2025 Annual Report: Vitality, Resilience, and Development Confidence of Chinese ports

Preface

The just-concluded China's Central Economic Work Conference said that "2025 is a truly extraordinary year." This year, amid an increasingly complex and challenging external environment, how have China's ports, as a crucial gateway to observing China's economic growth, stabilized operations under pressure and maintained resilience amid change? What new changes and trends have emerged in the operation of China's ports, which serve as front-line hubs of foreign trade?

Since the beginning of 2025, Global Times carried out year-long field research at coastal ports across China, engaging with front-line companies to assess port operations. Based on follow-up studies at key ports, along with expert interviews and public data analysis, it produced the 2025 Annual Report on the Vitality, Resilience, and Development Confidence of China's Ports.

The report shows that in 2025, China's ports actively responded to complex domestic and international changes, maintaining efficient and stable operations and providing strong support for global supply chains. Affected by fluctuations in China-US trade, ports adopted region-specific and differentiated development approaches, fully demonstrating their resilience and flexibility in responding to market changes.

The Central Economic Work Conference identified "adhering to opening-up and promoting win-win cooperation across multiple fields" as one of the key tasks for China's economic work next year, and outlined specific measures such as "steadily advancing the development of the Hainan Free Trade Port." Ports are an important front line of the country's opening up. Looking ahead to 2026, multiple ports told the Global Times that they will continue to advance higher-level opening up in serving the national opening-up agenda, deepen international cooperation, and further enhance their role as hubs in regional trade and global supply chains.

Part I Vitality: Coastal ports achieve an overall positive trend in cargo throughput growth with bustling activities despite multiple pressures

If 2025 were to be summed up with a few "keywords," how would China's ports define it? Many coastal ports interviewed by Global Times reporters gave the same answer: "responding to challenges." Over the past year, the US pushed its so-called "reciprocal tariffs" policy, global trade experienced sustained volatility, and international industrial chains underwent faster adjustment, with multiple pressures overlapping at different stages of the year. "Responding to challenges" was the reality facing many ports in 2025.

In sharp contrast to external pressures was the robust performance of port operations. When asked about their overall performance this year, Ningbo-Zhoushan Port, the world's largest port by cargo throughput, described it as "better than expected," while some other ports said results were "in line with expectations." Such outcomes formed another immediate impression of 2025 for some of China's ports.

Despite a complex and challenging external environment, Global Times reporters found China's coastal ports still bustling with activity. Shanghai Port told the Global Times that container throughput rose 6.7 percent year-on-year in the first 11 months, while Yantai Port said it expects cargo throughput in 2025 to grow 6.9 percent year-on-year.

Ningbo-Zhoushan Port is one of China's key ports for trade with the US. From January to November this year, its China-US route saw throughput rise over 3.5 percent year-on-year. The port told the Global Times that it expects to handle more than 1.39 billion tons of cargo and over 42 million TEUs (twenty-foot equivalent unit) of containers in 2025.

In 2025, Ningbo-Zhoushan Port's container throughput exceeded 40 million TEUs for the first time, making it the fastest-growing and largest-increment port among the world's top five ports over the past decade.

