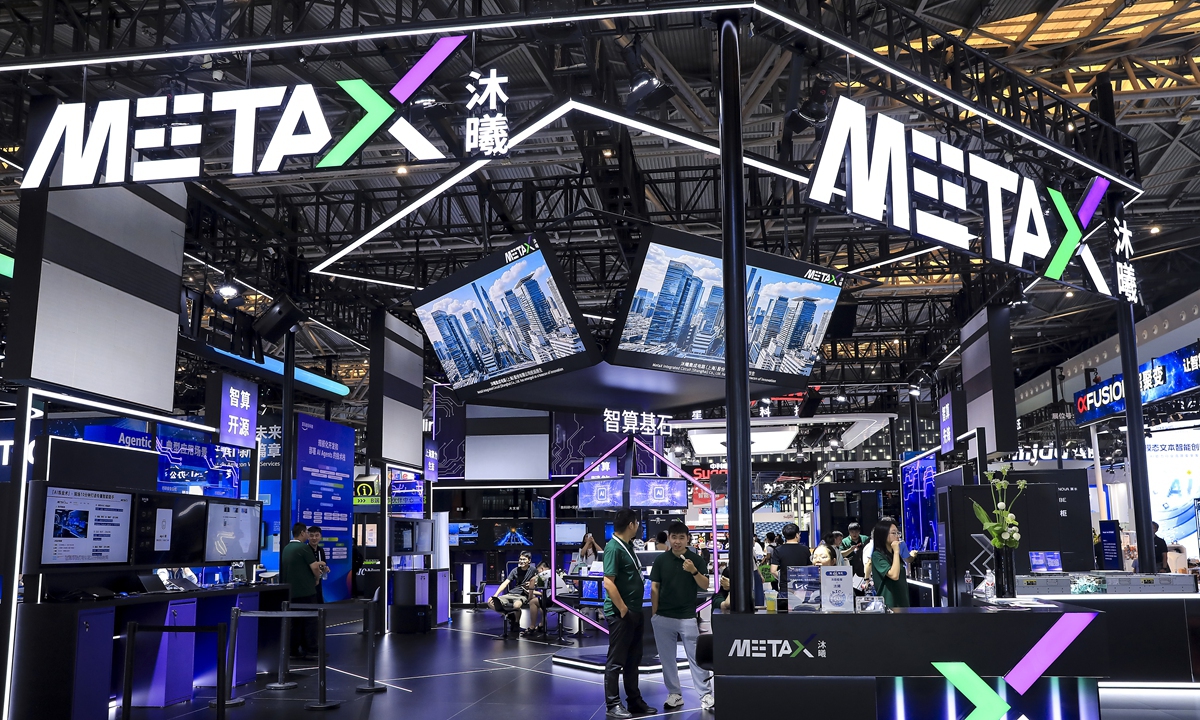

A booth of MetaX during World Artificial Intelligence Conference 2025 in Shanghai on July 29, 2025. Photo: VCG

Chinese graphics processing unit (GPU) developer MetaX saw its share price surge 692.95 percent to close at 829.90 yuan ($117.85) on Wednesday as it made its debut on the Shanghai Stock Exchange's STAR Market, China's Nasdaq-style Science and Technology Innovation Board.This spectacular rally follows another blockbuster listing earlier this month, when shares of Moore Threads Technology Co, another Chinese GPU developer, soared by more than 400 percent on its debut in Shanghai.

These staggering figures are a powerful financial endorsement, reflecting investor confidence in the growth potential embedded in China's push to develop domestic GPU technology companies, the vast opportunities in the domestic industry, and the R&D breakthroughs of domestic companies.

For starters, the strategic imperative for nurturing domestic high-end chip sector is a primary driver. In the increasingly fierce global tech competition, GPUs have emerged as a core computing power engine in key fields such as artificial intelligence (AI), big data, and high-performance computing. Amid some countries' restrictions on advanced AI chip exports, achieving technological self-sufficiency has become a priority for China.

From top-level design to implementation, a series of policies supporting the integrated circuit and AI industries have been intensively introduced, establishing a comprehensive support system covering fiscal and tax incentives, R&D support and market promotion, creating an unprecedented development environment for domestic GPU companies.

Beyond policy support, the immense and sustained demand emanating from China's digital economy also provides a solid foundation and strong momentum for the development of domestic GPUs. China boasts the world's largest digital economy and highly dynamic digital application scenarios. Whether it is the widespread application of AI, the rapid expansion of data centers, or the exploration of cutting-edge fields such as autonomous driving, metaverse and industrial simulation, there is a strong demand for high-performance computing power.

IDC predicts that China's accelerated computing market will maintain rapid growth, and the overall scale is expected to exceed $100 billion by 2029. Such certain and sustained growing demand provides domestic GPU developers with clear development opportunities.

Furthermore, the investor enthusiasm is increasingly fueled by technological progress of Chinese chipmakers. Although Chinese chipmakers started late and still need to strengthen their foundation, Chinese scientists and researchers are gradually making breakthroughs in multiple aspects through continuous and high-intensity R&D investment and technological endeavors.

In February, Chinese scientists have achieved a major breakthrough in integrated photonic quantum chips by demonstrating the first "continuous-variable" quantum multipartite entanglement and cluster states on the chip; in November, three newly-developed Chinese chips were unveiled at the Spatial Computing Summit 2025, marking a significant step forward in terms of the country's advancement in spatial computing, according to Xinhua.

Moore Threads will hold its first MUSA Developer Conference on December 20-21 (Saturday to Sunday) in Beijing, which is expected to outline the company's full-stack strategy and long-term vision centered on MUSA, unveil a next-generation GPU architecture, and roll out a comprehensive lineup covering products, core technologies and industry solutions, according to the company's official Weibo account.

These advancements collectively convince the market that technological self-reliance is an accelerating reality. Each advancement enhances competitiveness and strengthens the narrative that China's semiconductor industry can gradually overcome external constraints.

In conclusion, the capital market's interest in domestic GPU companies is a financial echo of the national strategic will for technological independence, a market-driven response to industrial upgrading and supply chain security needs. This indicates that China's high-end chip sector is transitioning into a more mature, multi-engine development phase, powered by the combination of policy, market demand, capital, and technological progress.

While short-term market movements can be influenced by sentiment, and the long-term journey faces significant challenges, the current influx of financial support is injecting vital resources and dynamism into the industry, further accelerating the sector's journey toward independent innovation and sustainable growth.