EC’s proposed restrictions on steel imports spark wide concern

Move risks undermining stability of international supply chains: CCCEU

Workers grind steel components at a workshop in Tengzhou City, east China's Shandong Province, Oct. 2, 2025. (Photo by Li Zhijun/Xinhua)

The European Commission (EC), the EU's executive arm, proposed on Tuesday 50 percent tariffs — twice the current rate — on all steel imports above a quota that will be cut by 47 percent. The move sparked concerns, including in the UK and South Korea as well as the European Automobile Manufacturers' Association (ACEA), while a Chinese chamber noted it risks further fragmenting global steel trade and undermining the stability of international supply chains.

In a press release on Tuesday, the EC said that the proposal will limit tariff-free import volumes with a reduction of 47 percent compared with 2024 steel quotas, while doubling the level of out-of-quota duty to 50 percent. It will also strengthen the traceability of steel markets.

The proposal will now be subject to the ordinary legislative procedure, so it will be for the European Parliament and the Council to agree on the final regulation. Once adopted by the Council and Parliament, the measure will replace the EU's safeguard on steel when it expires in June 2026, according to the EC.

After the EC announced the plan, the UK's steel industry has said it could be "perhaps the biggest crisis" it has ever faced, according to BBC on Wednesday.

Speaking on his way to India on Tuesday, UK Prime Minister Keir Starmer said that there would be "strong support" from the government for the British steel industry, per BBC.

The director-general of UK Steel, Gareth Stace, said that the government "must go all out to leverage our trading relationship with the EU to secure UK country quotas or potentially face disaster," according to the report.

South Korea said on Wednesday that the EC's proposal would negatively impact South Korean steel exports if implemented as planned, Reuters reported. South Korea's top trade envoy Yeo Han-koo plans to meet EU Trade Commissioner Maros Sefcovic in coming days to express the country's position, according to the report.

Within the bloc, the ACEA said on its website that automobile manufacturers source about 90 percent of their direct steel purchases in the EU and are most concerned about the inflationary impact that an effective continuation of the safeguard will have on European market prices.

"The Commission needs to look individually at sectors like automotive where, despite a heavy reliance on domestic steel supply, our manufacturers still need to import certain quantities and qualities," the association said.

ACEA Director-General Sigrid de Vries said that "We do not contest the need for some level of protection for a commodity industry like steel but we feel that the parameters as proposed by the Commission go too far in ring-fencing the European market. We need to find a better balance between the needs of European producers and users of steel in this measure."

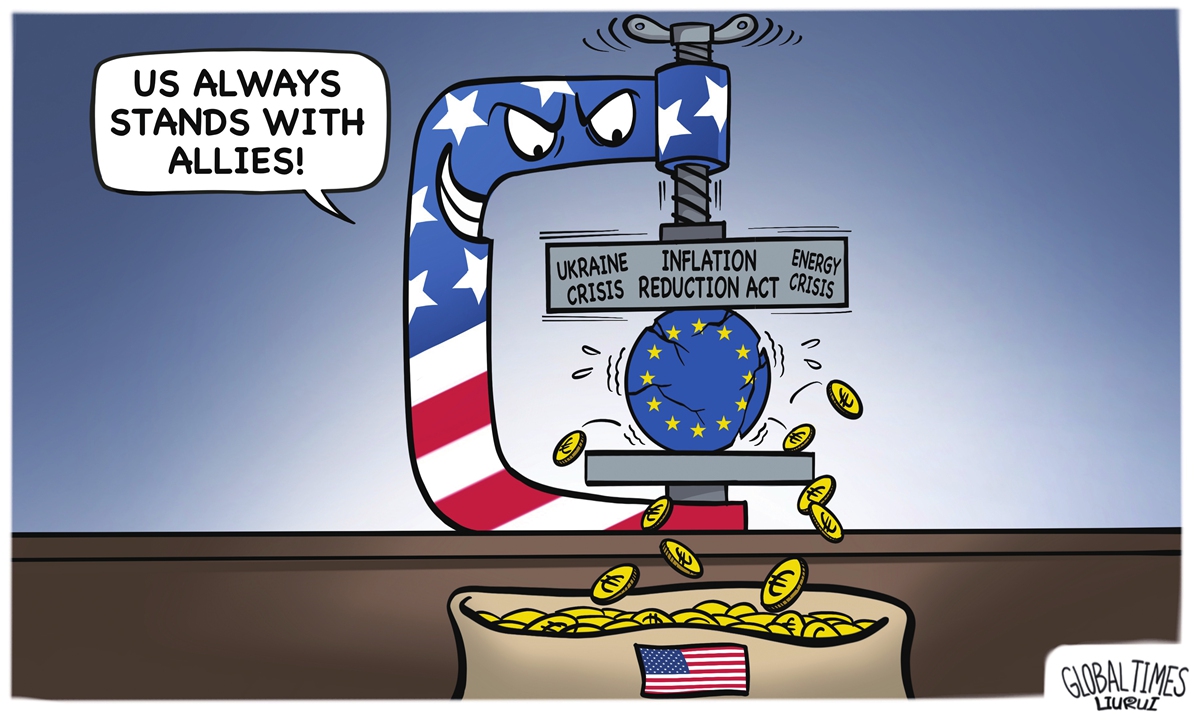

The China Chamber of Commerce to the EU (CCCEU) also has taken note of the EC's proposal. The decision to align with certain countries' unilateral tariff approaches risks further fragmenting global steel trade and undermining the stability of international supply chains, the chamber announced on its WeChat account on Wednesday.

The CCCEU said that while the measure is presented as a defensive safeguard, it in fact represents a "protectionist step that could generate significant challenging spillover effects across downstream industries" — particularly the automotive, machinery, and construction sectors.

"Although China's steel exports to the EU account for only a modest share of its total global exports, this move nevertheless signals a worrying rise in trade protectionism within the EU market," the Chinese trade chamber said, noting that such a trend "runs counter to the EU's long-standing commitment to open, rules-based, and predictable trade."

"The EC's move may provide some protection to the local steel industry in the short term, but whether the supply can meet demand remains to be verified," Jian Junbo, director of the Center for China-Europe Relations at Fudan University's Institute of International Studies, told the Global Times on Wednesday.

However, Jian noted that the EU's restrictions on steel imports will increase manufacturing costs in the long run, particularly for the automotive sector, thus weakening the global competitiveness of EU-made vehicles.

"If implemented, the EC's move would disrupt the production and supply chains of the global steel industry, bringing greater negative impacts to an already sluggish world economy under its unilateral move," the expert warned.