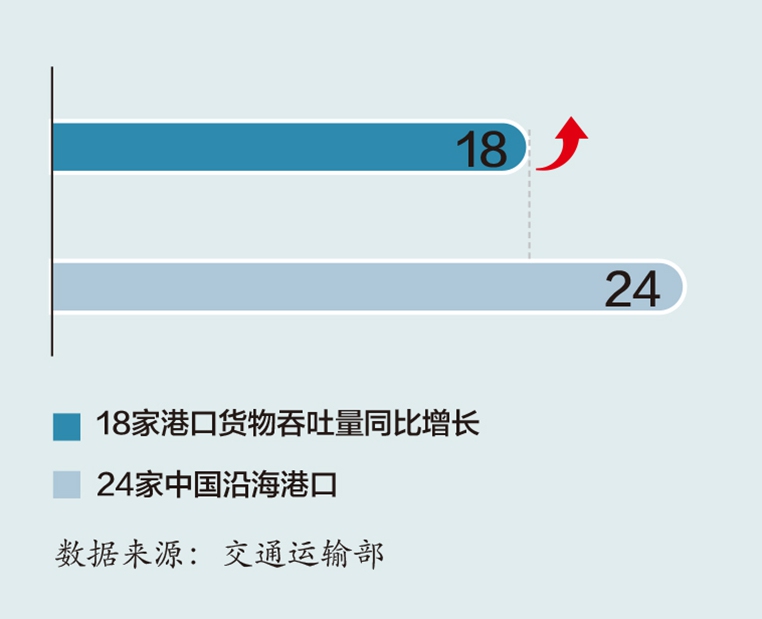

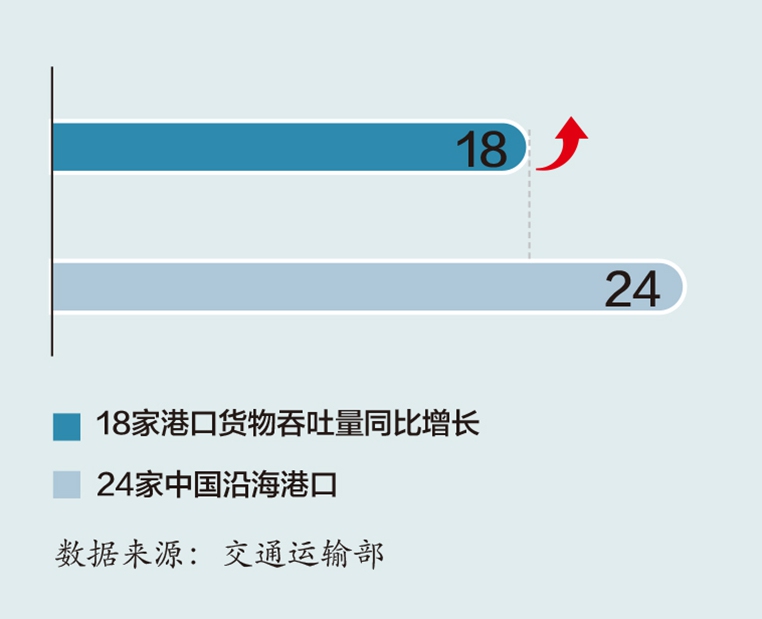

Among 24 Chinese coastal ports with official data released, including Qingdao, Shantou, and Guangzhou, 18 reported year-on-year cargo growth from January to October, with eight exceeding 5 percent. These figures reflect the fundamentals of coastal port operations and provide a relatively clear reference for assessing how ports withstand pressure amid ongoing external volatility.

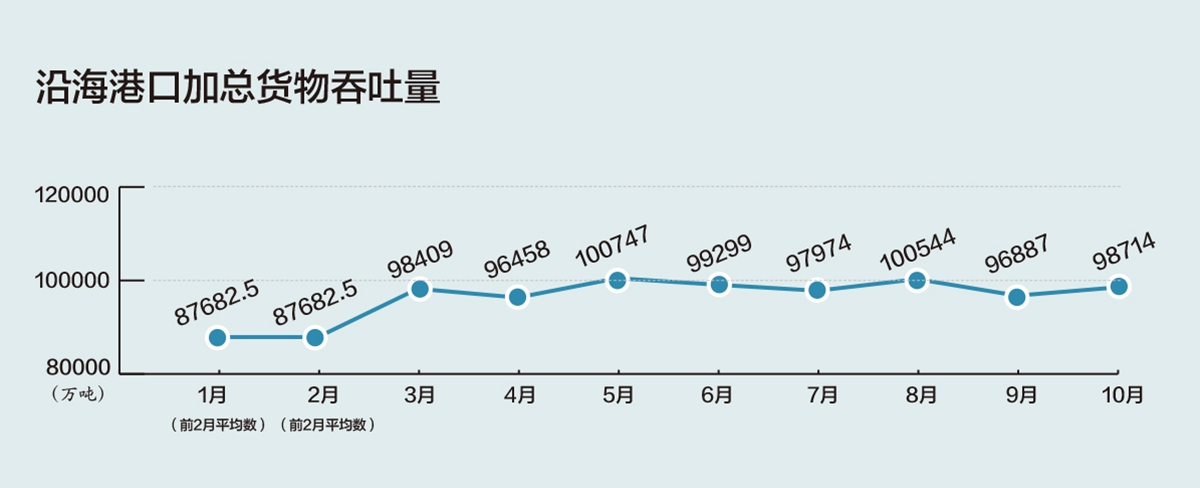

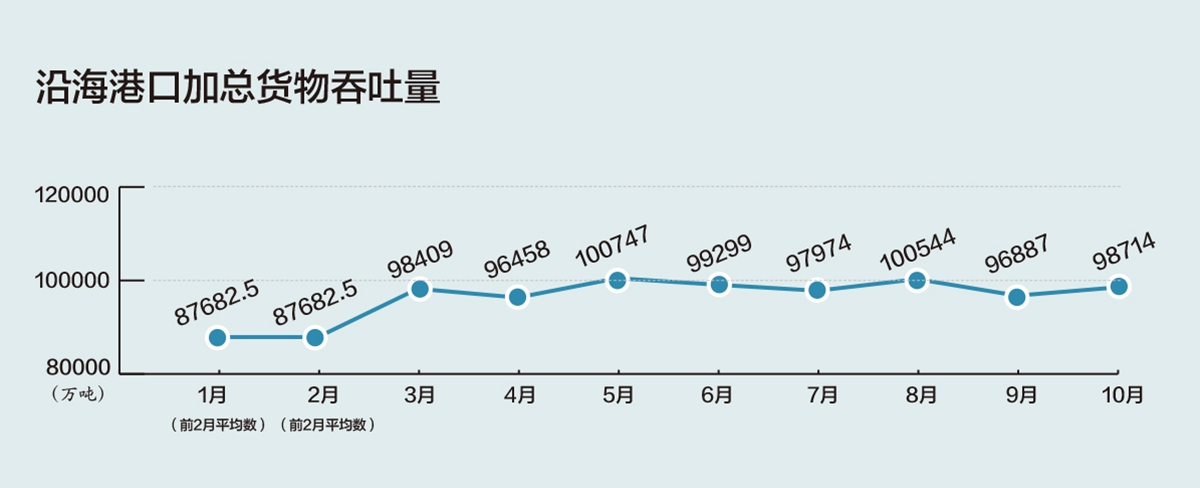

Monthly data show that the combined cargo throughput of coastal ports experienced only slight fluctuations, with a relatively stable trend. Despite frequent US tariff policy adjustments and growing external uncertainties this year, this steady curve demonstrates the resilience and capability of China's coastal ports to maintain relatively stable operations in a complex environment.

