the potential of domestic demand, which provide a reliable driving force for global economic growth.

Effective policies

Hangzhou-based startup Zhejiang Lianxin Technology Co Ltd is a specialized and sophisticated technology enterprise that is engaged in providing mental health services with artificial intelligence (AI), and boasts rich research achievements, including 280 intellectual property rights (IPRs).

Previously, it was difficult for asset-light small and medium-sized high-tech enterprises to get financing from banks since they don't have many assets as collateralization. However, Bank of Communications recently provided 10 million yuan ($1.41 million) in credit support to Zhejiang Lianxin Technology Co for digital asset collateralization, which marks the first such financing in the AI field in Zhejiang Province, according to a press release the bank sent to the Global Times on Friday.

This case marks the earnest policy implementation, as a Political Bureau meeting held in April this year pointed out that "New structural monetary policy instruments and policy-based financial instruments will be established to foster technological innovation, expand consumption, and keep foreign trade stable."

Facing an increasingly complex and challenging external environment, China has effectively implemented more proactive and effective macroeconomic policies, further strengthened the domestic economic circulation, continued to advance high-level opening-up and steadily pushed forward economic transformation and high-quality development.

Over the past 12 months, the People's Bank of China, the central bank, has implemented two comprehensive reserve requirement ratio (RRR) cuts of 0.5 percentage points each, releasing a total of approximately 2 trillion yuan in liquidity. The country's main policy interest rate - seven-day reverse repurchase rate - has cumulatively declined by 30 basis points, driving the loan prime rate - both one-year and five-year terms - down by a total of 35 basis points each, according to a Securities Times report.

"A series of incremental fiscal and monetary policies has achieved remarkable results, delivering positive improvements in financial aggregates, financing costs, credit structure, and financing accessibility, thereby providing ample financial support to the real economy," Cao Heping, an economist at Peking University, told the Global Times on Saturday.

To bolster domestic consumption, several targeted measures were implemented. In June, the People's Bank of China launched a dedicated 500 billion yuan relending facility aimed at stimulating service consumption and the elderly care sectors. In addition, fiscal support has been increased for consumer goods trade-in programs and initiatives that enhance people's well-being, including nationwide childcare subsidies, all aimed at empowering consumers.

Cao said that given the overall performance of China's main sectors, these policies have delivered the expected results. He expressed confidence in achieving the annual GDP growth target of around 5 percent this year, citing the economy's strong resilience.

Strong resilience

Between January and August, retail sales of consumer goods across the country rose 4.6 percent from a year earlier, while in the industrial sector, the value-added output of major industrial enterprises rose by 6.2 percent year-on-year over the period, according to data released by the National Bureau of Statistics (NBS).

Fu Linghui, an NBS spokesperson, stressed at a press conference on September 15 that the country's economic transformation and upgrading sustains, with innovations playing a more important role.

Since the beginning of 2025, from Unitree Robotics' humanoid robots performance becoming a hot topic at the Spring Festival Gala and DeepSeek's artificial intelligence (AI) large model capturing global attention to BYD's new battery and charging system that allows an EV to gain 400 kilometers of range in just five minutes, a wave of China's phenomenal innovations has caught global spotlight.

The phenomenon underscores the prodigious dynamism in China's tech field. China has risen to the 10th position in the global innovation ranking for 2025, up one spot from the previous year, marking its first entry into the top 10, according to the World Intellectual Property Organization (WIPO) on September 16.

This demonstrates that under the innovation-driven development strategy, China is steadily building the country into a sci-tech powerhouse and intellectual property powerhouse, Li Chang'an, a professor at the Academy of China Open Economy Studies at the University of International Business and Economics, told the Global Times on Saturday.

Li said that driven by advances in China's high-tech sector and major policies to stabilize the market and expectations, the country's stock markets have continued to rebound this year, prompting international investors to re-evaluate them.

Benefiting from the Chinese mainland's sustained economic transformation and upgrading, as well as the accelerated internationalization strategies of high-quality Chinese enterprises, Hong Kong Special Administrative Region's capital market has demonstrated remarkable vitality and resilience in 2025, Mandy Zhu, UBS Asia's vice-chair of global banking, was quoted as saying in a note sent to the Global Times recently.

"As an international financial institution deeply rooted in China, UBS remains fully confident in the long-term potential of the Chinese market. Moving forward, we will continue to leverage our leading market position and professional expertise to actively participate in financing plans for top-tier Chinese enterprises, empowering them to achieve greater breakthroughs on the global stage," Zhu said.