G7’s ‘critical minerals alliance’ driven by ‘tech anxiety,’ ‘political bloc-building’ faces long road; move seeking confrontation risks supply disruptions, higher costs: expert

Rare earth Photo:VCG

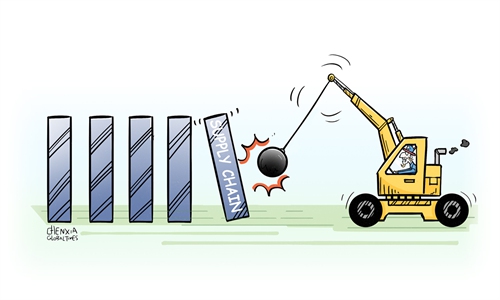

The Group of Seven (G7) nations are reportedly set to announce a so-called "critical minerals production alliance," which they claim aims to secure supply chains and counter China's dominance. Chinese experts say the initiative, driven by "technological anxiety," is likely to be a long and difficult endeavor that will ultimately harm the member countries' own industries while offering little appeal to other nations.

The group of wealthy countries - the US, Canada, UK, Germany, France, Italy and Japan - plans to unveil the pact at the conclusion of a meeting of their energy ministers in Toronto on Friday, Bloomberg reported on Thursday, citing a senior government official said.

According to the report, the initiative is said to target what the G7 calls China's "market manipulation," referring to its adjustments in export policies and production levels of certain critical minerals - an accusation China has firmly rejected, stating its measures are legitimate and consistent with international norms.

The pact will cover a range of critical minerals and involve firms from G7 nations, with Canada - reportedly leading the initiative - expecting economic benefits given its abundant mineral reserves, Bloomberg reported, citing an official.

This development represents a stage in the G7's ongoing effort to "decouple" from China in critical minerals, driven by their "technological anxiety" and "political bloc-building," Liu Dan, a research fellow at the Center for Regional Country Studies at Guangdong University of Foreign Studies, told the Global Times on Thursday.

"But achieving real decoupling, whether in rare earths or other key minerals, will be a long and difficult process, given China's leading edge across the entire supply chain," Liu said, adding that "besides seeking confrontation in these crucial sectors will come at the cost of their own interests, making the long-term feasibility and effectiveness of such push highly questionable.

Liu further warned that a long-term decoupling would risk higher production costs and supply disruptions, ultimately harming the member countries' industrial growth and interests.

The planned announcement will build on the critical minerals action plan agreed at the G7 leaders' summit in June, which claims it will work with partners beyond the G7 to boost the resilience of critical minerals supply chains and pledges more relevant investment, per an official statement.

The latest progress is said to involve so-called offtake agreements that commit a buyer to a certain percentage stake of a mine's output at a fixed price, along with price floors and stockpiling arrangements, per Bloomberg, saying that the US and Canada have both extended funding to mining projects and processing plants.

The bloc's efforts to influence the market through price floors and tariffs are inherently limited by technological constraints, Zhou Chengxiong, researcher the Institutes of Science and Development of the Chinese Academy of Sciences, told the Global Times. "Rare earth refining involves thousands of patented technologies and cannot be built with money alone; it requires skilled workers, supporting industries, and years of accumulated experience," Zhou noted.

Also, the G7's push to "decouple" from China lacks appeal to other countries, many of which benefit from stable technological support and shared gains from the industrial chain through cooperation with China, Zhou said.

On October 21, China's Foreign Ministry (FM) spokesperson Guo Jiakun commented on reports regarding a US-Australia critical mineral agreement, saying global industrial and supply chains were shaped by market and business decisions, and that countries with critical mineral resources should play a constructive role in maintaining the safety and stability of these chains while ensuring normal trade and economic cooperation.

"China's export control measures are consistent with international practice and are taken to better safeguard world peace and regional stability, and to fulfill China's non-proliferation and other international obligations," Lin Jian, another FM spokesperson said on October 16, in response to US calls for its allies to "de-risk" from China.

China is promoting the upgrading of the global rare earth industry through openness, cooperation, and technology sharing, while the G7's price caps and tariff measures are likely to make the global supply chain more vulnerable, Liu said.

Some G7 countries, including Canada and Australia, have strong potential for cooperation with China in multiple sectors, and closer collaboration in energy and minerals could support their economic development and energy transition goals, said Zhao Xingshu, deputy director of the Department of Canadian Studies at the Institute of American Studies, Chinese Academy of Social Sciences.

"Improving bilateral relations requires more than verbal gestures; it also depends on concrete actions that demonstrate sincerity and commitment," Zhao told the Global Times.