Lianyungang Port told the Global Times that despite some fluctuations in external demand, the direct impact on the port has been relatively limited. The port noted that, leveraging its strategic position along the land bridge and coastal corridor, it has intensified efforts to expand into the Japanese, South Korean, and Southeast Asian markets. This has not only supported growth in foreign trade volume but also enhanced its transit transport capacity. From January to October this year, Lianyungang Port handled 301.34 million tons of cargo, up 6.9 percent year-on-year.

Regarding overall operations of China's coastal ports in 2025, Zheng Ping, chief analyst with industry news portal chineseport.cn, told the Global Times that on one hand, major bulk commodity imports faced pressure, with foreign trade cargo throughput at Chinese ports slowing to 3.7 percent year-on-year in the first ten months, down sharply from last year's 7.4 percent growth. On the other hand, benefiting from factors such as "stabilizing domestic demand" and "supporting exports," container throughput still grew 6.4 percent over the same period, only 1.2 percentage points below last year and well above market expectations.

Among container ports with a high share of export boxes, growth reached 6.5 percent at Shanghai Port, 10.5 percent at Ningbo-Zhoushan Port, 6.1 percent at Shenzhen Port, and 7.2 percent at Qingdao Port, showing that major Chinese ports maintained strong resilience and stable growth amid China-US trade fluctuations, Zheng said.

Part II Resilience: China-US trade fluctuations have limited impact on coastal ports; ports expand their 'circle of trade partners'

In 2025, the US adjusted its trade policies multiple times - did this put pressure on port operations? Some ports said that US tariff hikes caused temporary disruptions on certain routes and cargo types, while others considered the overall impact manageable, with limited effect on the fundamentals of annual operations.

Regarding China-US shipping routes, Global Times reporters found that this year, some ports did experience short-term capacity adjustments on these routes, but that didn't trigger chain reactions across ports, and the impact varied.

Ports not directly affected by China-US route changes also made operational adjustments in response to broader shipping market shifts, reflecting a refined approach to managing external fluctuations. Some ports reported that capacity adjustments in foreign trade temporarily tightened domestic route availability. In response, ports strengthened coordination with shipping companies to guide capacity toward the domestic market. At the same time, for foreign trade vessels, ports supported operations by optimizing berth schedules and ensuring cargo storage, keeping overall operations stable.

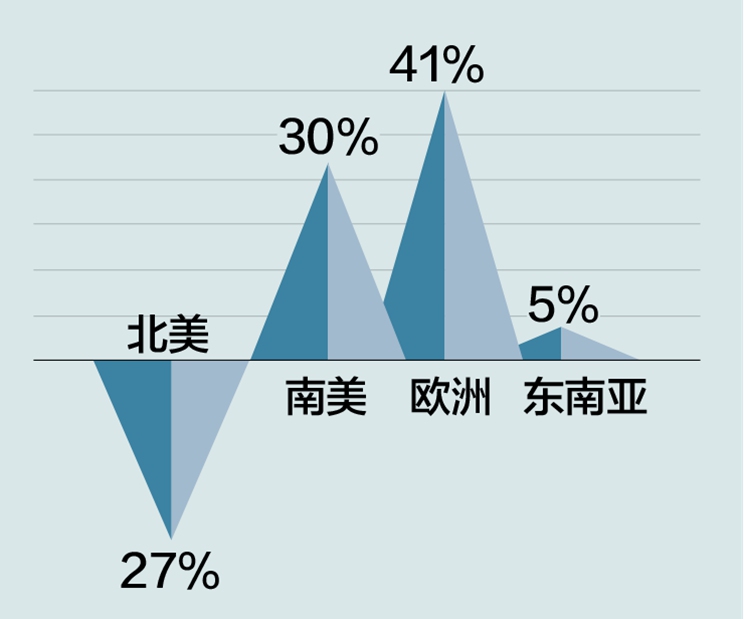

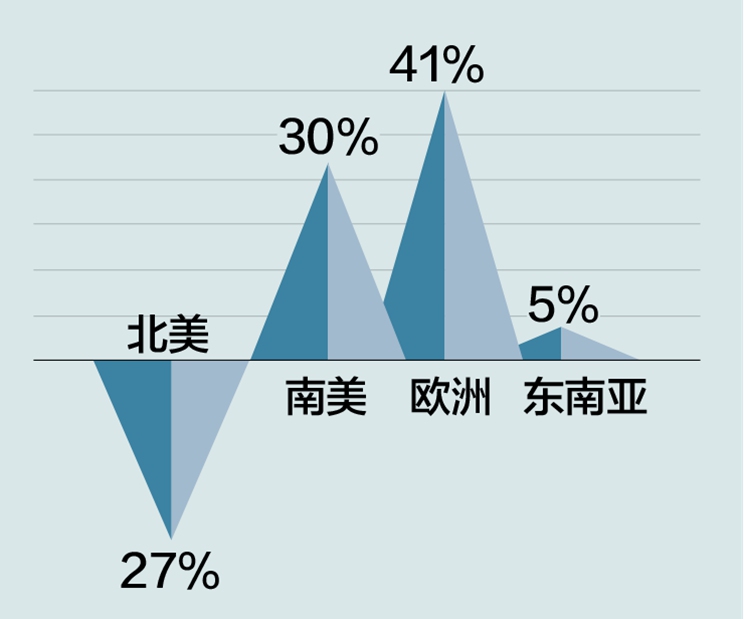

Ports directly affected by China-US route changes responded more intensively in terms of route structure and business organization, with more significant adjustments. For example, a port in southeastern China saw its North America routes fall 27 percent year-on-year, with their share dropping by 6 percentage points. In contrast, business to other destinations grew notably - South America routes up 30 percent, Europe surging 41 percent, and Southeast Asia up 5 percent year-on-year. In 2025, the port launched 36 new routes, with some achieving improved operational efficiency; for instance, durian imports from Vietnam cleared customs within 48 hours, setting a record for the port.

Affected by fluctuations in US trade policy, the port's China-US routes experienced a large number of empty sailings in May. Although overall route throughput from January to October slightly declined, monthly data show that throughput remained relatively stable. This demonstrates the port's ability to maintain operational continuity and overall balance amid external volatility.

Amid the overall stability of China's coastal port operations, Yiwu provides a more specific point of observation. The Yiwu (Suxi) International Hub Port, which began operations in June, closely connects Ningbo-Zhoushan with the "world's small commodities capital." By the end of October, the "Yiwu (Suxi) International Hub Port-Ningbo-Zhoushan Port" sea-rail intermodal service had handled over 60,000 TEUs, achieving its annual target ahead of schedule.

According to Yiwu Customs, in the first 10 months of 2025, the city's import and export volume exceeded 700 billion yuan for the first time in history. From January to October, total trade reached 701.19 billion yuan, up 25.2 percent year-on-year, with exports up 24.4 percent and imports up 31.1 percent - both achieving double-digit growth.

Although some ports experienced temporary adjustments on China-US routes, such changes accounted for a limited share of overall coastal port business. Chinese ports continued to advance operations on other routes, bulk cargo throughput, and specialized capabilities. For example, Rizhao Port completed and put into operation its grain base this year, along with the expanded Lannan bulk grain storage and transport system, giving the port an annual turnover capacity exceeding 20 million tons and effectively enhancing its comprehensive capabilities in bulk grain logistics and industrial services.

Looking ahead to 2026, interviewed coastal ports show divergent expectations for China-US routes: some anticipate further contraction, while others foresee basic stability. However, most expect continued growth in emerging-market routes and other directions, highlighting a focus on diversified layouts and integrated transport capabilities amid shifting global trade patterns.

Zheng Ping believes US tariff policies disrupt China-US routes but represent short-term, structural impacts that cannot erase underlying demand. The long-term market preference for affordable, high-quality Chinese goods and reliance on China's stable supply chains cannot be fully replaced by other countries or markets.

Part III Development: Coastal ports accelerate digital transformation in 2025; cross-border e-commerce and multimodal transport boost growth

In 2025, China's ports continued to advance intelligent transformation, with accelerated construction of automated terminals. The number of completed or under-construction automated terminals remains the top of global rankings, while the application of informatization and automation technologies in port operations deepened further.

Accelerating automation and intelligent construction represents a key trend in the high-quality development of ports. For instance, under traditional operations, a skilled truck driver could handle several hundred tons of cargo daily at most. In contrast, following the advancement of smart port initiatives, a team of around ten staff members can simultaneously operate dozens of mechanical equipment units, resulting in significantly enhanced operational efficiency.

For example, Tianjin Port has deeply fused 5G, the BeiDou Navigation Satellite System, AI, and other technologies into production, enhancing synergy among "people, machines, vehicles, ships, cargo, and yards." Over 80 percent of its large container handling equipment is automated. The port invests over 300 million yuan annually in R&D, holding more than 900 effective patents.

Meanwhile, Rizhao Port also expanded automated operations, launching 12 domestically made lightweight rail cranes in 2025 to create "unmanned + visualized" operations. Overall efficiency of its automated container terminal rose 9.5 percent year-on-year.

Zheng Ping noted that China's ports have markedly improved service capabilities and infrastructure, with digital and smart achievements leading globally. Applications of 5G, big data, cloud computing, AI, and blockchain have revitalized traditional ports.

In 2025, new businesses and new models drove throughput growth at some ports. Interviewed ports noted that cross-border e-commerce spurred volume increases and accelerating express and dedicated lines.

In September, the Ningbo-Zhoushan Port-Felixstowe "China-Europe Arctic Express" - the world's first dedicated Arctic container route for e-commerce and high-value goods - was launched. It offers faster, low-carbon logistics for high-end manufacturing, e-commerce, and new-energy sectors.

Alongside new business expansion, multimodal transport has also emerged as a key direction for ports to enhance logistics organization capabilities. Multiple coastal ports highlighted related progress in interviews.

Recently, commercial vehicles and auto parts from South Korea and other countries departed Yantai Port via cross-border trains, arriving in Kyrgyzstan and other Central Asian nations in about 12 days - marking the routine operation of Yantai Port's "one-bill" cross-border sea-rail intermodal trains. This "one-bill" system completes end-to-end transport with a single document, promoting seamless coordination among rail, road, and sea modes.

Additionally, break-bulk cargo maintained strong momentum in 2025. Yantai Port launched four new routes to Cuba and Vietnam, achieving "global networking" with 30 liner services covering Africa, Southeast Asia, South America, and Europe. Annual break-bulk liner volume is projected to exceed 16 million tons.

Part IV Confidence: China's ports steadily support global supply chains; 'port + free trade' creates new opportunities

In 2025, China's coastal ports maintained stable operations in safeguarding supply chain resilience. Interviewed ports reported improvements in vessel scheduling, berthing, loading/unloading, customs clearance, and transfer efficiency, while others described overall smooth and steady performance. Despite trade protectionism from certain countries that have disrupted global industrial chains, China's coastal ports effectively sustained supply chain stability, providing continuous and reliable logistics support for domestic and international markets.

As frontiers of opening-up, Chinese ports serve as critical hubs in global trade and socioeconomic development. In 2025, coastal ports continued to advance opening-up to the rest of the world.

On December 18, the Hainan Free Trade Port initiated island-wide independent customs operations - a landmark measure underscoring China's resolute commitment to high-standard opening-up. Institutional innovations such as "zero-tariff" policies are expected to further highlight the role of ports as a hub for shipping and navigation.

In the first three quarters of 2025, Hainan's Yangpu Port handled 2.145 million TEUs, reflecting a 48.4 percent year-on-year increase. Since the beginning of 2025, Yangpu Port has added 14 domestic and international trade routes, bringing the total container lines to 64, with strategic partnerships established with multiple renowned international ports.

Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times that China is continuously promoting trade facilitation through innovative customs supervision measures and paperless clearance - many of which are implemented at ports. Given that a substantial portion of China's trade transits through ports, efficiency gains not only enhance international competitiveness but also ensure stable business development.

To deepen opening-up and international cooperation, coastal ports have actively expanded overseas markets. For example, Lianyungang Port organized a delegation to Korea this year for promotional activities, visiting local logistics companies to advance international rail services. The port also facilitated visits from enterprises such as South Korea's Taewoong Logistics, further broadening international collaboration.

Xiamen Port has vigorously expanded Belt and Road routes, adding 16 such lines in 2025 to meet regional trade logistics demands. Concurrently, Xiamen Port partnered with PSA International to develop a multimodal smart logistics center, advancing integrated logistics projects.

High-level opening-up necessitates seamless connectivity and synergy between domestic and international resources. Coastal ports function both as vital gateways for external opening-up and key nodes in dual circulation. Multiple ports indicated plans to pursue even higher-level opening-up and international cooperation in the coming year, further strengthening their hub status in regional trade and global supply chains.

Looking ahead to 2026, interviewed coastal ports anticipate increased external uncertainty. When asked whether potential international trade turbulence or other uncertainties in 2026 would affect development confidence, most responded to the Global Times: "Slight impact, but proactive response."

One interviewed port highlighted top 2026 external risks, including geopolitical and trade policy uncertainties, strategic adjustments by international carriers, and potential loss of ocean or emerging regional routes. To address complex conditions, the port plans to continue focusing on container business, advancing major-client strategies, expanding domestic and international trade routes, and increasing overall volumes. Overall interview findings indicate that ports maintain clear awareness of potential risks while holding cautiously optimistic views on sustaining relatively stable operations.

Conclusion

Based on comprehensive interviews, China's coastal ports said they maintained stable operations in 2025 amid a complex external environment, while further enhancing overall capabilities through intelligent upgrades, new business development, and strengthened international cooperation. Looking ahead to 2026, key projects are expected to advance steadily, with ports accelerating the construction of efficient, innovative, and sustainable global supply-chain hubs.

The Recommendations of the Central Committee of the Communist Party of China (CPC) for Formulating the 15th Five-Year Plan (2026-30) for National Economic and Social Development, adopted at the fourth plenary session of the 20th CPC Central Committee, states: "We must continue to expand opening up at the institutional level, safeguard the multilateral trading system, and promote broader international economic flows. We should draw momentum from opening up to propel reform and development, and share opportunities with the rest of the world and promote common development."

As China continues to advance high-level opening-up, ports will remain pivotal. 2026 marks the opening year of the 15th Five-Year Plan. The Global Times will further deepen and broaden its coverage to tell the world the story of high-quality development in China's ports and marine economy.

The just-concluded China's Central Economic Work Conference said that "2025 is a truly extraordinary year." This year, amid an increasingly complex and challenging external environment, how have China's ports, as a crucial gateway to observing China's economic growth, stabilized operations under pressure and maintained resilience amid change? What new changes and trends have emerged in the operation of China's ports, which serve as front-line hubs of foreign trade?

Since the beginning of 2025, Global Times carried out year-long field research at coastal ports across China, engaging with front-line companies to assess port operations. Based on follow-up studies at key ports, along with expert interviews and public data analysis, it produced the 2025 Annual Report on the Vitality, Resilience, and Development Confidence of China's Ports.

The report shows that in 2025, China's ports actively responded to complex domestic and international changes, maintaining efficient and stable operations and providing strong support for global supply chains. Affected by fluctuations in China-US trade, ports adopted region-specific and differentiated development approaches, fully demonstrating their resilience and flexibility in responding to market changes.

The Central Economic Work Conference identified "adhering to opening-up and promoting win-win cooperation across multiple fields" as one of the key tasks for China's economic work next year, and outlined specific measures such as "steadily advancing the development of the Hainan Free Trade Port." Ports are an important front line of the country's opening up. Looking ahead to 2026, multiple ports told the Global Times that they will continue to advance higher-level opening up in serving the national opening-up agenda, deepen international cooperation, and further enhance their role as hubs in regional trade and global supply chains.

Part I Vitality: Coastal ports achieve an overall positive trend in cargo throughput growth with bustling activities despite multiple pressures

If 2025 were to be summed up with a few "keywords," how would China's ports define it? Many coastal ports interviewed by Global Times reporters gave the same answer: "responding to challenges." Over the past year, the US pushed its so-called "reciprocal tariffs" policy, global trade experienced sustained volatility, and international industrial chains underwent faster adjustment, with multiple pressures overlapping at different stages of the year. "Responding to challenges" was the reality facing many ports in 2025.

In sharp contrast to external pressures was the robust performance of port operations. When asked about their overall performance this year, Ningbo-Zhoushan Port, the world's largest port by cargo throughput, described it as "better than expected," while some other ports said results were "in line with expectations." Such outcomes formed another immediate impression of 2025 for some of China's ports.

Despite a complex and challenging external environment, Global Times reporters found China's coastal ports still bustling with activity. Shanghai Port told the Global Times that container throughput rose 6.7 percent year-on-year in the first 11 months, while Yantai Port said it expects cargo throughput in 2025 to grow 6.9 percent year-on-year.

Ningbo-Zhoushan Port is one of China's key ports for trade with the US. From January to November this year, its China-US route saw throughput rise over 3.5 percent year-on-year. The port told the Global Times that it expects to handle more than 1.39 billion tons of cargo and over 42 million TEUs (twenty-foot equivalent unit) of containers in 2025.

In 2025, Ningbo-Zhoushan Port's container throughput exceeded 40 million TEUs for the first time, making it the fastest-growing and largest-increment port among the world's top five ports over the past decade.

Among 24 Chinese coastal ports with official data released, including Qingdao, Shantou, and Guangzhou, 18 reported year-on-year cargo growth from January to October, with eight exceeding 5 percent. These figures reflect the fundamentals of coastal port operations and provide a relatively clear reference for assessing how ports withstand pressure amid ongoing external volatility.

Monthly data show that the combined cargo throughput of coastal ports experienced only slight fluctuations, with a relatively stable trend. Despite frequent US tariff policy adjustments and growing external uncertainties this year, this steady curve demonstrates the resilience and capability of China's coastal ports to maintain relatively stable operations in a complex environment.

(Source: Ministry of Transport)

Lianyungang Port told the Global Times that despite some fluctuations in external demand, the direct impact on the port has been relatively limited. The port noted that, leveraging its strategic position along the land bridge and coastal corridor, it has intensified efforts to expand into the Japanese, South Korean, and Southeast Asian markets. This has not only supported growth in foreign trade volume but also enhanced its transit transport capacity. From January to October this year, Lianyungang Port handled 301.34 million tons of cargo, up 6.9 percent year-on-year.

Regarding overall operations of China's coastal ports in 2025, Zheng Ping, chief analyst with industry news portal chineseport.cn, told the Global Times that on one hand, major bulk commodity imports faced pressure, with foreign trade cargo throughput at Chinese ports slowing to 3.7 percent year-on-year in the first ten months, down sharply from last year's 7.4 percent growth. On the other hand, benefiting from factors such as "stabilizing domestic demand" and "supporting exports," container throughput still grew 6.4 percent over the same period, only 1.2 percentage points below last year and well above market expectations.

Among container ports with a high share of export boxes, growth reached 6.5 percent at Shanghai Port, 10.5 percent at Ningbo-Zhoushan Port, 6.1 percent at Shenzhen Port, and 7.2 percent at Qingdao Port, showing that major Chinese ports maintained strong resilience and stable growth amid China-US trade fluctuations, Zheng said.

Part II Resilience: China-US trade fluctuations have limited impact on coastal ports; ports expand their 'circle of trade partners'

In 2025, the US adjusted its trade policies multiple times - did this put pressure on port operations? Some ports said that US tariff hikes caused temporary disruptions on certain routes and cargo types, while others considered the overall impact manageable, with limited effect on the fundamentals of annual operations.

Regarding China-US shipping routes, Global Times reporters found that this year, some ports did experience short-term capacity adjustments on these routes, but that didn't trigger chain reactions across ports, and the impact varied.

Ports not directly affected by China-US route changes also made operational adjustments in response to broader shipping market shifts, reflecting a refined approach to managing external fluctuations. Some ports reported that capacity adjustments in foreign trade temporarily tightened domestic route availability. In response, ports strengthened coordination with shipping companies to guide capacity toward the domestic market. At the same time, for foreign trade vessels, ports supported operations by optimizing berth schedules and ensuring cargo storage, keeping overall operations stable.

Ports directly affected by China-US route changes responded more intensively in terms of route structure and business organization, with more significant adjustments. For example, a port in southeastern China saw its North America routes fall 27 percent year-on-year, with their share dropping by 6 percentage points. In contrast, business to other destinations grew notably - South America routes up 30 percent, Europe surging 41 percent, and Southeast Asia up 5 percent year-on-year. In 2025, the port launched 36 new routes, with some achieving improved operational efficiency; for instance, durian imports from Vietnam cleared customs within 48 hours, setting a record for the port.

(Source: ports surveyed)

Affected by fluctuations in US trade policy, the port's China-US routes experienced a large number of empty sailings in May. Although overall route throughput from January to October slightly declined, monthly data show that throughput remained relatively stable. This demonstrates the port's ability to maintain operational continuity and overall balance amid external volatility.

Amid the overall stability of China's coastal port operations, Yiwu provides a more specific point of observation. The Yiwu (Suxi) International Hub Port, which began operations in June, closely connects Ningbo-Zhoushan with the "world's small commodities capital." By the end of October, the "Yiwu (Suxi) International Hub Port-Ningbo-Zhoushan Port" sea-rail intermodal service had handled over 60,000 TEUs, achieving its annual target ahead of schedule.

According to Yiwu Customs, in the first 10 months of 2025, the city's import and export volume exceeded 700 billion yuan for the first time in history. From January to October, total trade reached 701.19 billion yuan, up 25.2 percent year-on-year, with exports up 24.4 percent and imports up 31.1 percent - both achieving double-digit growth.

Yiwu’s foreign trade in Jan-Oct 2025

Although some ports experienced temporary adjustments on China-US routes, such changes accounted for a limited share of overall coastal port business. Chinese ports continued to advance operations on other routes, bulk cargo throughput, and specialized capabilities. For example, Rizhao Port completed and put into operation its grain base this year, along with the expanded Lannan bulk grain storage and transport system, giving the port an annual turnover capacity exceeding 20 million tons and effectively enhancing its comprehensive capabilities in bulk grain logistics and industrial services.

Looking ahead to 2026, interviewed coastal ports show divergent expectations for China-US routes: some anticipate further contraction, while others foresee basic stability. However, most expect continued growth in emerging-market routes and other directions, highlighting a focus on diversified layouts and integrated transport capabilities amid shifting global trade patterns.

Zheng Ping believes US tariff policies disrupt China-US routes but represent short-term, structural impacts that cannot erase underlying demand. The long-term market preference for affordable, high-quality Chinese goods and reliance on China's stable supply chains cannot be fully replaced by other countries or markets.

Part III Development: Coastal ports accelerate digital transformation in 2025; cross-border e-commerce and multimodal transport boost growth

In 2025, China's ports continued to advance intelligent transformation, with accelerated construction of automated terminals. The number of completed or under-construction automated terminals remains the top of global rankings, while the application of informatization and automation technologies in port operations deepened further.

Accelerating automation and intelligent construction represents a key trend in the high-quality development of ports. For instance, under traditional operations, a skilled truck driver could handle several hundred tons of cargo daily at most. In contrast, following the advancement of smart port initiatives, a team of around ten staff members can simultaneously operate dozens of mechanical equipment units, resulting in significantly enhanced operational efficiency.

For example, Tianjin Port has deeply fused 5G, the BeiDou Navigation Satellite System, AI, and other technologies into production, enhancing synergy among "people, machines, vehicles, ships, cargo, and yards." Over 80 percent of its large container handling equipment is automated. The port invests over 300 million yuan annually in R&D, holding more than 900 effective patents.

Meanwhile, Rizhao Port also expanded automated operations, launching 12 domestically made lightweight rail cranes in 2025 to create "unmanned + visualized" operations. Overall efficiency of its automated container terminal rose 9.5 percent year-on-year.

Zheng Ping noted that China's ports have markedly improved service capabilities and infrastructure, with digital and smart achievements leading globally. Applications of 5G, big data, cloud computing, AI, and blockchain have revitalized traditional ports.

In 2025, new businesses and new models drove throughput growth at some ports. Interviewed ports noted that cross-border e-commerce spurred volume increases and accelerating express and dedicated lines.

In September, the Ningbo-Zhoushan Port-Felixstowe "China-Europe Arctic Express" - the world's first dedicated Arctic container route for e-commerce and high-value goods - was launched. It offers faster, low-carbon logistics for high-end manufacturing, e-commerce, and new-energy sectors.

Alongside new business expansion, multimodal transport has also emerged as a key direction for ports to enhance logistics organization capabilities. Multiple coastal ports highlighted related progress in interviews.

Recently, commercial vehicles and auto parts from South Korea and other countries departed Yantai Port via cross-border trains, arriving in Kyrgyzstan and other Central Asian nations in about 12 days - marking the routine operation of Yantai Port's "one-bill" cross-border sea-rail intermodal trains. This "one-bill" system completes end-to-end transport with a single document, promoting seamless coordination among rail, road, and sea modes.

Additionally, break-bulk cargo maintained strong momentum in 2025. Yantai Port launched four new routes to Cuba and Vietnam, achieving "global networking" with 30 liner services covering Africa, Southeast Asia, South America, and Europe. Annual break-bulk liner volume is projected to exceed 16 million tons.

Part IV Confidence: China's ports steadily support global supply chains; 'port + free trade' creates new opportunities

In 2025, China's coastal ports maintained stable operations in safeguarding supply chain resilience. Interviewed ports reported improvements in vessel scheduling, berthing, loading/unloading, customs clearance, and transfer efficiency, while others described overall smooth and steady performance. Despite trade protectionism from certain countries that have disrupted global industrial chains, China's coastal ports effectively sustained supply chain stability, providing continuous and reliable logistics support for domestic and international markets.

As frontiers of opening-up, Chinese ports serve as critical hubs in global trade and socioeconomic development. In 2025, coastal ports continued to advance opening-up to the rest of the world.

On December 18, the Hainan Free Trade Port initiated island-wide independent customs operations - a landmark measure underscoring China's resolute commitment to high-standard opening-up. Institutional innovations such as "zero-tariff" policies are expected to further highlight the role of ports as a hub for shipping and navigation.

In the first three quarters of 2025, Hainan's Yangpu Port handled 2.145 million TEUs, reflecting a 48.4 percent year-on-year increase. Since the beginning of 2025, Yangpu Port has added 14 domestic and international trade routes, bringing the total container lines to 64, with strategic partnerships established with multiple renowned international ports.

Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times that China is continuously promoting trade facilitation through innovative customs supervision measures and paperless clearance - many of which are implemented at ports. Given that a substantial portion of China's trade transits through ports, efficiency gains not only enhance international competitiveness but also ensure stable business development.

To deepen opening-up and international cooperation, coastal ports have actively expanded overseas markets. For example, Lianyungang Port organized a delegation to Korea this year for promotional activities, visiting local logistics companies to advance international rail services. The port also facilitated visits from enterprises such as South Korea's Taewoong Logistics, further broadening international collaboration.

Xiamen Port has vigorously expanded Belt and Road routes, adding 16 such lines in 2025 to meet regional trade logistics demands. Concurrently, Xiamen Port partnered with PSA International to develop a multimodal smart logistics center, advancing integrated logistics projects.

High-level opening-up necessitates seamless connectivity and synergy between domestic and international resources. Coastal ports function both as vital gateways for external opening-up and key nodes in dual circulation. Multiple ports indicated plans to pursue even higher-level opening-up and international cooperation in the coming year, further strengthening their hub status in regional trade and global supply chains.

Looking ahead to 2026, interviewed coastal ports anticipate increased external uncertainty. When asked whether potential international trade turbulence or other uncertainties in 2026 would affect development confidence, most responded to the Global Times: "Slight impact, but proactive response."

One interviewed port highlighted top 2026 external risks, including geopolitical and trade policy uncertainties, strategic adjustments by international carriers, and potential loss of ocean or emerging regional routes. To address complex conditions, the port plans to continue focusing on container business, advancing major-client strategies, expanding domestic and international trade routes, and increasing overall volumes. Overall interview findings indicate that ports maintain clear awareness of potential risks while holding cautiously optimistic views on sustaining relatively stable operations.

Conclusion

Based on comprehensive interviews, China's coastal ports said they maintained stable operations in 2025 amid a complex external environment, while further enhancing overall capabilities through intelligent upgrades, new business development, and strengthened international cooperation. Looking ahead to 2026, key projects are expected to advance steadily, with ports accelerating the construction of efficient, innovative, and sustainable global supply-chain hubs.

The Recommendations of the Central Committee of the Communist Party of China (CPC) for Formulating the 15th Five-Year Plan (2026-30) for National Economic and Social Development, adopted at the fourth plenary session of the 20th CPC Central Committee, states: "We must continue to expand opening up at the institutional level, safeguard the multilateral trading system, and promote broader international economic flows. We should draw momentum from opening up to propel reform and development, and share opportunities with the rest of the world and promote common development."

As China continues to advance high-level opening-up, ports will remain pivotal. 2026 marks the opening year of the 15th Five-Year Plan. The Global Times will further deepen and broaden its coverage to tell the world the story of high-quality development in China's ports and marine economy.